By Matt Walker

This short note provides an early review of 3Q23 market growth and capex spending figures for two of the three operator segments we cover: webscale, and carrier-neutral. (Our third segment, telco, will be addressed in a few weeks as more earnings reports are available.) The analysis is based on a review of over 80% of reporting companies in the two segments. Our official forecast for 2023 calls for $218B of capex for webscalers, and $39B for carrier-neutral operators (CNNOs). Market figures through 3Q23 suggest actual capex is likely to be closer to $200B and $36B for the two segments, respectively. This is a small change, however, and the tech portion of webscale capex is rising modestly. Moreover, new data from DigitalBridge makes clear that private equity-funded spend is strong in the data center CNNO market, helping to offset a weaker public CNNO market. Consequently, the vendor opportunity in selling to these two markets in 2023 is roughly the same size as forecast.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 1

- Introduction – page 1

- Analysis – page 2

- Webscale

- Carrier-neutral

- Generative AI

- Outlook – page 4

- Appendix – page 6

Figures and Tables

Figure 1: Capex projection for Webscale and CNNO market (US$B), per 7/23 forecast

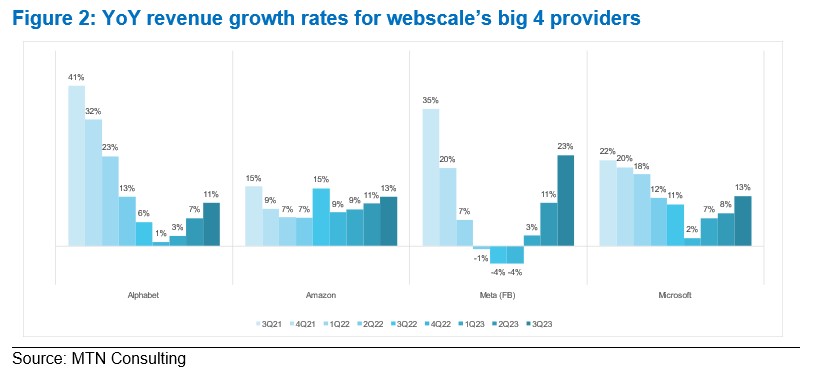

Figure 2: YoY revenue growth rates for webscale’s big 4 providers

Figure 3: Capex for select* CNNOs in 3Q21-3Q23 (US$M)

Coverage

Organizations mentioned:

Alphabet

Amazon

American Tower

Apple

BAM Digital Realty

Blackstone

Brookfield

China Tower

Compass Data Centers

CoreSite Realty

Crown Castle

Cyxtera

Data4

DCI

Digital Realty

DigitalBridge

Equinix

Indus Towers (aka Bharti Infratel)

Level 3

Meta (FB)

Microsoft

QTS Realty

SBA Communications

Switch

Vianet

Visuals