AT&T and Verizon 1Q19 earnings: careful capex management and ongoing layoffs

Background

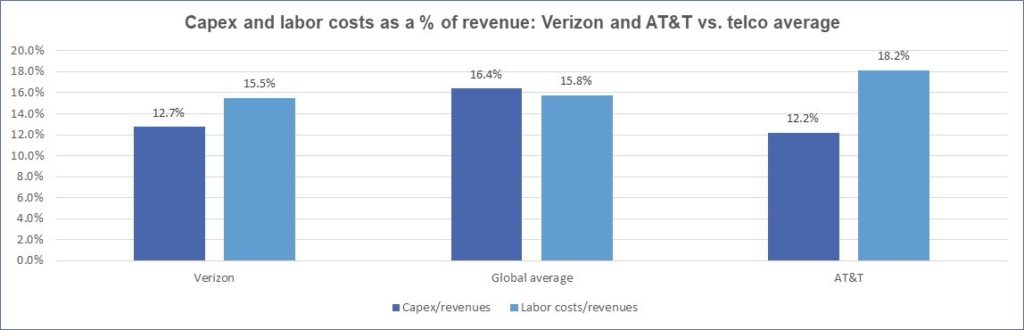

AT&T and Verizon both reported first quarter 2019 (1Q19) earnings this week. Analysts expecting a capex bump from 5G were disappointed. Capital expenditures (capex) fell at both companies on a year-over-year (YoY) basis, down 14% at AT&T and 6% at Verizon. Capital intensity at AT&T fell to what is probably an all-time low in 1Q19: capex is now 11.2% of revenues, on a 12-month annualized basis. Verizon’s 12.5% annualized capital intensity is also near its all-time low. Both telcos continue to cut headcount: their combined employees fell by over 11,000 in just three months, from December 2018 to March 2019.

Our view

AT&T and Verizon continue to hype 5G and aim to position themselves as 5G leaders – even before the network capabilities and services are really there. This is not a new phenomenon, or unique to the US.

While they want brand leadership, that doesn’t mean they want to spend as much on 5G as they can. In this environment, they prefer to spend as little as needed. Top-line revenue growth has been weak, and operating margins flat. Both telcos are spending big on acquisitions and other investments as they expand into cloud and media markets. They’re also paying down their debt. For example, AT&T’s year-end 2019 goal is net debt of $150B, from $169B currently – that requires selling assets, including office properties and a Hulu investment. Actual capex outlays on 5G-capable networks will be incurred gradually, as they can be justified. Marketing is much easier and faster to scale than network construction.

Moreover, some aspects of network construction are getting cheaper & easier. Open networking/open source solutions have matured dramatically over the last few years. Both telcos are using solutions from this community in some aspect of their 5G deployments, even if not the RAN. AT&T is more vocal; it has plans to deploy up to 60,000 “white box” cell site gateway routers across its mobile network (eventually). Earlier this month, AT&T demonstrated the UfiSpace white box (running Vyatta’s OS) at the Open Networking Summit in San Jose. Verizon is also incorporating more open source projects into its network. At both companies, the direct impact of this is small now, but white boxes as a share of telco capex will grow over time.

Even as both telcos spend cautiously on 5G, they are cutting headcount. AT&T’s total employees fell 2.2% in three months, to 262.3K. Verizon’s fall was steeper, down 3.5% from December 2018 to 139.4K employees.

When telcos lay off employees – including voluntary retirement schemes – some cuts are related to mergers and “redundancies”, but most are part of a natural evolution. Operators are always in search of scale economies. Networks are more automated now, requiring fewer people to run than in the past. When operators converge business lines, fewer salespeople are needed. Both AT&T and Verizon have, like most telcos, been shrinking their workforce for many years.

Even with these cuts, they both spend much more on their staff than on capex (figure, above). This gap has remained wide for several years. Their capital spending has declined to record lows, and can’t sink much further as a percent of revenues. In order to fund a 5G uptick in capex, while also keeping debt in check, both operators will continue to slim their workforce.

-END-

Photo credit: Shutterstock.