By Matt Walker

This brief provides a snapshot of 4Q22 financial results for the webscale network operator (WNO) sector.

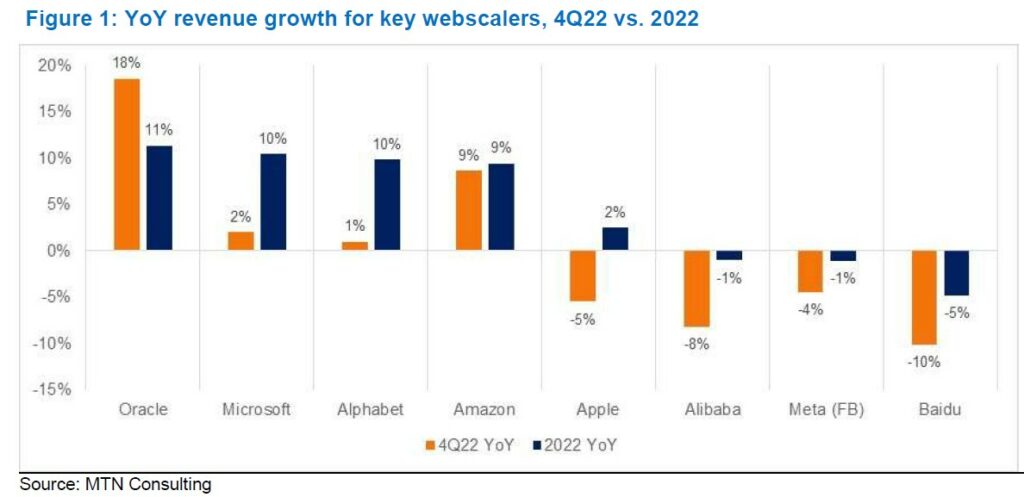

Financial results for the webscale sector are available for ~85% of the market. Based on this sample, capex for the group surged by about 16% in 2022, surpassing $200 billion (B). This is in line with MTN Consulting’s projected 2022 capex of $206B. Webscalers continued to expand their data center footprints and invest heavily in AI. However, webscale growth has clearly slowed. Revenue growth for 4Q22 was under 1% YoY, and revenues grew just 5% for 2022 overall. As capex remains high but cash generated from operations has sunk, webscalers’ free cash flow has fallen. Annualized FCF margin for 4Q22 was just 14.2%, from 17.1% in 2021. Webscale headcount at year-end 2022 was about 4.1 million, flat versus 2021. Capex guidance has fallen back to earth. That includes Meta (Facebook), which powered capex growth in 2022. These cutbacks will hit some vendors. They will also mean webscalers will rely a bit more on rented facilities than newly built and self-owned data centers. This helps data center-focused carrier-neutral operators like Digital Realty and Equinix. Even with moderating capex, the big three cloud webscalers are enjoying the fruits of previous capex outlays by penetrating more sectors more deeply with their cloud services offerings. That includes telecom: MTN Consulting estimates that combined revenues in the telco sector for these 3 webscalers reached ~$4.5B in 2022, from $2.6B in 2021.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

Summary – page 2

Summary of 4Q22 results – page 2

Webscale impact on telco & carrier-neutral sector – page 4

Spending outlook – page 5

Appendix – page 6

Figures and Tables

Figure 1: YoY revenue growth for key webscalers, 4Q22 vs. 2022

Figure 2: Annual capex in last three years for key webscalers (US$B)

Coverage

Companies mentioned:

Airtrunk

Alibaba

Alphabet

Amazon

Amdocs

Apple

AWS

Azure

Baidu

ByteDance/TikTok

Digital Realty

Equinix

GCP

HPE

JD.Com

Macquarie Infrastructure

Meta (Facebook)

Microsoft

Oracle

SAP

Tech Mahindra

Tencent

Tencent Cloud

Visuals