By Matt Walker

This brief provides a snapshot of preliminary 2022 results for the telco network infrastructure (Telco NI) market. It discusses demand and supply trends in Telco NI based on revenue reports and estimates for 105 active vendors, representing about 75% of the market. Telco NI’s giant, Huawei, has yet to report.

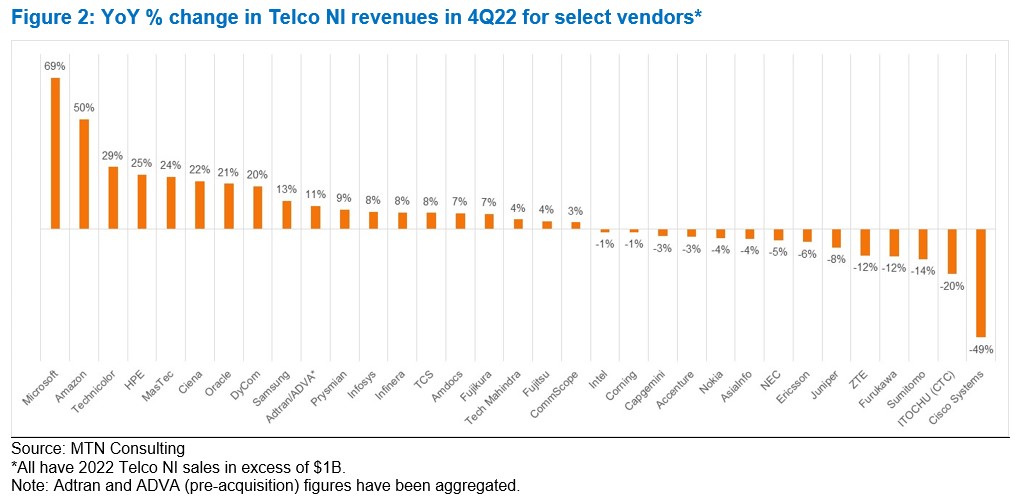

In the last few months, MTN Consulting has noted that network spending was starting to flatten in the telco segment. In 3Q22, telco capex dipped 5% YoY, the first decline since 4Q20. The vendor market also weakened in 3Q22, as Telco NI vendor revenues grew just 2% after seven straight quarters of much stronger growth. Now we have a solid set of preliminary results for 2022’s final three months, 4Q22. For the 105 vendors available, Telco NI revenues fell by 1% YoY in 4Q22; this is the first decline for this group of Telco NI vendors since 2Q20, when COVID shut down economies. For CY2022, Telco NI grew just 2% YoY, down from +9% in 2021, when telcos splurged post-COVID, and the 5G RAN market saw a nice run-up. Among the larger reporting vendors, the best 4Q22 Telco NI growth was recorded at the three cloud providers (AWS, Azure, and GCP); engineering services companies Dycom and MasTec; NEPs Calix, Ciena, Samsung, and Technicolor (now Vantiva). New vendor Rakuten Symphony recorded the best overall growth rate in 4Q22, with revenues of $180M up 193% YoY. On the other side, Cisco, Ericsson, and ZTE saw the worst declines in 4Q22, due in part to a downswing in spend among their largest customers.

For the overall market, some of the decline seen in 4Q22 was inevitable, as telcos slow down their initial 5G network buildouts. Other negatives include higher interest rates, higher energy costs, weak economic growth, cloud alternatives to network builds, and 5G’s inability to deliver services revenue growth. Revenue guidance for 2023 from key vendors suggests a flat to slightly down market, as telcos absorb capacity and continue to wrestle with these challenges. Capex guidance from telcos is consistent.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- Telco NI vendor results for 4Q22 (prelim) – page 2

- For preliminary dataset, YoY revenue growth in 2022 was +2%, but -1% in 4Q – page 2

- Supply chain constraints easing – page 5

- Telco capex outlook – page 6

- Enhancements to our Telco NI coverage – page 7

- A note on the preliminary database – page 8

- Appendix – page 9

Figures and Tables

Figure 1: YoY growth in Telco NI vendor revenues (all companies vs. group of 105 reporting already)

Figure 2: YoY % change in Telco NI revenues in 4Q22 for select vendors*

Figure 3: YoY USD change in Telco NI revenues in 2022 for select vendors*

Figure 4: Corporate revenues per employee for key Telco NI vendors*

Figure 5: R&D expenses as % of revenues for key Telco NI vendors*

Coverage

Companies mentioned:

3M

A10 Networks

Accenture plc

Accton Technology

ADTRAN

ADVA Optical

Affirmed Networks

Airspan

Akamai

Alcatel-Lucent

Allied Telesis

Allot

Alphabet

Altran Technologies

Amazon

Amdocs

Amphenol

Anritsu

Arista Networks

ARRIS International

AsiaInfo

Atos Origin

Audiocodes

Avaya

Aviat Networks

Beijing Xinwei

Broadcom

BroadSoft

Brocade

CA Technologies

Calix

Capgemini

Casa Systems

Ceragon Networks

Check Point

China Comservice

Ciena

Cisco Systems

Citrix Systems

Clearfield

Comarch

Comba Telecom

CommScope

Commvault Systems

Comptel

Convergys

Coriant

Corning

CSG

Cyan

DASAN Zhone

Datang Telecom

Dell Technologies

DragonWave

DXC Technology

DyCom Industries

Dynatrace

ECI Telecom

Ericsson

EXFO

Extreme Networks

F5 Networks

Fiberhome

FireEye

Fortinet

Fujikura

Fujitsu Limited

Furukawa Electric

General Cable

Harmonic

HCL Technologies

Hengtong Optic

Hitachi

HPE

Huawei

Huber+suhner AG

IBM

Infinera

Infosys

Inseego

Intel

Italtel

ITOCHU Tech (CTC)

Juniper Networks

Kathrein

Kudelski

Kyndryl Holdings

Lenovo

MasTec

Mavenir

Metaswitch

Microsoft

Mitsubishi Electric

NEC Corp

Net Insight

Netcomm

NetScout Systems

Nexans

Nokia

Nutanix

Openet

OPTIVA

Oracle

Pace plc

Palo Alto Networks

Prysmian

Quantenna

Radcom

Radisys

Radware

Rakuten Group

Red Hat

Ribbon

Ruckus Wireless

Samsung Electronics

SAP SE

SeaChange

Sopra Steria

Spirent

Sterlite Tech

Subex

Sumitomo Electric

SYNNEX

TCS

TE Connectivity

Tech Mahindra

Technicolor

Tejas Networks

Transmode

Trigiant Group

Ubiquiti

Virtusa

VMware

Vubiquity

Westell

Wipro

Wiwynn

YOFC

ZTE

Visuals