By Matt Walker

This forecast report presents our latest projections for the network operator market, spanning telecommunications operators (telcos), webscalers, and carrier-neutral network operators (CNNOs). The forecast is based on our quarterly coverage of over 175 operators. Our forecast includes revenues, capex and employee totals for all segments, and additional metrics for each individual segment. In 2024, we expect the three operator groups to account for $4.38 trillion (T) in revenues (2022: $4.11T), $552 billion (B) in capex (2022: $563B), and 8.71 million (M) employees (2022: 8.88M). This report provides 2011-22 actuals and projections through 2028, and includes projections from past forecasts for reference.

Top line quantitative results

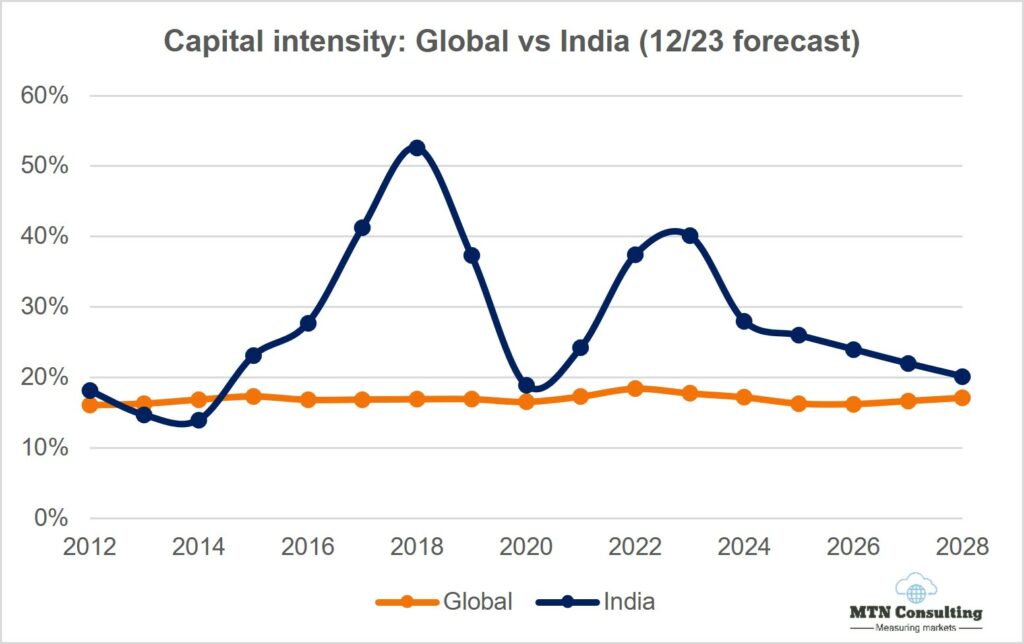

Revenues from the aggregate of our three segments – telco, webscale, and carrier-neutral – were $4,109 billion (B) in 2022, and will grow to $5,344B by 2028. Three segment capex ended 2022 at $563B, will fall to ~$550B for both 2023 and 2024, then grow to $662B in 2028. Webscale capex has flattened recently but over the longer timeframe this sector accounts for most network operator growth. In 2011, webscale was less than 10% of capex, but exceeded 36% in 2022 and will be over 43% by 2028. CNNOs will represent 7% of 2028 capex, a bit more than today, while telcos will capture just under 50% of expected 2028 network operator capex. In capital intensity terms, the all-operator average was 13.7% in 2022 but that will be just 12.4% in 2028. That’s largely because of telcos: their annualized capital intensity peaked at 18.7% in 1Q23 and has begun to come down rapidly, now that most 5G networks are built. That will start to come back in 2027 and hit 17.1% in 2028. Webscalers also saw an all-time high capital intensity in 2022, of 9.1%, which is now easing. The portion of webscalers’ capex spent on the network is rising, though, as operators fill up existing data centers. Capital intensity is highest in carrier-neutral, as usual, well over 30% for the whole forecast period.

Headcount across the three operator segments has grown dramatically in the last decade, from 6.48 million in 2011 to 8.88M in 2022. That is roughly the same as the 2021 figure: telcos accelerated headcount reductions in 2022, and several webscalers announced layoffs. In 2023, total headcount will be 8.76M, a bit down YoY, due mainly to ongoing telco cuts. Looking forward, we expect telco reductions to slightly accelerate, with contributions from GenAI. Webscalers will grow a bit through 2025 but then headcount will begin to decline steadily. All the years of big R&D investments into robotics and AI will start to really pay off after this, lowing workforce costs, especially for the ecommerce-oriented webscalers like Amazon and JD.Com. CNNO employment will stay just above 100,000. By segment, revenue per employee is by far the highest in CNNO, at ~$876K in 2023, versus $562K for webscale and $391K for telco. Growth in this metric will be highest in webscale, though, as the workforce starts to shrink in 2026. Telcos’ growth in revenues per employee is the slowest, even with our fairly aggressive assumptions about job cuts. There is another scenario possible, in which telco execs implement GenAI aggressively in order to support near-term layoffs, especially in sales & marketing; BT is one telco which has pointed to this scenario. Most telcos will be cautious about immediate GenAI implementation for sensitive areas such as network operations, though.

Key findings by network operator type

This forecast includes detailed breakouts for each of the three network operator types. Here is a summary of some of the key findings, by segment:

Telcos: as we keep saying, telecom is essentially a zero-growth industry. Specific countries and companies do grow from time to time, in part from market share shifts, the different timing of growth cycles, or M&A. But global telco revenues have hovered in a narrow range ($1.7-$1.9 trillion) since 2011, and this will likely remain true through 2028. In 2022, revenues were $1.78T, will fall a bit in 2023, then will grow an average annual rate of 1.4% to reach $1.93T by 2028. Capex continues to vary with technology upgrade cycles (e.g. 5G) and government actions (e.g. newly issued spectrum, or rural fiber subsidies). In 2022, capex totaled $328B, or 18.1% of revenues; that’s an annual all-time high capital intensity, for our coverage timeframe (2011-present). Capex will decline slightly through 2025, though, and then rise modestly again to reach $331B in 2028, which would be a 17.1% capital intensity. US capex surged in 2022, but will drop significantly in both 2023 and 2024; we already expected this, though, so the current forecast is not significantly different. Software capex is growing more slowly than expected, and now likely to remain under 20% of total capex for the forecast period. Headcount in telecom is declining faster than expected, and now likely to fall below 4.2 million in 2028, from just under 4.6 million in 2022. Labor costs per head will revert to a growth trajectory in 2023, as telcos develop a more IT/software-centric workforce.

Webscalers: growth from webscale has lifted the overall network operator market over the last decade. Webscalers surged during COVID, by all measures – revenues, capex, employment. Demand for data center chips and related gear also surged. The sector saw slower growth last year, though, and is cutting back on costs, capex, and headcount. In 2023, revenues will be about $2.32 trillion, up just 4% YoY for the second straight year. We expect revenues to grow at a ~7% CAGR through 2028. Webscale capex was $203B in 2022, a healthy increase from 2021; capex will be in a holding pattern through end of 2024 though, allowing for a couple years of capacity absorption, and start to grow again in 2025. During the lull, a larger portion of capex will be for Network/IT/software investments R&D spending by webscalers will remain high but fall from the record-breaking level of 2022 (12.0% of revenues), to a bit over 10% in 2028. As topline growth gets harder for webscalers, they will become more cost conscious and short-term oriented.

Carrier-neutral: the carrier-neutral sector remains tiny, with just $95B in 2022 revenues, but will grow to about $124B by 2028. Webscalers and telcos alike will both rely more on CNNOs over time for expansion of their data center, tower and fiber footprints. Telcos will continue to spin out portions of their infrastructure to third-parties – both traditional CNNOs (e.g. TASC Towers, which just bought 30,000 towers from Zain and Ooredoo), and joint ventures like Gigapower, the AT&T-Blackrock partnership. Total CNNO capex for 2022 was $33B, and will grow to about $45B by 2028; a large chunk of the CNNO sector’s expansion will be inorganic, though, via acquisition of existing assets from other sectors. By 2028, the CNNO sector will have under its management approximately 3.8 million cell towers (2022: 3.3M), 1,718 data centers (2022: 1,223), and 1.13M route miles of fiber (2022: 945K).

Key changes since last forecast

We publish a full forecast every 6 months. Here are some factors we considered in developing this latest forecast update:

Macroeconomics: Interest rates have risen a bit more, inflation shows signs of cooling, but economic growth forecasts from the IMF remain lackluster: “The baseline forecast is for global growth to slow from 3.5 percent in 2022 to 3.0 percent in 2023 and 2.9 percent in 2024, well below the historical (2000–19) average of 3.8 percent.”

Generative AI: interest and adoption of generative AI (GenAI)-based tools and apps has continued to accelerate, and operators increasingly point to GenAI as a driver for infra investment, especially in the data center. The initial impact is to drive the carrier-neutral market, enticing more investment from private equity firms to have a position in the market. There is a lot of unmeasured private market activity in the data center market, and ongoing pull from PE firms to take assets private (e.g. in 2023, Bain-ChinData, and Brookfield-Cyxtera). GenAI will help webscale capex to lift off again starting 2025.

Telco business models: Telcos continue to spin off assets and search for new business models as 5G revenue growth fails to materialize. Among the many examples: in August 2023, Austria’s A1 Telkom divested a portfolio of 12,900 cell towers across 5 countries, allowing it to shed 1B Euros in debt; also in 3Q23, Polish operator Polsat made strides in scaling up its new renewable energy business line, signing a deal to sell wind-generated power to Google, commissioning 2 wind farms, one solar farm, and 2 public hydrogen refueling stations. Expansion into new markets like energy requires new capex, but that is possible for telcos who choose to move towards an asset-light business model by selling off passive assets.

Telco capex: Telcos were already guiding down capex for 2024, but the guidance became even more negative with 2Q23 and 3Q23 earnings releases. Telco capex fell 8% YoY in 3Q23, and revenues for vendors selling into the telco market fell by over 10% YoY (preliminary). We already expected capex to start to decline in 2023, but it’s started a bit sooner than expected. Telcos are pushing on every cost lever they can find, whether opex- or capex-related. The smarter ones are accepting that, as we expected, webscalers and other tech players are likely to reap most of the spoils of the world’s new 5G networks. Telco execs need to stick to their knitting.

Headcount: Employment levels continue to go down steadily in the telecom industry, and have plateaued in the webscale sector. There is a lot of enthusiasm among execs in the potential for GenAI to reduce headcount levels, including in the telecom industry; we have increased the rate of employee attrition in this market.

Conflict: Russia’s war on Ukraine remains ongoing, but hasn’t expanded to new countries. China has not invaded Taiwan as of yet, although this is a serious risk over the 5-year forecast horizon.

Climate change: global warming news continues to worsen. Intergovernmental efforts to address it are still disappointingly watered down and toothless, as the recent COP28 event confirmed. Private efforts are full of greenwashing and baby steps. Many industries are taking real change slowly, in hopes that someone else will do the heavy lifting. Within our universe of operators, there are a few webscalers and CNNOs with impressive environmental records, though most of these built their networks from scratch in the last decade. The telco market is a problem; it needs to do more in 2024. Converting to 100% renewable energy as fast as reasonable will soon be on every operator’s agenda, and this will come with some upfront investment. We don’t forecast energy-related capex, but we do expect green energy to account for a growing share of capex budgets over time. Offsetting this capex burden is that early moving operators will be able to stabilize their energy spending, boost their green credentials legitimately, and possibly develop a new business line (for examples, see China Tower, Indus, and Polsat).

The net impact of these factors can be seen in the individual forecast tabs within this report.

- Table Of Contents

- Figures & Charts

- Coverage

- Visuals

Table Of Contents

Key sections include:

- Abstract

- Network Operator Totals

- Telco

- Telco – Regional Splits

- Webscale

- Carrier-neutral (CNNO)

- Spending outlook for top operators

- About

Figures & Charts

This report has a large number of figures on each of the main result tabs: totals, telco, telco – regional splits, webscale, and carrier-neutral (CNNO). For a full list of figures please contact us. Here is a list of figures on the “Totals” tab:

Capex forecast by segment: Dec 2023 v. Dec 2022 outlook, % difference

Capex forecast by segment: Dec 2023 v. Dec. 2022 outlook, $B difference

Revenue growth rates, all operators: New vs. old forecast

Revenue growth rates, Telcos: New vs. old forecast

Capital intensity, Telcos: New vs. old forecast

Capital intensity, Webscalers: New vs. old forecast

Capital intensity, Carrier-neutral operators: New vs. old forecast

Revenue by operator type, 2011-28 (US$B)

Capex by operator type, 2011-28 (US$B)

Capex by operator type, 2011-28: % of total

Capital intensity by operator type, 2011-28

Employees by operator type (M)

Revenues/employee by operator type (US$K)

Network operator revenues by type, % global GDP

Network operator employees (M), and % global population

Telco revenues and capex per sub, 2011-22

Top 50 spending operators, annualized 3Q23 capex ($B)

Top 50 operators based on long-term capital intensity (4Q19-3Q23 avg)

Coverage

Companies mentioned:

21Vianet

A1 Telekom Austria

Advanced Info Service (AIS)

Airtel

Alibaba

Alphabet

Altice Europe

Altice USA

Amazon

America Movil

American Tower

Apple

AT&T

Axiata

Axtel

Baidu

Balitower

Batelco

BCE

Bezeq Israel

Bharti Infratel

Bouygues Telecom

BSNL

BT

Cable ONE, Inc.

Cell C

Cellcom Israel

Cellnex

CenturyLink

Charter Communications

China Broadcasting Network

China Mobile

China Telecom

China Tower

China Unicom

ChinData

Chorus Limited

Chunghwa Telecom

Cincinatti Bell

CK Hutchison

Cogeco

Cogent

Cognizant

Comcast

Consolidated Communications

Crown Castle

Cyfrowy Polsat

CyrusOne

Cyxtera

DEN Networks Limited

Deutsche Telekom

Digi Communications

Digital Realty

DigitalBridge

Dish Network

Dish TV India Limited

Du

eBay

EI Towers

Elisa

Entel

Equinix

Etisalat

Far EasTone Telecommunications Co., Ltd.

Frontier Communications

Fujitsu

GDS Data Centers

Globe Telecom

Grupo Clarin

Grupo Televisa

GTL Infrastructure

Hathway Cable & Datacom Limited

Helios Towers

HPE

IBM

IBS Towers

IHS Towers

Iliad SA

Internap

Inwit

JD.COM

KDDI

Keppel DC REIT

KPN

KT

Level 3

LG Uplus

Liberty Global

M1

Maroc Telecom

Masmovil

Maxis Berhad

Megafon

Meta (FB)

Microsoft

Millicom

Mobile Telesystems

MTN Group

MTNL

NBN Australia

NEXTDC

NTT

Oi

Omantel

Ooredoo

Oracle

Orange

PCCW

PLDT

Proximus

QTS Realty

Quebecor Telecommunications

Rakuten

Reliance Communications Limited

Reliance Jio

Rogers

Rostelecom

Safaricom Limited

SAP

Sasktel

SBA Communications

Shaw

Singtel

SITI Networks Limited

SK Telecom

SmarTone

SMN (Protelindo)

SoftBank

Spark New Zealand Limited

StarHub

STC (Saudi Telecom)

Summit Digitel

Sunevision

Superloop

Swisscom

Switch

Taiwan Mobile

Tata Communications

Tata Teleservices

TDC

TDF Infrastructure/Arcus

TDS

Tele2 AB

Telecom Argentina

Telecom Egypt

Telecom Italia

Telefonica

Telekom Malaysia Berhad

Telenor

Telesites

Telia

Telkom Indonesia

Telkom SA

Telstra

Telus

Tencent

Thaicom

Tower Bersama

TPG Telecom Limited

True Corp

Turk Telekom

Turkcell

Twitter

Uniti Group

Veon

Verizon

Vodafone

Vodafone Idea Limited

VodafoneZiggo

Windstream

Yandex

Zain

Zain KSA

Zayo

Visuals