By Arun Menon

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors’ revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market “telco network infrastructure”, or “Telco NI.” This study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-4Q23 period. Of these 134 vendors, 110 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

Below are the key highlights of the report:

Revenues: Telco NI vendor revenues were $54.8B in 4Q23 and $211.8B for the annualized 4Q23 period overall, down 9.6% and 9.2% on a YoY basis, respectively. Excluding Huawei, the total market declined by 13.5% in the latest single quarter and by 9.4% in annualized 4Q23 on a YoY baisis. After many disappointing quarters, Huawei appears to have turned a corner.

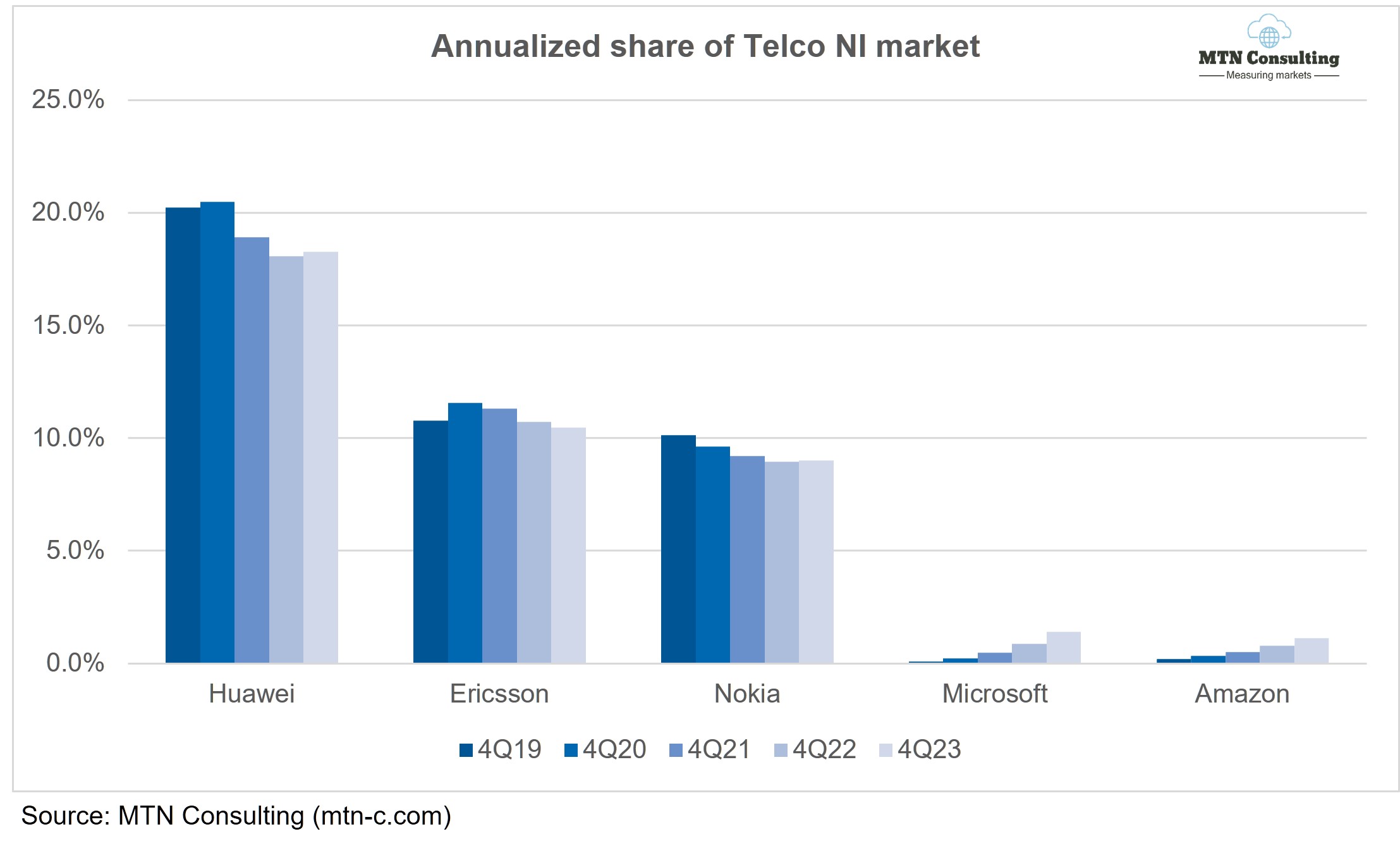

Top vendors: The top three Telco NI vendors continue to be the usual trio: Huawei, Ericsson, and Nokia. They account for 37.7% of the total market in annualized 4Q23, or 40.8% in 4Q23 alone. ZTE and China Comservice have been jostling for the 4th and 5th positions since early 2019.

Key vendors by YoY revenue growth: Four out of the top five vendors are common, in terms of YoY revenue growth, for both single quarter and annualized 4Q23: Alphabet, Broadcom, Microsoft, and Tejas Networks. Broadcom’s jump is due largely to the acquisition of VMWare, which closed in Nov 2023.

Spending outlook: Per our latest official forecast, we expect telco capex – the main driver of the Telco NI market – to dip from $315B in 2023 to $309B in 2024; unofficially, the 2024 forecast is unlikely to be reached as 1H24 spending remains tightly constrained. Capex will start to rise again in a couple of years, reaching $331B in 2028. Global telco capital intensity will average out to 17.1% in 2028, from 17.7% in 2023.

- Table of Contents

- Figures

- Coverage

- Visuals

Table of Contents

- Report Highlights

- SUMMARY – Results commentary

- Telco NI Market – Latest Results

- TOP 25 VENDORS – Printable tearsheets

- CHARTS – Single vendor snapshot

- CHARTS – 5 vendor comparisons

- R&D spending by vendors

- RAW DATA – revenue estimates by company

- Methodology & Assumptions

- ABOUT – MTN Consulting

Figures

Partial list:

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 4Q23 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 4Q23 ($B)

- Top 25 vendors based on Telco NI revenues in 4Q23 ($B)

- Key vendors’ annualized share of Telco NI market

- Telco NI market share changes, 4Q23 TTM vs. 4Q22 TTM

- Telco NI annualized revenue changes, 4Q23 vs. 4Q22

- YoY growth in Telco NI revenues (4Q23)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 4Q23 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 4Q23 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (4Q21-4Q23)

Coverage

| Company | Segment |

| 3M | CCV |

| A10 Networks | NEP |

| Accenture plc | ITSP |

| Accton Technology | NEP |

| ADTRAN | NEP |

| ADVA Optical Networking | NEP |

| Affirmed Networks | NSP |

| Airspan | NEP |

| Akamai | NSP |

| Alcatel-Lucent | NEP |

| Allied Telesis | NEP |

| Allot Communications | NEP |

| Alphabet | NSP |

| Altran Technologies | ITSP |

| Amazon | NSP |

| Amdocs | ITSP |

| Amphenol | CCV |

| Anritsu | T&M |

| Arista Networks | NEP |

| ARRIS International | CCV |

| AsiaInfo Technologies | NSP |

| Atos Origin | ITSP |

| Audiocodes | NSP |

| Avaya | ITSP |

| Aviat Networks | NEP |

| Beijing Xinwei | NEP |

| Broadcom Limited | NEP |

| BroadSoft, Inc. | NSP |

| Brocade Communications Systems, Inc. | NEP |

| CA Technologies | NSP |

| Calix | NEP |

| Capgemini | ITSP |

| Casa Systems | NEP |

| Ceragon Networks | NEP |

| Check Point Software | NSP |

| China Comservice | ES |

| Ciena Corporation | NEP |

| Cisco Systems | NEP |

| Citrix Systems | ITSP |

| Clearfield | CCV |

| Comarch | ITSP |

| Comba Telecom | NEP |

| CommScope Holding | CCV |

| Commvault Systems | ITSP |

| Comptel | NSP |

| Coriant | NEP |

| Corning | CCV |

| CSG | NSP |

| Cyan | NSP |

| DASAN Zhone | NEP |

| Datang Telecom Technology | NEP |

| Dell Technologies | NEP |

| DragonWave Inc. | NEP |

| DXC Technology (aka CSC) | ITSP |

| DyCom Industries | ES |

| Dynatrace | NSP |

| ECI Telecom | NEP |

| Ericsson | NEP |

| EXFO Inc | T&M |

| Extreme Networks | NEP |

| F5 Networks | ITSP |

| Fiberhome | NEP |

| Fortinet | ITSP |

| Fujikura | CCV |

| Fujitsu Limited | NEP |

| Furukawa Electric | CCV |

| General Cable | CCV |

| Harmonic Inc. | NEP |

| HCL Technologies | ITSP |

| Hengtong Optic-electric | CCV |

| Hitachi | NEP |

| HPE | ITSP |

| Huawei | NEP |

| Huber+suhner AG | CCV |

| IBM | ITSP |

| Infinera | NEP |

| Infosys | ITSP |

| Inseego | NEP |

| Intel | NEP |

| Italtel | NEP |

| ITOCHU Techno-Solutions Corporation | ES |

| Juniper Networks | NEP |

| Kathrein | CCV |

| Kudelski | NEP |

| Kyndryl Holdings | ITSP |

| Lenovo | NEP |

| MasTec | ES |

| Mavenir | NSP |

| Metaswitch | NSP |

| Microsoft | NSP |

| Mitsubishi Electric | NEP |

| NEC Corporation | NEP |

| Net Insight | NEP |

| Netcomm | NEP |

| NetScout Systems | NSP |

| Nexans | CCV |

| Nokia | NEP |

| Nutanix | NSP |

| Openet | NSP |

| OPTIVA | NSP |

| Oracle | NSP |

| Pace plc | NEP |

| Palo Alto Networks | NEP |

| Prysmian | CCV |

| Radcom | NSP |

| Radisys | NSP |

| Radware | NEP |

| Rakuten Group | NSP |

| Red Hat | NSP |

| Ribbon Communications | NEP |

| Ruckus Wireless | NEP |

| Samsung Electronics | NEP |

| SAP SE | NSP |

| SeaChange International, Inc. | NSP |

| Sopra Steria | ITSP |

| Spirent Communications | T&M |

| Sterlite Technologies | CCV |

| Subex | NSP |

| Sumitomo Electric | NEP |

| Tata Consultancy Services | ITSP |

| TE Connectivity | CCV |

| Tech Mahindra | ITSP |

| Technicolor | NEP |

| Tejas Networks | NEP |

| Transmode | NEP |

| Trigiant Group | CCV |

| Ubiquiti | NEP |

| VMWare | NSP |

| Vubiquity | ITSP |

| Westell | CCV |

| Wipro | ITSP |

| Wiwynn | NEP |

| YOFC | CCV |

| ZTE | NEP |

Visuals