By Matt Walker and Arun Menon

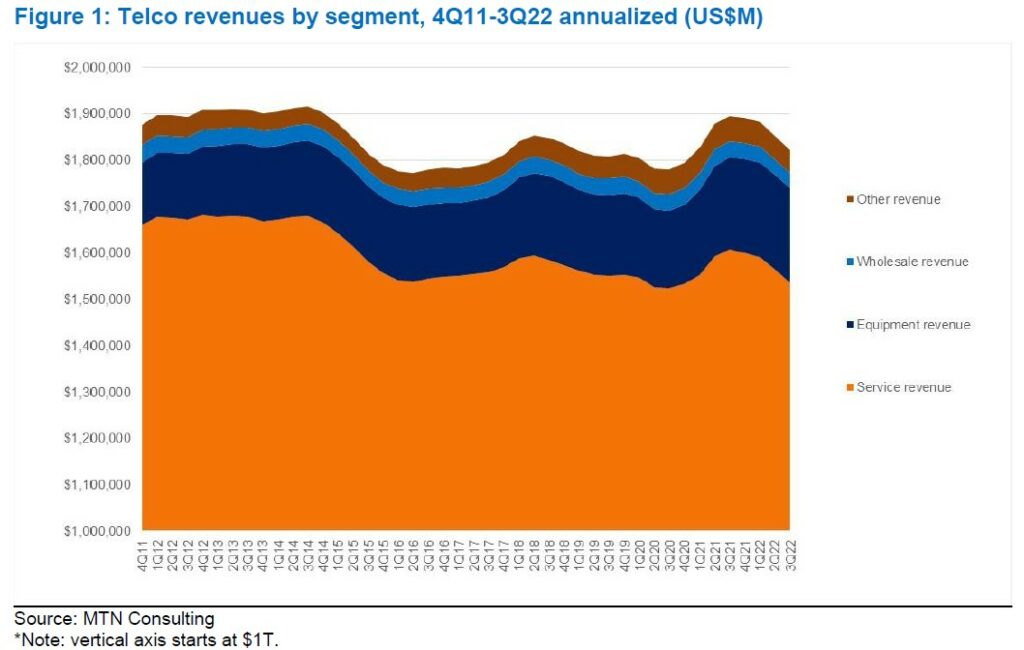

This brief presents a new data series compiled by MTN Consulting. We already publish quarterly total revenues for the global telco market. This new series provides a breakdown of revenues into several categories: services, equipment (devices, handsets, CPE), wholesale/infrastructure, and all other. The purpose is to understand real underlying trends in service revenues. The data will be published as part of our upcoming “Telecommunications Network Operator: 4Q22 Market Review”.

For the 3 months ended September 2022, total revenues for the telecommunications network operator (telco) sector declined 6.5% from 3Q21. This decline followed a similar 6.1% dip in 2Q22. These declines are largely due to weak service revenues. In 3Q22, for instance, service revenues dropped 7% YoY, while equipment revenues grew 2%. Services account for nearly 90% of revenues, so they tend to drive the average, but volatility in equipment revenues can be significant and impact the sector’s growth curve. With the rollout of 5G networks and availability of new devices, there has been a pickup in equipment revenues over the last 2 years. For the 3Q20 annualized period, equipment accounted for 9.4% of total revenues, but this has steadily grown since then, to 11.2% in 3Q22. Annualized equipment revenues for telcos were $204.6B in the 3Q22 annualized period, up 23% from 3Q20’s $166.7B. In the same timeframe, annualized services revenues grew less than 1%.

In general, telcos do not prioritize profitability when it comes to selling equipment. Their main priority is signing up and retaining subscription customers, who drive their service revenues. As such, big jumps in equipment revenues don’t necessarily help profits. They are nice, but don’t guarantee growth in related service revenues. It’s more important to focus on service revenues in assessing the health of the telco sector. That’s particularly important now, as telcos have spent heavily on their networks to deploy 5G. Telco capital intensity, or capex/revenues, reached an all-time high in 3Q22 of 17.9% (annualized), up from 16.8% in 3Q21. Telcos, and their investors, expect new revenue streams to result from these buildout costs. So far, 5G has not delivered.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- Equipment accounts for >11% of telco revenues – page 2

- Overview of the new dataset – page 2

- Segment revenue results for 2011-22 – page 3

- Company level revenues by type – page 4

- Equipment’s varying contribution at the company level – page 5

- Implications for spending – page 6

- Appendix – page 7

Figures and Tables

Figure 1: Telco revenues by segment, 4Q11-3Q22 annualized (US$M)

Figure 2: YoY growth in annualized revenues by type

Figure 3: Equipment as a share of total revenues, annualized

Coverage

Companies mentioned:

AIS

AT&T

Axtel

Bezeq

BT

CenturyLink (Lumen)

China Mobile

China Telecom

China Unicom

Comcast

Entel

Etisalat

Far EasTone Communications

KPN

KT

LG Uplus

M1

Maroc Telecom

NTT

Orange

PLDT

Polsat

Rakuten Mobile

SKT

Telecom Egypt

Telefonica

Telkom Indonesia

Verizon

Vodafone

Visuals