Tough times at Huawei in 1Q20

Tough times at Huawei in 1Q20

If you’re a Huawei watcher – and who isn’t in telecom nowadays – keeping up with the newsflow of the last few months has been a challenge. The company has long generated a lot of press, but this is different.

Looking at just the last three months, three things seem clear. One, US policymakers from both major parties are skeptical of Huawei. At a minimum, they oppose use of Huawei in US networks; at the fringes, some would like to put Huawei out of business. Two, a number of large countries aligned with the US are unable to resist Huawei’s offering, and/or not eager to cope with bullying from China Inc. Three, Huawei sees self-sufficiency as even more important now than a year ago, and the Chinese state budget will support that desire.

Pressure on Huawei

The most important recent speech on Huawei was delivered at last month’s Munich Security Conference by Nancy Pelosi, Speaker of the US House of Representatives. Her speech reminds us that concerns about Huawei are generally bipartisan in the US. Pelosi warned that “China is seeking to export its digital autocracy through its telecommunication giant, Huawei, threatening economic retaliation against those who do not adopt their technologies….We must instead move towards . . . an internationalization of digital infrastructure that does not enable autocracy.”

Some other recent developments causing headaches for Huawei’s management team include:

- Huawei’s rags to riches story has taken hits lately. On December 25, 2019, WSJ published a biting investigative piece called “State Support Helped Fuel Huawei’s Global Rise: China’s tech champion got as much as $75 billion in tax breaks, financing and cheap resources as it became the world’s top telecom vendor”

- Chinese state officials continue to exert political pressure to support Huawei; recently the Chinese ambassador to Germany threatened retaliation if Berlin excludes Huawei from developing its 5G network. This is not only wrong, it is self-defeating for a company that is trying to appear a purely private concern.

- Some European telcos (notably Vodafone) are being forced to rip and replace Huawei equipment in their network; even when these efforts are subsidized, it will make telcos think twice about future commitments.

- On February 6, Trump’s attorney general, Bill Barr, suggested having a US company invest directly (or acquire) one of the two European mobile RAN suppliers, Nokia or Ericsson. While unlikely to take place, there is real support for US government subsidies to the growing ecosystem of open RAN vendors based in the US.

- In early February the US Department of Justice charged Huawei with racketeering and conspiracy to steal trade secrets in a new indictment. Around the same time, the WSJ reported that U.S. officials said they have obtained evidence of Huawei’s ability to access mobile networks through a “back door,” and have shared such information with several European governments in recent months

- In late February Intel entered the 5G base station chip market, threatening indirectly Huawei’s competitive positioning in the 5G RAN market

Also, let’s not forget that Huawei’s CFO remains under house arrest in Canada pending the outcome of an extradition hearing.

Huawei is keeping its eye on the long-term prize

Despite a growing list of problems, Huawei has had plenty of wins lately, and appears focused on the long term.

In December, Telefonica Deutschland awarded its 5G rollout to Huawei and Nokia, jointly. In January, the UK chose to allow Huawei participation in 5G networks, with some limitations (by market share and application). Also in January, India’s regulator allowed Huawei and ZTE to participate in 5G trials.

In late February Huawei announced it had secured more than 90 commercial 5G contracts to date, versus 79 for Ericsson. Huawei also made the most of an MWC-less February, communicating with analysts and customers virtually via webinars and targeted briefings. Huawei also reorganized recently, creating the “Cloud & AI” business unit, to function in parallel to the legacy Carrier, Enterprise, and Consumer business groups. For telcos considering a bet on further Huawei deployment, these are all positive signs.

Behind the scenes, though, I suspect Huawei sees the writing on the wall – its US problems did not start with Trump, and they won’t end with a new President. As such, Huawei continues to work towards its long-term goal of self-sufficiency. This is not new, but has been accelerated by recent events. It’s especially important at the chip level. For instance, Huawei has increased its investments recently in subsidiary HiSilicon, increased collaboration with local chipmaker SMIC, and placed orders with Taiwan-based TSMC to be fulfilled out of China-based factories in Nanjing. Huawei has an enormous R&D budget and always-growing ambitions, so its efforts to bypass the US for technology development will persist.

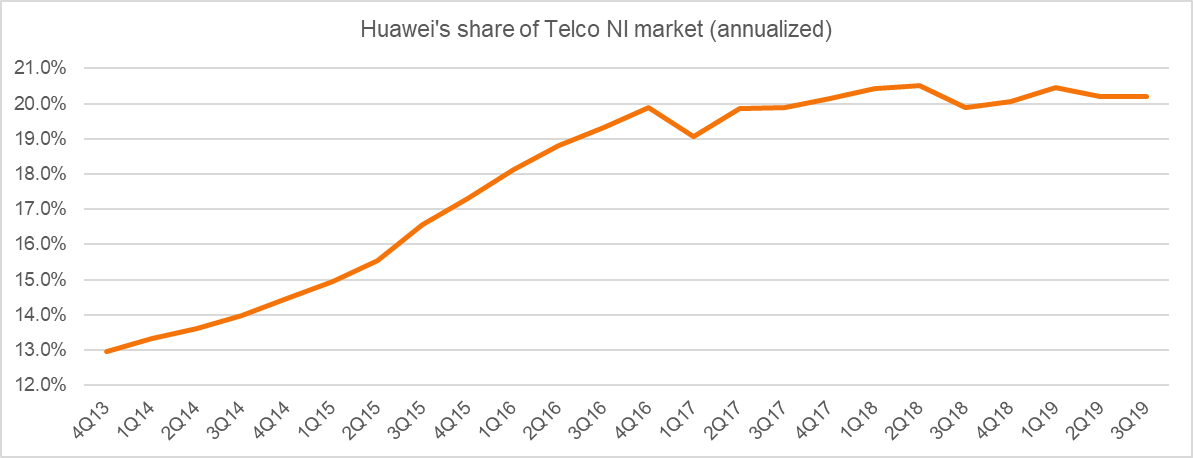

Source: MTN Consulting