Vendor sales to telcos up ~2% in 2Q19 so far

About 20% of telecom’s 100 or so key vendors have now reported second quarter 2019 (2Q19) results. From these early vendor results, there are modest signs of a ramp-up in 5G-related spending.

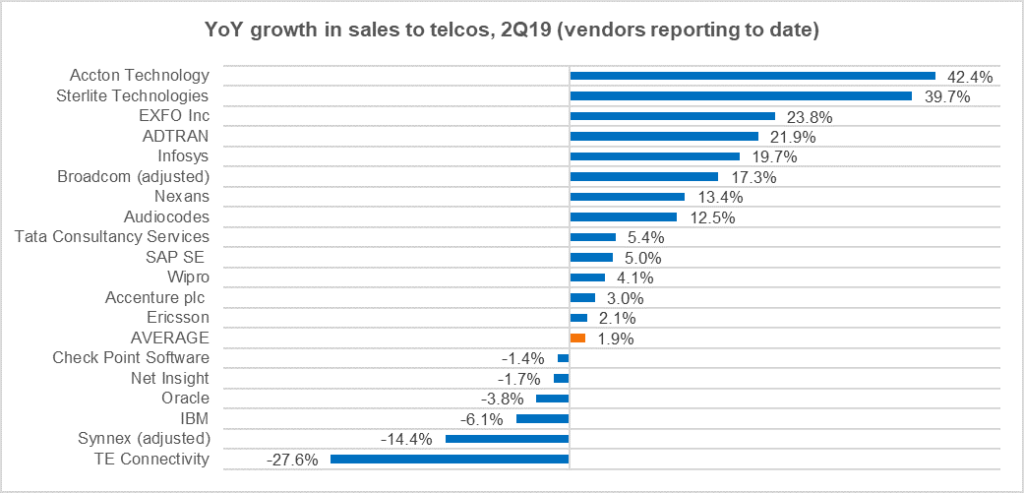

Preliminary totals indicate growth of +1.9% YoY in vendor revenues to telecom operators (or telcos). Revenues for all vendors dropped last quarter, by 0.6% YoY, so this would be a slight trend reversal.

Ericsson only big NEP to report so far

Of the vendors reporting so far, the only large Network Equipment Provider (NEP) is Ericsson. (We also track IT services providers, and fiber/cabling vendors selling to telcos). Ericsson is also by far the largest to report so far, accounting for over 50% of reported revenues.

Per MTN Consulting estimates, Ericsson’s telco sales grew 2.1% YoY (on a USD basis), near the market average of 1.9% to date (see figure, below). That’s the fastest growth seen by Ericsson in several years, but it appears to have come at a price. Ericsson notes a negative margin impact from its push for “strategic contracts” in the Networks division.

There is a broad range of growth rates around the Ericsson-driven average. Vendors are finding growth in different aspects of the market, including high-capacity switches & open networking (Accton), high-speed test equipment (EXFO), 5G-related services & software (Infosys, TCS, Wipro), FTTx (Adtran, Nexans), and digital transformation consulting (Accenture). Some of these vendors sell to multiple segments, some are more specialized in the telecom vertical.

Some vendors also saw revenue dips in the telco segment, per our estimates; that includes Oracle and IBM, most importantly. These two vendors sell a range of software and services to telcos, as well as some network equipment, but are facing new competition. For example just last week Microsoft signed a large cloud deal with AT&T, a multiyear collaboration to help lower the company’s network and IT costs, moving more apps to the public cloud. At the same time, AT&T also expanded an existing cloud partnership with IBM. Both Oracle and IBM have annual sales to telcos in the $2-3B range, so don’t count them out.

The revenue drop shown above for TE Connectivity is estimated: SubCom is now part of Cerberus Capital, and does not report. However, SubCom’s pipeline was weak at the time of acquisition and deal integration usually causes a slowdown. Parts of the submarine market are picking up though, due to webscale investment and much-needed gap-filling in the Middle East & Africa. Nexans appears to be a beneficiary. Corning, Prysmian and other key fiber suppliers have not yet reported.

Growth trajectory remains modest

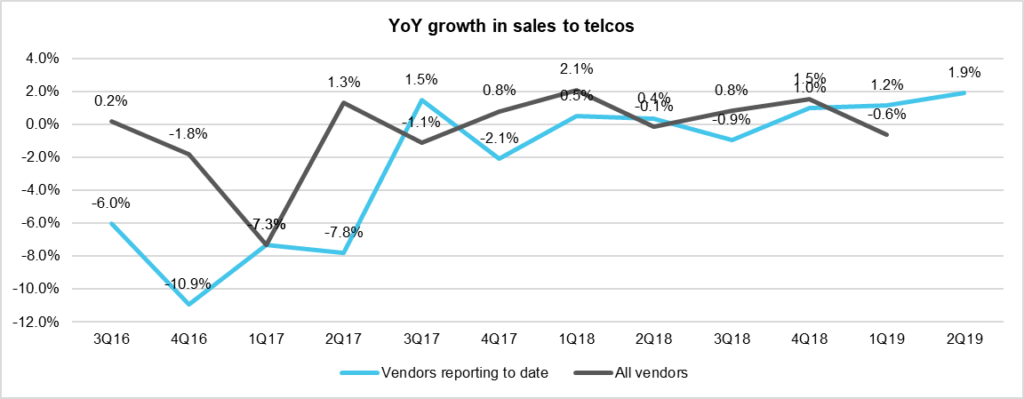

The figure below compares YoY growth rates for the sample with the market, i.e. the sum of all companies in MTN Consulting’s telecom vendor share coverage database.

When including all vendors (black line, above), revenues have largely been flat over the last several quarters. The sample of companies reporting appears broadly similar. However, on the demand side, guidance from telcos on expected spending levels (capex and network opex) was quite conservative for 2Q19. The final growth rate for 2Q19 vendor revenues in the telco vertical will likely be below +2%.

To reiterate findings from our latest (1Q19) telco sector Market Review:

Telco profit margins remain tight, nothing new for the telecom industry. Operators are getting more concerned about debt, though. The net debt (debt minus cash) of the global telco sector was roughly half of revenues in 2018, after having been in the 30-40% range of revenues at the cusp of the LTE buildout cycle. Few telcos have room in their budgets for a 5G capex splurge.

Telco network investments continued a declining trend, as capex touched $70B in 1Q19, down almost 2.5% YoY. The weak 1Q19 result and continued supply side uncertainty does not bode well for 2019. The slowdown could be due to operator caution about market demand. Yet competitive realities will require operators to spend big on 5G and fiber in 2019-20. The market’s average capital intensity will exceed 17% by the end of this year.

We expect to publish further commentary on the market after Nokia and Samsung report next week.