By Matt Walker

MTN Consulting tracks three segments of network operators: telco, webscale, and carrier-neutral (CNNO). The CNNO market is by far the smallest, accounting for 2.2% of 2017-21 combined operator revenues, and 6.1% of combined capex. However, CNNOs are essential for the efficient functioning of operator markets. CNNOs help lower the cost of building and operating networks for telcos and webscalers, and accelerate their time to market. CNNOs also do much more than simply rent out space or capacity on neutral platforms. Increasingly they are investing in technology, for instance data center interconnect. Further, they provide electricity and other utilities to their customers, and as such are central to the sustainability concerns of the operator industry.

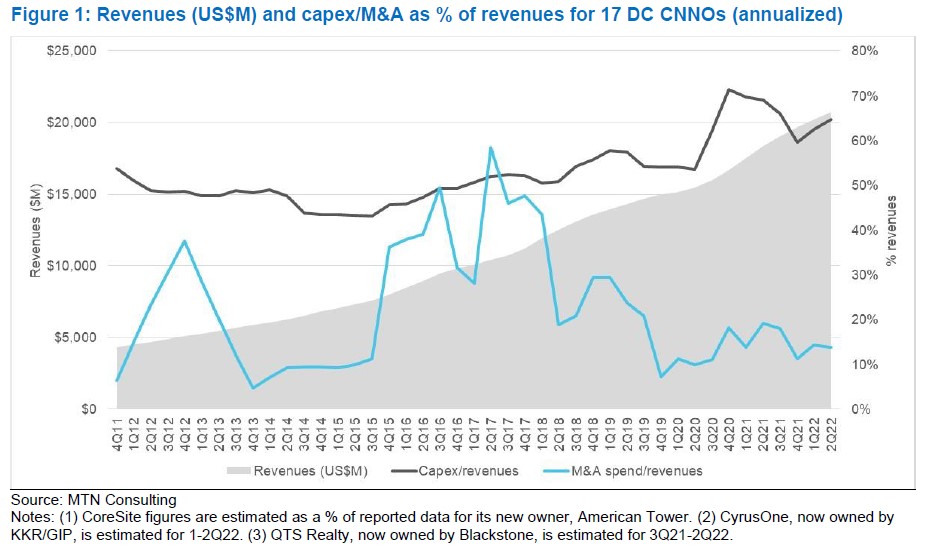

Within the CNNO market, there are three types of infrastructure focus: towers, data centers, and fiber/bandwidth. Many CNNOs own and operate two or all three of these infra types. Over time this integrated approach to CNNO infrastructure is becoming more common. As we argued in a July 2021 report: “a new breed of integrated owners of infrastructure network assets will emerge over the next 2-3 years, converging towers, data centers, and fiber networks.” This convergence is indeed occurring. However, data centers are the hot spot at the moment. There is significant new investment into CNNO data centers from asset management and real estate firms, and there is a lot of M&A activity in the DC market aimed at building bigger portfolios. Some of the investment targets so-called “hyperscale” facilities designed for the needs of the largest Internet companies, such as the cloud providers which we track in the webscale market; other investment is aimed at smaller facilities at the edge of the network, serving a wider range of customers including mobile operators. We have reviewed first half 2022 earnings and market activity in the CNNO space to gauge market directions for data center-focused CNNO platforms. Spending outlook is generally modest for the key public CNNOs, but private asset management companies – plus DigitalBridge, a now-public CNNO with a private equity past – continue to make splashy announcements and acquisitions in the sector.

- Table Of Contents

- Figures

- Coverage

- Visuals

Table Of Contents

Summary – page 2

Key players in data center CNNO markets – page 2

Public CNNO financials – page 4

Implications – page 7

About – page 9

Figures

Figure 1: Revenues (US$M) and capex/M&A as % of revenues for 17 DC CNNOs (annualized)

Figure 2: First half capex for top data center CNNOs, 2020-22 (US$M)

Figure 3: DigitalBridge’s strategy progression

Coverage

Companies and organizations mentioned in this report include:

21Vianet

American Tower

AT&T

AtlasEdge

Blackstone Group

Brookfield Infrastructure Partners

ChinData

Cogent

Colony Capital

CoreSite

CyrusOne

Cyxtera

DataBank

DigiPlex

Digital Realty

DigitalBridge

DuPont Fabros

Entel

EQT

Equinix

Evoque Data Centers

Gaw Partners

GDS

GI Partners

Goldman Sachs

ICONIQ Capital

Infomart

Interxion

IPI Partners

Iron Point Partners

Keppel DC REIT

KKR

Macquarie Capital

MainOne

NEXTDC

Patria Investments

QTS Realty

Scala Data Centers

Stack Infrastructure

Stonepeak Infrastructure Partners

Sunevision

Supernap Italia

Swiss Life

Switch

T5 Data Centers

Vantage Data Centers

Visuals