By Matt Walker and Arun Menon

Multiple types of companies are investing heavily in data center assets. Two years ago, the data center market was already vibrant, but COVID-19 gave this a boost as enterprises accelerated digital transformation efforts, and multiple sectors (enterprise, government, education…) moved many activities to the cloud. As a result, data center investment has boomed. This investment is coming from multiple sources: webscalers, carrier-neutral operators, telcos, a broad range of asset management specialists aiming to benefit from growing DC demand. With this investment, the market is seeing consolidation and the emergence of new business models. Meanwhile, the technologies deployed in the data center are evolving rapidly. Vendors are creating new products and customizing old ones in order to cater to the data center. Even if you’re steeped in the data center world, it can be hard to keep up. This “Data Center Investment Tracker” provides an up-to-date synthesis of this investment and technology activity.

This is the second edition of our data center investment tracker, covering developments through April 2022. The scope of coverage has been expanded considerably since the first edition, and we have added a new section addressing energy topics. The report includes the following sections:

Footprint: a summary of the data center footprint, energy usage, and major projects underway of all key webscale and carrier-neutral network operators, and a few large telcos with data center holdings. In total, 52 companies are included, from 27 last quarter.

Capex: capital expenditures (capex) recorded from 1Q11-4Q21 by the big spenders driving the data center market – webscale and carrier-neutral operators. In total, capex information is included for 31 companies with data center holdings. Capex for these companies was $177.3 billion (B) in 2021, up 29% from 2020. A large portion of this capex was dedicated to data center construction and operation.

Vendor contracts: a database of 281 contracts between data center operators and vendors, cutting across many different categories of technology, in particular: servers (and the chips that run them), switches, routers, storage, security, optical interconnect, software, and power/cooling. The database attempts to be comprehensive for January 2020 through early May 2022.

Asset management: mini-profiles of 40 (from 30 last quarter) asset management & real estate companies with active interests in data centers, summarizing their approach to data center investment, major holdings, and recent developments.

Mergers & acquisitions: a summary of 73 significant M&A transactions involving the data center market, focusing on 2020 to early May 2022. The database includes 15 deals announced in 2022, which account for total deal value of $16.8B. The largest three deals in 2022 to date are: the joint bid by DigitalBridge and IFM Ventures to take Switch private, for $11B; Digital Realty’s $3.5B acquisition of 55% of Teraco, a South Africa-based CNNO; and, Equinix’s $705M acquisition of 4 data centers from South American telco, Entel.

Energy: for most of the large data center operators, this tab addresses overall energy consumption, energy spending, the shift to renewables, and data center efficiency (i.e. PUE).

All information is current as of early May 2022, with one exception: capex data is through the December 2021 reporting period (4Q21). However, when available we have summarized more recent guidance from each company on 2022 capex plans.

- Table Of Contents

- Figures & Tables

- Coverage

- Visuals

Table Of Contents

- ABSTRACT

- DC Footprint: Data center footprint of major operators

- DC Capex: Capex of major data center operators

- VC Summary: Data center operator contracts with technology vendors

- Vendor Contracts: Data center vendor contracts database

- AM: Asset management firms active in data centers

- MA: Data center mergers & acquisitions – summary

- MA Data: Data center M&A database

- Energy: Energy usage by major data center operators

- About

Figures & Tables

- Figure (dynamic): Data center footprint (for 52 companies)

- Figure: Annualized capex by segment, CNNO & Webscale (US$M)

- Figure: Top 15 providers based on 4Q21 annualized capex (US$M)

- Figure: 4Q21 annualized capex ($M) and cumulative % WNO/CNNO total

- Figure: YoY changes in annualized capex, 4Q21 vs. 4Q20

- Table: Summary of vendor contracts included

- Table: Major announcements between technology suppliers and data center operators/builders

- Figure (dynamic): Asset management firm approach to DC investing, major holdings, and recent developments (for 40 companies)

- Table: Summary of M&A deals included

- Table: Significant M&A deals involving data center operators and assets

- Figure: Total electricity consumption by major data center operator (terawatt-hours)

- Figure: Estimated electricity spending as % of revenues by major DC operator*

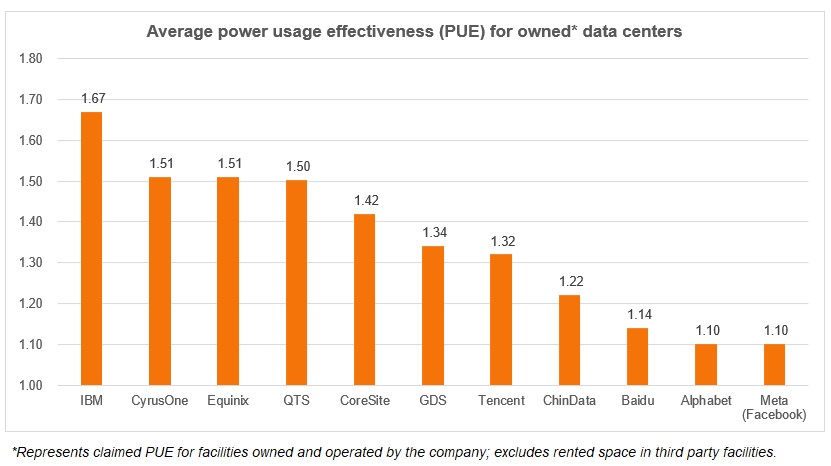

- Figure: Average power usage effectiveness (PUE) for owned* data centers

- Figure: Renewable energy* as % of total consumption by operator

Coverage

Partial list:

365 Data Centers

AARNet

Aesler Group

Africell

Airtrunk

Alibaba

Alphabet (Google)

Altaba

Altibox Carrier

Amazon

Angola Cables

Apple

Aqua Comms & Telia

ARC Solutions

Asia Pacific Telecom

AtlasEdge Data Centres (Liberty/DigitalBridge)

AWS

Azercell Telecom

Baidu

BCE

Beyond.pl

BitNAP Datacenter

BroadBand Tower

ByteDance

C3ntro Telecom

Capital Online

China Media Group

China Mobile

China Telecom

China Telecom Global

China Telecom Guangdong

China Telecommunication Tech Labs

China Unicom

ChinaCache

ChinData

CITIC Telecom

CityFibre

CNT

Cogent

Cognizant

Colocation Australia

Cologix

Colt Data Centre Services

Colt Technology Services

Comcast Business

CoreSite

CRT Informatique

CyrusOne

Cyxtera

DataBank (including Zayo/zcolo)

DC BLOX

DEWA (Moro Hub)

Digital Realty

DISH

Djibouti Telecom

DT Global Carrier

DuPont Fabros

eBay

EdgeConnex

Equinix

Espanix

everyWAN

Evoque Data Centers

FirstLight

Flexential

Fujitsu

GDS

GigeNET

Global Switch

GlobalNet

Green Mountain

Greenergy Data Centers

Hanoi Telecom

Hetzner Online

HPE

Huawei Cloud

i3D.net

IBM

i-Data

IKOULA

Interxion

IP Telecom

Iron Mountain

Iusacell

Japan Network Access Point

JD.com

Jolera

KDDI Telehouse

Keppel DC REIT

LG CNS

Lightstorm Telecom Ventures

LinkedIn

Lumea

M1

Marcatel

Mercantil do Brasil

Meta (Facebook)

Microsoft

Munich Re

National Security Agency

National Supercomputing Center

NAVER

Neos Networks

NEXTDC Limited

NICT Japan

Ningxia Cable TV

Nipa Cloud

NL-ix

NorthC Datacenters

Northwest Access Exchange

NTT Communications

NxtGen Data Centers

Nxtra by Airtel

Omantel

Ooredoo Qatar

OpenColo

Oracle

PAIX data centres

PeaSoup

PIT Chile

PLDT

Prime Data Centers

QTS Realty

Rakuten

RETN

Salumanus (SI)

SAP

Serverius

Shinsegae I&C

Sichuan Unicom

SMC Corporation

Southern Cross Cable Limited

SpaceDC

Sparkle

SSE Enterprise Telecoms

Stack Infrastructure

StarHub

stc

Steel Authority of India

Sunevision

Swiss National Supercomputing Centre

Switch

team.blue Denmark

Telefonica

Telefónica del Perú

Telstra

Tencent

Teraco

Thésée DataCenter

Three Gorges Group

T-Mobile Polska

Togocom

Turkcell

Twitter

UK Crown Commercial Service

Uninett

US Department of Energy

Vantage Data Centers

Verizon

VNET Group (21 Vianet)

Vocus New Zealand

Vodacom South Africa

Vodafone Infrastructure Partners

Vodafone New Zealand

Vodafone Turkey

WIN Technology

Windstream

XData Properties

XDC+

Yandex

Zayo Group Holdings

Zenlayer

Zoom

Visuals