5G vendors report earnings

5G vendors report earnings

The top five vendors selling 5G network infrastructure have now reported 3Q19 earnings. Nokia, Ericsson, and Samsung each reported public earnings data allowing a breakout of revenues to telcos. ZTE provided its usual interim (1st and 3rd quarter) report, which lacks revenues by customer segment. Huawei published a press release including total revenues and high-level commentary on demand trends.

Our take

There are modest signs of an uptick in telco spending in these results. Overall, the five recorded approximately $25.9B in 2Q19 revenues to the telco vertical (“Telco NI”), up 1% from the group’s 3Q18 total of $25.5B. For each of these vendors, except perhaps Samsung, 5G is only a small slice of their overall activities – and many things are being re-branded as 5G, so true 5G breakouts are challenging. Nevertheless, early figures do suggest commercial 5G momentum is spreading, despite ongoing trade wars and supply chain interruptions.

These are preliminary figures, based on a few assumptions. One is that Huawei’s actual carrier (Telco NI) revenues grew 3% in local currency terms; this is an assumption that needs to be further verified given Huawei’s limited reporting. Second is that ZTE’s carrier (Telco NI) revenues amount to 70% of total, which also needs to be confirmed.

With these assumptions, Samsung and ZTE are the clear growth standouts, growing Telco NI revenues by 17% and 13% YoY in 3Q19, respectively. Samsung continues to ride its domestic market’s early adoption of 5G. ZTE’s recorded growth benefits from an unusual 3Q18 base period, when sanctions were in place.

Huawei’s assumed 3% annual growth in RMB translates to a -0.2% decline in USD revenues. If this bears out, this would be a significant improvement over 2Q19, when we estimate that Huawei’s Telco NI revenues declined 6% YoY. The push by Chinese telcos to accelerate 5G and invest in new areas (including overseas, for China Mobile) is helping both Huawei and ZTE, as it has in the past.

Ericsson and Nokia grew Telco NI revenues at roughly the same rate in 2Q19 (in USD), about +2% YoY, but Ericsson opened up a lead in 3Q19 with 0.7% YoY growth (Nokia: -1.3%).

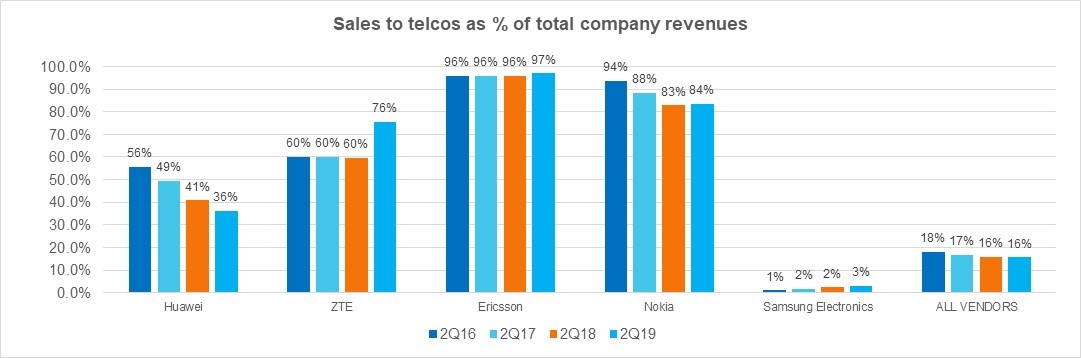

There is lots of noise around the number of signed commercial contracts, especially deals involving deep-pocketed telcos. However, it’s notable that 5G is much more of a multi-vertical technology than previous generations, with complex use cases being laid out across sectors. All key 5G vendors are exploring these. Of the top 5, Ericsson will likely be the most reliant on partnerships, given its relatively high dependence on the telco market for its revenues (Figure, below).

Source: MTN Consulting