2020 – The Year of 5G in Thailand

Thailand is making good progress in its goal of launching commercial 5G service in 2020. The recent auction of frequencies in the 700 MHz band, the agreements between operators and telecom equipment suppliers, as well the development in academia and 5G lab setups by suppliers in the Eastern Economic Corridor (at Chonburi) are all great steps in the right direction.

| Recommendations |

| To further streamline the process of effective and meaningful commercialization of 5G following recommendations may be considered by the administration and operators:

• Provide a deadline to shutdown 3G networks. Operators should study this subject and deduce plans; |

Thailand overview

The Kingdom of Thailand is a country at the center of the Southeast Asian Indochinese peninsula composed of 76 provinces. Home to over 69 million people, it shares borders with Cambodia, Malaysia, Myanmar and Laos. It also has a long coastline along the Gulf of Thailand (1,875 km) and the Andaman Sea (740 km), excluding the coastlines of some 400 islands (Figure 1). GDP per capita was $7,274 in 2018.

Figure 1

Telecom Market Overview

Government

The Ministry of Digital Economy and Society was formed on October 03, 2002. It is responsible for national policy on digital development, statistics and meteorology. It is also responsible for managing country’s telecommunication networks and regulating cyber security. It manages two public telecommunication companies namely TOT (Telephone Organization of Thailand) Public Company Ltd and CAT (Communications Authority of Thailand) Telecom Public Company Ltd. Prior to the 2002 creation of the MDES, Thailand’s telecom sector was overseen by a Ministry of Information and Communication Technology.

The National Broadcasting and Telecommunications Commission or NBTC is the national and independent regulator in Thailand that manages both telecommunications and broadcasting sectors. It has the authority to assign frequency spectrum and regulate the two sectors in accordance with the Act on Spectrum Allocation Authority, Regulatory & Control over Radio & TV Broadcast and Telecommunications of 2010 (or NRA Act of 2010).

Mobile Operators

Thailand is a market of approximately 94 million mobile subscribers (June 2019), resulting in a mobile phone penetration rate of about 136%. It is predominantly a prepaid market having more than 70% share.

The mobile phone operators can be divided into two groups – stated owned enterprises and private companies. TOT and CAT are the state-run operators having a combined market share of around 2%. While their services share is tiny, TOT and CAT play important roles as concession holders for private telcos. In addition, their networks include lots of fiber in the backbone and backhaul, as well as cell towers, so they are important infrastructure suppliers to the private sector.

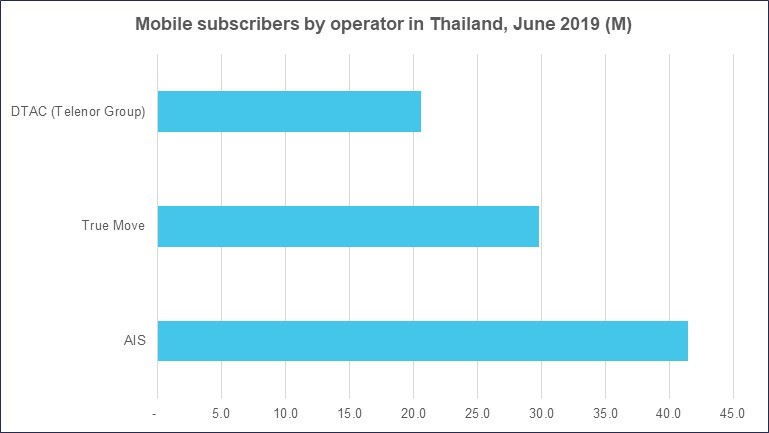

The key private telcos are three players – AIS (Advanced Info Service), TrueMove H and DTAC (Total Access Communication). AIS is the market leader with 41.5 million subscribers followed by True Move with 29.8 million. DTAC, which is owned by Telenor Group, comes in at number three with 20.6 million of users at end of June 2019 (Figure 2).

Figure 2

A number of MVNOs (Mobile Virtual Network Operators) are also present that provide services to their customers using the networks of the state-run enterprises. For example, Buzzme uses TOT’s network whereas Real Move depends on CAT’s network. These MVNOs lack their own radio frequencies and networks, instead they lease capacity from the two state run enterprises.

Fixed line Operators

Thailand’s fixed line subscriptions continue to decline as in other ASEAN countries due to heavy penetration of mobile phones and mobile broadband. The subscription total is down from 3.466 million in 2017 to 2.929 million in 2018. After the dissolution of TT&T (Thai Telephone & Telecommunications) in 2017, TOT took over TT&T’s operations. Now, TOT and AIS are the only two large fixed line operators remaining in the country. TOT has around 70% of the market while most of the rest belongs to AIS. The AIS fixed line customer base comes partly from its 2017 acquisition of CSLoxinfo (see “Running Converged Networks is Costly; A View From Thailand”). In addition to AIS there are several smaller ISPs with fiber and/or DSL networks, some targeting mainly consumer (such as 3BB, owned by Jasmine) and some focused on enterprise (such as Symphony).

Spectrum

Over the last few years the regulator conducted multiple auctions for the launch and promotion of 3G/4G services. The most important one happened in 2012, when the regulator allocated 45 MHz in the 2100 MHz frequency band. An assignment of 15 MHz was made to each of the three mobile phone operators. This spectrum is currently used to offer 3G/4G services. To keep up with the pace of demands from 3G/4G networks, the regulator successfully managed to auction some spectrum in the 900 MHz and 1800 MHz frequency bands in 2015.

To kickoff 5G, the regulator conducted an auction of 700 MHz in June 2019. A block of 2 x 10 MHz was assigned to each of the three private operators and the respective licenses will be valid for the next 15 years starting from October 01, 2020. The auction was conducted at a reserve price of THB17.6 billion ($562 million) per block. This frequency band could be instrumental in kicking off 5G in the country.

The current spectrum assignments for each operator is are shown in Table 1.

Table 1

| Operator | 700 MHz | 850 MHz | 900 MHz | 1800 MHz | 2100 MHz | 2300 MHz | Total Spectrum per Operator |

| AIS | 20 | 0 | 20 | 40 | 30 | 0 | 110 MHz |

| TrueMove | 20 | 30 (wholesale agreement with CAT) | 20

|

30 | 30 (partnership with TOT) | 0 | 130 MHz |

| DTAC | 20 | 0 | 10 | 10 | 30 | 60 (partnership with TOT) | 130 MHz |

| Total Bandwidth per band | 60 MHz | 30 MHz | 50 MHz | 80 MHz | 90 MHz | 60 MHz |

Sources: company announcements and NBTC’s 5G Preparation in Thailand.

5G in Thailand

Thailand is moving ahead to launch 5G during 2020.

The regulator (NBTC) took a great step in December 2018 by mandating operators to shut down 2G services by October 2019 in order to free up capacity for 5G services. The recently concluded 700 MHz auction, along with the existing bands that were in use for 2G services, will also help in the launch and development of 5G.

There are other positive signs:

- Vendor deals: The recent agreements of Nokia, Huawei and ZTE with AIS on the development of 5G use cases for a wide range of industrial verticals.

- 5G use case development: besides spectrum auctions, NBTC is also facilitating the development of 5G at leading educational institutes in each region. After an initial trial at Chulalongkorn University, 5G service was launched at Chiang Mai University (CMU), Khon Kaen University (KKU) and Prince of Songkla University in the 25 and 28 GHz bands. CMU is situated in northern Thailand, KKU in northeast, PSU in south whereas Chulalongkorn University is located in Bangkok (central Thailand). This project will assist academia as well the telecom sector in the development of 5G across the length and breadth of Thailand.

- R&D: Another key development is the 5G lab setups by Huawei, Nokia and Ericsson. These are located in Chonburi, about 90 km (56 miles) southeast of Bangkok. The surrounding area is the target of the Eastern Economic Corridor, which Thailand is hoping to develop by attracting $45B of new investment.

Connectivity

Thailand’s domestic fiber optic cable network spanned 310,000 kilometers at the end of 2018. Most of this is owned by the public sector (210,000 kilometers in total), in particular TOT and CAT. The private sector owns the remaining 100,000 kilometers.

Thailand has multiple submarine cable landing stations for international connectivity. The main submarine cables landing in Thailand are SEA-ME-WE 3, SEA-ME-WE 4, Thailand-Indonesia-Singapore cable, Asia-Pacific Cable Network, Thailand-Vietnam-Hong Kong cable, and FLAG (Fiber-Optic Link Around the Globe). In addition, a new cable system, the SJC2 (South-East Asia Japan Cable System 2) cable is under construction and will land in Songkhla by end of next year.

Key Challenges

Thailand is in a reasonable position to launch 5G. However, there are still a number of challenges that need to be addressed:

The famous C-band: Frequencies in the range of 3.4 to 4.2 GHz, which is part of the core 5G band, are extensively used for TV broadcasting services in Thailand. This spectrum won’t free up for a while. Even though the only satellite that operates in 3.4 GHz to 3.7 GHz range is Thaicom5, its license will not expire before 2022-23. The newer Thaicom6 is also an issue, as it operates in the 3.7-4.2 GHz range and has a valid license till 2029. Field trials are underway in Thailand to understand the compatibility / co-existence of IMT with existing satellite services in the 3.4 to 3.7 GHz band. The only possibility at least for the near future is 3.3-3.4 GHz band for 5G services.

Spectrum Roadmap: lack of a clear spectrum roadmap remains an issue in Thailand. It’s promising that, in addition to the recent 700 MHz auction, NBTC is planning to auction 2.6 GHz, 26 GHz, 28 GHz bands in 2020. However, the cost of acquisition issue needs to be addressed.

Recommendations

To further streamline the process of effective and meaningful commercialization of 5G, the following steps may be considered:

- 3G Shutdown: Operators should start thinking about shutting down their 3G networks. This will free up capacity, reduce the number of network elements, reduce their annual license cost, and spectrum can be returned to the regulator if needed and/or possible or can be reused for 5G if possible. In a nutshell, it will improve their networks’ quality of service and overall financial health. Transition issues such as QoS degradation and vendor contract renegotiation are manageable.

- USO Contribution: Operators make USO obligatory payments out of their revenues to the government. These payments are made to extend the reach of telecommunication services to underserved and remote areas of the country where getting a return on investment is next to impossible. Though the government has recently cut the USO fee to 2.5% from 3.75%, the rate is worth a relook.

- 2020 Spectrum Auction: A 2×10 MHz block in 700 MHz is not suitable to offer real 5G broadband services and thus additional frequencies are needed. Fortunately, there are other options. According to NBTC, a total of 190 MHz in 2.6 GHz, 2.25 GHz of bandwidth in the 26 GHz band, and 3 GHz in 28 GHz are available and all are expected to be put on auction in 2020. We recommend that either 26 GHz or 28 GHz band may be auctioned but not both in 2020. Secondly, we suggest that 2600 MHz may not be put for auction as it is not one of the desired bands at the world stage for 5G in 2020:

- Both bands (26 GHz and 28 GHz) have enough bandwidth to offer 5G for the coming years

- Not to give additional financial burden to the operators

- C-band (3.4 GHz – 3.7 GHz): A quick completion of the currently underway 5G and satellite co-existence/ compatibility trial will be good omen, particularly if the results are positive. Thailand may recommend a footnote for the future use of 3.4-4.2 GHz for IMT at the World Radiocommunication Conference 2019.

- 3.3 GHz – 3.4 GHz: This range may only be made available if existing satellite usage in 3.4 – 3.7 GHz can co-exist with IMT, otherwise bandwidth is not enough to be shared among three operators along with the guard band of 10-20 MHz.

- Spectrum Roadmap: A clear 3 to 5 year roadmap is needed to assist operators and their shareholders in their decision-making process.

–

Photo by Frankie Spontelli on Unsplash