By Arun Menon

This market review provides a comprehensive assessment of the global telecommunications industry based on financial results through June 2022 (2Q22). The report tracks revenue, capex and employees for 139 individual telecommunications network operators (TNOs). For a sub-group of 79 large TNOs, the report also assesses labor cost, opex and operating profit trends. The report also covers annual data for other financial metrics such as debt, cash & short term investments, M&A spend and cash flow from operations for all the 79 companies from the TNO-79 subset. Our coverage timeframe spans 1Q11-2Q22 (46 quarters). The report’s format is Excel.

ABSTRACT

2Q22 RESULTS SUMMARY

Telco topline posts steepest quarterly decline since 3Q15

Telco topline nosedived by 6.2% on a YoY basis in the latest single quarter, the most since 3Q15 when revenues fell significantly by 7.2%. Telco revenues reached $448.6 billion (B) in 2Q22, as it registered its third consecutive falloff since the fourth quarter of last year. The steep decline also impacted annualized revenues and its growth rate – they were $1.851T for the annualized 2Q22 period, down 1.4% YoY over annualized 2Q21.

The drop is not as bad as it seems, however: AT&T’s April 2022 spinoff of its WarnerMedia unit was big enough to impact the global market. As reported by the company, AT&T’s 2Q22 revenues (post spinoff) fell by 33% YoY. If you instead assume AT&T’s 2Q22 revenues were flat (0% growth) YoY, revenues for the global telco market would have fallen only by 3.1% in 2Q22, rather than 6.2%.

Among the top 20 companies by revenues, the three Chinese operators topped the list to post sizeable growth on an annualized basis. These include China Telecom (13.1% YoY vs. annualized 2Q21), China Mobile (12.1%), and China Unicom (9.7%). Growth witnessed by the three Chinese telecom giants was largely due to a surge in their “emerging businesses” revenues. These businesses include cloud computing, big data, internet data centers, and Internet of Things (IoT). Growth witnessed by a few other operators was mostly an outcome of non-service revenues, as these have grown with 5G device sales in many markets. Telcos now hope that the 5G-enabled devices already deployed will help to generate new revenue streams in the forthcoming quarters of 2022 and beyond. But that seems unlikely as a major chunk of the growth is expected to come from device sales. MTN Consulting’s latest forecast calls for 2022 telco revenues of $1,929B, up 2% YoY. The worst annualized telco growth among the top 20 operators came from AT&T, down 15.6% on an annualized basis, largely due to the WarnerMedia spinoff. However, 11 other out of the top 20 operators posted a decline in revenues on an annualized basis in 2Q22, without a big asset sale to explain the drop. Four other key operators, namely Telefonica (-12.9%), America Movil (-9.5%), NTT (-7%), and KDDI (-6.8%) were among the top 20 to post a >5% decline in revenues on an annualized basis in 2Q22.

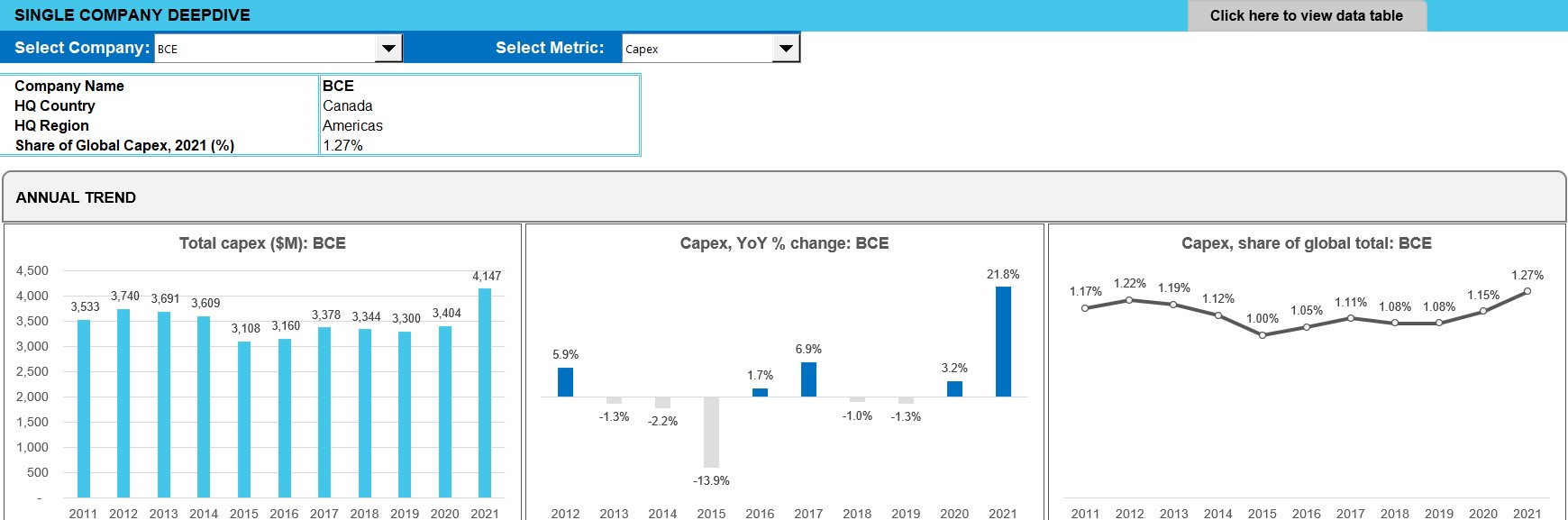

Annualized capex and capital intensity hit 10-year peak

Despite stalled revenue growth and macro pressures, telcos continue to be on a spending spree. Telco investments grew for the sixth straight quarter with the industry reaching a new capex peak. For the annualized 2Q22 period, telco capex was $329.5B, while the ratio of capex to revenues (i.e. capital intensity) was 17.8%. Both figures represent new record highs, at least for the 46 quarter period (11.5 years) that MTN Consulting covers (1Q11-2Q22). While post-COVID bump continues to be a key factor behind the capex spending spike, many telcos continue to upgrade networks to 5G, with a growing number beginning deployment of stand-alone 5G core networks, often relying on collaboration with webscale operators like AWS, Azure and GCP for key functions. Another factor has been the fiber spending by telcos which has been strong in a number of markets, especially the US but also in Europe, Australia, China, and India. That’s to support FTTx deployments but also to connect together all the new radio infrastructure needed to support 5G. MTN Consulting expects full-year 2022 capex to total $331B.

As noted earlier, the market’s annualized capital intensity rose to a record high, from 16.5% in 2Q21 to 17.8% in 2Q22. The previous high of 17.5% was recorded in 1Q16, during the peak of the LTE build cycle. At the operator level, Rakuten beats all other telcos handily with a roughly 174.8% capex/revenue ratio for the quarter on an annualized basis; this has been declining in the recent quarters as its greenfield network rollout is reaching its peak. Globe Telecom’s capital intensity for the annualized 2Q22 period stood at 58.5%, the highest among established operators. Globe’s figure is due to a network infrastructure buildup that includes 1,080 new cell sites, upgrades to at least 12,900 sites including both 4G LTE and 5G, and installation of over one million fiber-to-the-home lines. PLDT’s annualized capital intensity stood at 53.8% in 2Q22, as spending ramped both for meeting connectivity demands and taking on new competition from the new mobile player Dito Telecommunity Corp. The global capex climb was also due to telcos choosing from a smaller set of suppliers than in previous years: the US-sponsored entity list has severely limited opportunities outside China for Huawei, which is still the world’s largest telecom vendor. Less competition frequently means higher prices. Inflationary pressures in many economies make this worse as it has impacted the entire telecom value chain, from chips to components to systems to services.

The biggest capex spender in 2Q22 on a single quarter and annualized basis was China Mobile, posting a YoY growth of 10.5% in the annualized 2Q22 period. That growth comes despite efforts to share costs on the network side enabled by partnership with China Broadcasting Network. Seven out of the top 20 operators by annualized capex spend posted double-digit growth rates in the period ended 2Q22. Some of these include: America Movil (75.3% YoY vs. annualized 2Q21), BT (41.2%), Telecom Italia (31.8%), Verizon (29.3%), China Telecom (19.3%), AT&T (18.4%), and China Mobile (10.5%).

Persistent efforts towards digital transformation and automation keep telco profitability sound

Telcos have been able to deliver steady profitability margins amid the immense burden of investments, stagnating revenues, and macro pressures for the past several years. Historically, telco EBIT (operating) margins have been in the range of 13-18% while EBITDA margins have never fell below 30% since 2011. This trend continued to stretch out into 2022. Annualized operating margins ended 2Q22 at 14.9%, slightly up from 14.6% in the same quarter of 2021, while annualized EBITDA margins stood at 33.9% in 2Q22 (unchanged YoY). Within the overall telco opex budget, telcos are having success in cutting their sales & marketing and G&A spending, as telcos adjust to working from home and accelerate the migration of sales & support to digital platforms. These efforts accelerated in 2020, as COVID-19 spread and telcos were forced to do business with minimal human intervention, but have continued in 2021-22. MTN Consulting expects telcos to continue reducing their headcount by revamping their processes, investing in digital transformation, and adopting automation. These investments will cause labor’s share of opex ex-D&A to rise again soon, and remain above 22% for the next few years. Meanwhile, many telcos are reporting that network operations is taking up a larger portion of the opex pie. To drive sweeping changes going forward, telcos will have to implement dramatic, strategic measures to optimize their cost structure in order to increase and sustain profitability. These strategic measures will be a mix of technology-enabled solutions and collaborations, some of which will transform the telco business model. While automation will continue to be a key enabler, other key strategic cost optimization measures that telcos will pursue over the next 2-3 years include core network sharing, network slicing, and partnerships with webscale cloud providers, each of which has the potential to hit multiple cost bases.

No respite in industry headcount reduction as labor costs rise

Telco industry headcount was 4.59 million in 2Q22, down from 4.74 million a year ago. MTN Consulting expects headcount reductions to continue via attrition and voluntary retirement schemes, heading towards 4.39 million by 2026. Spending on employees (labor costs) continues to be on a rise though on a per-person basis. Even as telcos cut headcount, they recognize how key their workforce is to success. As such they are investing in training programs, and hiring a new generation of highly-skilled employees able to function in the telco of 2022. Data from 2Q22 verifies that telcos’ average labor costs per employee are rising as telcos make this transition – annualized labor costs per employee increased to $56.8K in 2Q22 from $55.5K in 2Q21. MTN Consulting expects the average telco employee salary to continue rising, reaching just above US$70K by 2026.

Asia remains the biggest market by both revenues and capex

The Asia region maintained its leadership position in 2Q22 after surpassing the Americas region in the previous quarter to become the single largest region by revenues. In terms of growth, all regions were a mixed bag – MEA was the only region to register revenue growth among the four major regions in 2Q22, while all but Europe posted growth in capex in the latest quarter. On a capex basis, the Asia region has been outspending the Americas for many years but the Americas region posted the highest capex growth of 17.4% YoY in the latest quarter; America Movil, Verizon and AT&T are responsible for most of this growth. AT&T’s capital intensity in 2Q22 was 21.9%, easily the highest for the company in the last decade. Europe’s capex growth declined steeply by 13.8% in 2Q22, while its share of global spending also witnessed a sharp drop from 23.4% in 2Q21 to 19.6% in 2Q22 (22.4% in 1Q22). However, Europe’s annualized capital intensity of 19.6% (2Q21: 18.3%) was the highest among the four regions in 2Q22. This surge was a direct result of 5G buildouts, many of which were delayed from 2020 due to COVID shutdowns and spectrum auction delays.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Market snapshot

- Analysis

- Key stats through 2Q22

- Labor stats

- Operator rankings

- Company Deepdive & Benchmarking

- Country breakouts

- Country breakouts by company

- Regional breakouts

- Raw Data

- Subs & traffic

- Exchange rates

- Methodology & Scope

- About

Figure & Charts

- TNO market size & growth by: Revenues, Capex, Employees – 1Q20-2Q22

- Regional trends by: Revenues, Capex – 1Q20-2Q22

- Opex & Cost trends

- Labor cost trends: 1Q20-2Q22

- Profitability margin trends: 1Q20-2Q22

- Spending (opex, labor costs, capex): annual and quarterly trend

- Key ratios: annual and quarterly trend

- Workforce & productivity trends: 1Q14-2Q22

- Operator rankings by revenue and capex: latest single-quarter and annualized periods

- Top 20 TNOs by capital intensity: latest single-quarter and annualized periods

- Top 20 TNOs by employee base: latest single-quarter

- TNOs: YoY growth in single quarter revenues

- TNOs: Annualized capital intensity, 1Q16-2Q22

- TNOs: Revenue and RPE, annualized 1Q16-2Q22

- TNOs: Capex and capital intensity (annualized), 1Q16-2Q22

- TNOs: Total headcount trends, 1Q16-2Q22

- TNOs: Revenue and RPE trends, 2011-21

- TNOs: Capex and capital intensity, 2011-21 ($ Mn)

- TNOs: Capex and capital intensity, 1Q16-2Q22 ($ Mn)

- TNOs: Revenue and RPE trends, 1Q16-2Q22

- Top 79 TNOs by total opex, 2Q22

- Top 79 TNOs by labor costs, 2Q22

- TNOs: Software as % of total capex

- TNOs: Software & spectrum spend

- TNOs: Total M&A, spectrum and capex (excl. spectrum)

- Top 79 TNOs by total debt: 2011-21

- Top 79 TNOs by total net debt: 2011-21

- Top 79 TNOs by long term debt: 2011-21

- Top 79 TNOs by short term debt: 2011-21

- Top 79 TNOs by total cash and short term investments ($M): 2011-21

Coverage

Operator coverage:

| A1 Telekom Austria | Advanced Info Service (AIS) | Airtel | Altice Europe | Altice USA | America Movil | AT&T | Axiata | Axtel | Batelco |

| BCE | Bezeq Israel | Bouygues Telecom | BSNL | BT | Cable ONE, Inc. | Cablevision | Cell C | Cellcom Israel | CenturyLink |

| Cequel Communications | Charter Communications | China Broadcasting Network | China Mobile | China Telecom | China Unicom | Chunghwa Telecom | Cincinatti Bell | CK Hutchison | Clearwire |

| Cogeco | Com Hem Holding AB | Comcast | Consolidated Communications | Cyfrowy Polsat | DEN Networks Limited | Deutsche Telekom | Digi Communications | DirecTV | Dish Network |

| Dish TV India Limited | DNA Ltd. | Du | EE | Elisa | Entel | Etisalat | Fairpoint Communications | Far EasTone Telecommunications Co., Ltd. | Frontier Communications |

| Globe Telecom | Grupo Clarin | Grupo Televisa | Hathway Cable & Datacom Limited | Idea Cellular Limited | Iliad SA | KDDI | KPN | KT | Leap Wireless |

| LG Uplus | Liberty Global | M1 | Manitoba Telecom Services | Maroc Telecom | Maxis Berhad | Megafon | MetroPCS Communications | Millicom | Mobile Telesystems |

| MTN Group | MTNL | NTT | Oi | Omantel | Ono | Ooredoo | Orange | PCCW | PLDT |

| Proximus | Quebecor Telecommunications | Rakuten | Reliance Communications Limited | Reliance Jio | Rogers | Rostelecom | Safaricom Limited | Sasktel | Shaw |

| Singtel | SITI Networks Limited | SK Telecom | Sky plc | SmarTone | SoftBank | Spark New Zealand Limited | Sprint | StarHub | STC (Saudi Telecom) |

| SureWest Communications | Swisscom | Taiwan Mobile | Tata Communications | Tata Teleservices | TDC | TDS | Tele2 AB | Telecom Argentina | Telecom Egypt |

| Telecom Italia | Telefonica | Telekom Malaysia Berhad | Telenor | Telia | Telkom Indonesia | Telkom SA | Telstra | Telus | Thaicom |

| Time Warner | Time Warner Cable | TPG Telecom Limited | True Corp | Turk Telekom | Turkcell | Veon | Verizon | Virgin Media | Vivendi |

| Vodafone | Vodafone Idea Limited | VodafoneZiggo | Wind Tre | Windstream | Zain | Zain KSA | Ziggo | ||

| Masmovil |

Regional coverage:

| Asia | Americas | Europe | MEA |

Visuals