By Matt Walker and Arun Menon

Multiple types of companies are investing heavily in data center assets. Two years ago, the data center market was already vibrant, but COVID-19 gave this a boost as enterprises accelerated digital transformation efforts, and multiple sectors (enterprise, government, education…) moved many activities to the cloud. As a result, data center investment has boomed. This investment is coming from multiple sources: webscale and carrier-neutral operators, and from asset management specialists aiming to benefit from growing data center demand. With this increased demand, the market is seeing consolidation and the emergence of new business models. Meanwhile, the technologies deployed in the data center are evolving rapidly. Vendors are creating new products and customizing old ones in order to cater to the data center. Even if you’re steeped in the data center world, it can be hard to keep up. This “Data Center Investment Tracker” provides an up-to-date synthesis of this investment and technology activity.

This 4Q21 tracker is our first edition. The format and scope of this deliverable will evolve over time. This edition describes in detail the following:

Footprint: a summary of the data center footprint, energy usage, and major projects underway of all key webscale and carrier-neutral network operators, and a few large telcos with data center holdings.

Capex: capital expenditures (capex) recorded from 1Q11-3Q21 by the big spenders driving the data center market – webscale and carrier-neutral operators.

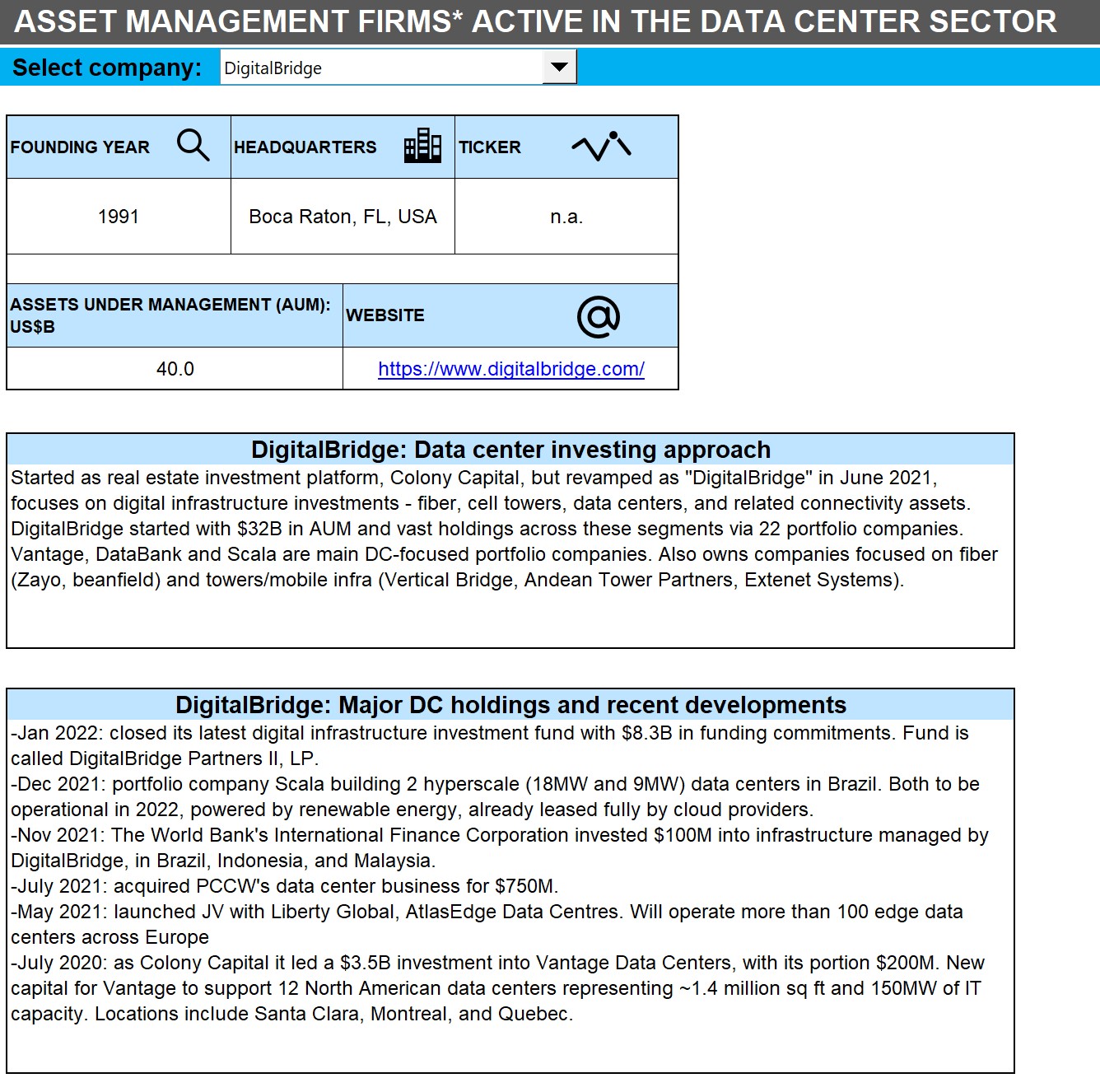

Asset management: mini-profiles of 30 asset management companies (mainly private equity firms) with active interests in data centers, summarizing their approach to data center investment, major holdings, and recent developments

Mergers & acquisitions: focusing on the last two years, the tracker provides a summary of 60 significant M&A transactions involving the data center market. That includes the two deals from 4Q21 in excess of $10B each, and the $3.5B deal from January 2022 in which Digital Realty took a majority stake in South Africa-based CNNO, Teraco.

Vendor contracts: a database of 243 contracts between data center operators and vendors, cutting across many different categories of technology, in particular: servers (and the chips that run them), switches, routers, storage, security, optical interconnect, software, and power/cooling. The database attempts to be comprehensive for January 2020 through January 2022.

All information is current as of late January 2022. Capex data is through the September 2021 reporting period (3Q21), as 4Q21 figures were only available for a handful of companies when this report was finalized. The next edition of this report will include financials through year-end 2021.

- Table Of Contents

- Figures & Tables

- Coverage

- Visuals

Table Of Contents

- Abstract

- Data center footprint of major operators

- Capex of major data center operators

- Asset management firms active in data centers

- Data center mergers & acquisitions – summary

- Data center M&A database

- Data center operator contracts with technology vendors

- Data center vendor contracts database

- About

Figures & Tables

- Figure (dynamic): Data center footprint (for 27 companies)

- Figure: Annualized capex by segment, CNNO & Webscale (US$M)

- Figure: Top 15 providers based on 3Q21 annualized capex (US$M)

- Figure: 3Q21 annualized capex ($M) and cumulative % WNO/CNNO total

- Figure: YoY changes in annualized capex, 3Q21 vs. 3Q20

- Figure (dynamic): Asset management firm approach to DC investing, major holdings, and recent developments (for 30 companies)

- Table: Summary of M&A deals included

- Table: Significant M&A deals involving data center operators and assets

- Table: Summary of vendor contracts included

- Table: Major announcements between technology suppliers and data center operators/builders

Coverage

1547 DC Fund II & Harrison

21Vianet

AARNet

ABB

ABRY Partners

ACDC Holdings (Supernap Italia)

ADVA

Africell

AIMS APAC REIT

AirTrunk

Alibaba

Alphabet (Google)

Altaba

Altibox Carrier

Amazon (Amazon Web Services)

AMD

American Tower

Ampere Computing

Angola Cables

Anschutz Investment Company

Apple

Aqua Comms

ARC Solutions

Ardian Capital

Arista Networks

Ascendas REIT

Ascenty

Asia Pacific Telecom

AT&T

AtlasEdge (Liberty Global / DigitalBridge)

Axtel

Azercell Telecom

Azrieli Group

Baidu

Bain Capital

BC Partners

BCE

Berkshire Partners

Beyond.pl

Big Data Exchange (I Squared Capital)

BitNAP Datacenter

Blackstone Inc.

BroadBand Tower

Broadcom

Brookfield Asset Management Inc.

Brookfield Infrastructure

ByteDance

C3ntro Telecom

Capital Online

Carlyle Group

China Media Group

China Mobile

China Telecom

China Telecommunication Tech Labs

China Unicom

ChinaCache

Ciena

Cisco Systems

Citrix

CityFibre

Cloud Capital

CNT

Cognizant

Colo Atl

Colocation Australia

Colt Data Centre Services

Colt Technology Services

Compass Datacenters

Cordiant Capital

Cordiant Digital Infrastructure

CoreSite Realty

CRT Informatique

Cummins

CyrusOne

Cyxtera

Data Foundry

DataBank

DataGryd

DataSite

DC BLOX

Dell Technologies

Delta Power Solutions

DigiPlex

Digital 9 Infrastructure

Digital Colony

Digital Edge

Digital Realty Trust

DigitalBridge

DISH

Djibouti Telecom

Dodid Pte. Ltd.

DT Global Carrier

DuPont Fabros

eBay

EdgeConneX

Edgecore Networks

Ekinops

Empyrion DC

Epsilon Telecommunications

EQT Group

Equinix

Espanix

Etisalat Group

Everstone Capital

everyWAN

Extreme Networks

Facebook

Fiberhome

Fiera Real Estate/SEDCO Capital joint venture

Fortinet

Fujitsu

Fungible

Gaw Capital Partners

GDS

GI Partners L.P.

Global Data Center

Global Infrastructure Partners

Global Switch

GlobalNet

Goldman Sachs Group

GPX Global Systems

Great Hill Partners

Green Mountain

GTT Communications

Guangdong Bluesea Data Development Co. Ltd. (Bluesea)

H3C

H5 Data Centers

Hanoi Telecom

Hitec Power Protection

HP

HPE

Huawei Technologies

I Squared Capital

i3D.net

IBM

i-Data

IKOULA

Indosat

Infinera

Inmark Asset Management Pty Ltd.

Intel

Interxion

IO Data Centers

IP Telecom

IPI Partners

Iron Mountain

Itochu Techno-Solutions

Iusacell

Japan Network Access Point

JD.com

JLL

Jolera

Juniper Networks

Keppel Capital

Keppel REIT

Khazna Data Centers

KKR & Co. L.P.

KT Corp

Kuok Group

Land Securities Group Plc

Lenovo

LG CNS

LightEdge Solutions

Lightstorm Telecom Ventures

LinkedIn

Lumea

M1

Macquarie Capital

Macquarie Infrastructure & Real Assets

MainOne

Mapletree Investments Pte Ltd

Marcatel

Marvell

MCAP Global Finance UK

Medallion Data Centres

Medina Capital

Menlo Equities

Mercantil do Brasil

Meta (Facebook)

Microsoft

National Security Agency

National Supercomputing Center

NAVER

NEC Corp

Neos Networks

NetApp

NetScout

NEXTDC Limited

NICT Japan

Ningxia Cable TV

NL-ix

Nokia

NorthC Datacenters

Northwest Access Exchange

NTT Communications

NVIDIA

NxtGen Data Centers

Omantel

Ooredoo Qatar

OpenColo

Oracle

Packet

PacketLight Networks

Padtec

PAG

Patria Investments

PCCW

Peak 10

PeaSoup

Pembani Remgro Infrastructure Fund

Permira I.P Limited

PIT Chile

PLDT

Princeton Digital Group

Providence Equity Partners

Pure Storage

QCT

QTS Realty Trust

Radcom

Rakuten

RETN

Rolls-Royce Power Systems

ROOT Data Center

Ruijie Networks

SAP

Schneider Electric

Sejong Telecom

Sentinel Data Centers

Serverius

Shaw

Shinsegae I&C

Sichuan Unicom

Siemens

SiFive

Sila Realty Trust

Silver Lake

Sixth Street Partners

Smedvig

SoftIron

Southern Cross Cable Limited

SpaceDC

Sparkle

SSE Enterprise Telecoms

Starboard Value Acquisition Corp

StarHub

Stonepeak Infrastructure Partners

Submer

Supermicro

Swiss National Supercomputing Centre

Switch, Inc.

Tejas Networks

Telecity

Telefónica del Perú

Telstra

Telx

Tencent

Teraco

The Pittock Block

Thésée DataCenter

T-Mobile Polska

Togocom

TPG Inc.

Triple Point Group

Turkcell

Twitter

U.S. Colo LLC

UK Crown Commercial Service

Uninett

US Department of Energy

Vantage Data Centers

Verizon

Verne Global

Vertiv

ViaWest

Vocus New Zealand

Vodacom South Africa

Vodafone Infrastructure Partners

Vodafone New Zealand

Vodafone Turkey

Vxchnge

Warburg Pincus LLC

WIN Technology

Windstream

Wiwynn

XDC+

XL Axiata

Yandex

Zayo Group Holdings

zColo

Zenlayer

Zoom

ZTE

Visuals