By Matt Walker

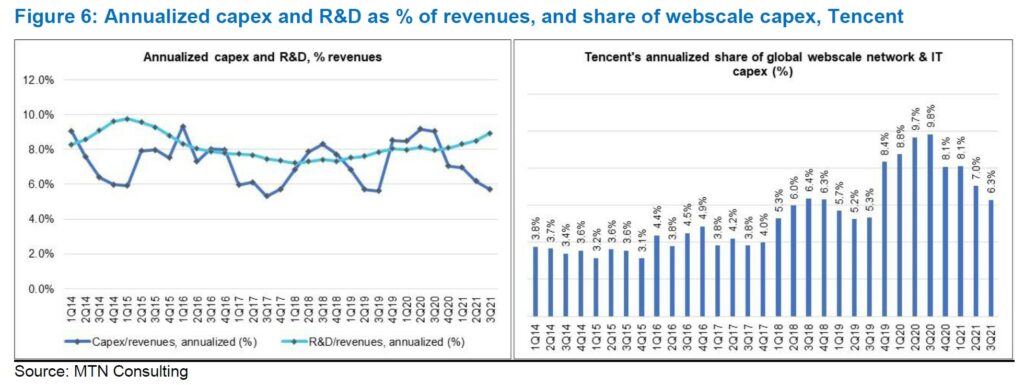

Tencent is China’s largest Internet company. It has built a huge network in China to support growth of its vast digital ecosystem of services, both those provided directly and by partners. As Tencent Cloud has grown in recent years, Tencent has ramped up its spending on both network infrastructure and R&D projects aimed at deploying new services and developing more of its own network technology. The company has a proprietary approach to data center design which looks promising, it builds its own data center servers, and it has made progress in the last few months with self-design of the key ingredient of the modern data center, server chips. Last year, the company made a commitment to spend $70 billion over 5 years on cloud and related infrastructure and technology, stretching across capex and R&D spend, and it is well on its way. For the 12 months ended September 2021, capex and R&D spend totaled $4.8B and $7.5, respectively, or $12.3B in total.

Increasingly Tencent aims at the global market, in particular in the gaming and cloud arenas. Despite current government pressure on several Chinese tech players including Tencent, the company is poised to become a major global tech brand. The company has been successful in monetizing services which are provided for free (i.e. subsidized by ads) by a number of other tech providers, including Facebook (Meta) and Google (Alphabet). Tencent is one of a few top global players in the gaming market, and becoming a major media player with Tencent Pictures and Tencent Music. Tencent is investing in a number of important adjacent markets with growth potential, including connected cars and robotics. In the cloud, it is well behind China’s top player Alibaba, and further behind the global top three (AWS, Azure, and GCP), but Tencent has deep pockets, technology chops, and global ambitions. Its profile will rise considerably in the next few years. One of many reasons is its positioning to go after “metaverse” opportunities, which blend well with its technical strengths and customer base in both gaming and video.

- Table Of Contents

- Figures & Tables

- Coverage

- Visuals

Table Of Contents

- Summary

- Company overview

- Introduction

- Organization

- Revenues and profitability

- Subsidiaries, associates and investments

- International position

- Strategy and positioning

- Technology spending

- Technology suppliers

- Network infrastructure

- Overview

- Tencent Cloud

- CDN infrastructure

- Data centers

- Servers and server chips

- Data center interconnect

- Appendix

Figures & Tables

Figure 1: Tencent organizational structure

Figure 2: Revenues and profit margins, Tencent (1Q14-3Q21)

Figure 3: Tencent revenues (and other gains) by segment, 3Q21 vs. 3Q20 (US$B)

Figure 4: Tencent’s international gaming push

Figure 5: Tencent’s digital ecosystem

Table 1: Tencent’s technology spending areas in support of its corporate strategy

Figure 6: Annualized capex and R&D as % of revenues, and share of webscale capex, Tencent

Figure 7: Tencent’s expenses by nature, 2018-20 (% total opex, including D&A)

Table 2: Tencent’s key relationships with technology suppliers

Figure 8: Tencent Cloud – regions and availability zones

Figure 9: Tencent Cloud offerings

Figure 10: Tencent’s “lego” components for the T-block data center

Figure 11: OPC-4 3D Image

Coverage

Companies and organizations mentioned in this report include the following:

Ampere Computing

AOL

Apple

Arm

Baidu

Barefoot networks

Bilibili

BMW

Broadcom

ByteDance

China Aerospace Science & Industry Haiying Co. Ltd.

China Mobile

China Telecom

Chinese Communist Party (CCP)

CICC Capital

Cisco

CITIC

Comcast

Committee on Foreign Investment in the United States

Daimler

Dalian Wanda

Enflame Technology

Ericsson

Foxconn (Hon Hai)

Gao Energy

GDS Data Centers

Geely

Huada Semiconductor

Huawei

IBM

iflix

iFLYTEK

Infineon Technologies

Intel

Inventec

ixia

JD.Com

Legendary Entertainment

Lenovo

Luokung Technology

Meituan

Mellanox

Meta (Facebook)

Microsoft (Azure)

Midea

MIIT

NBCUniversal

Nintendo

Nio

Nokia

NVIDIA

Open Compute Project

Oracle

Pinduoduo

Primavera

PUBG

Qting Vision

Qualcomm

Razer

Reddit

Rosenberger

Ruijie Networks

Satellogic

Sea Ltd

Shenzhen Baoan Bay Tencent Cloud Computing Co., Ltd

Shopee

Sinoits Tech

SMIC

Snap

Sogou

STMicrolectronics

Sumo Group

Tencent Games

Tencent Music

Tencent Pictures

Tesla

TSMC

Ubisoft

Viavi

Vivo

Volvo

Warner Music

Xilinx

ZTE

Visuals