By Matt Walker

The telco network infrastructure (Telco NI) market had a blockbuster year in 2021. Vendor revenues in the telco vertical surged 7.8% from 2020 to end the year at $232.1 billion (B). This was the biggest market and strongest overall growth in at least 8 years. Strong vendor revenues were consistent with customer spending dynamics: telco capex grew 10% YoY in 2021, to $325B, and opex grew about 5%.

Some of Telco NI’s 2021 growth is just a bounce back from COVID-plagued 2020, when telco spending weakened. But more of the growth is due to high overall demand. 5G RAN spending is a driver, but that was more a factor in 2020. In 2021, telcos spent more on 5G core, services deployment, and cloud collaborations. Fiber access was strong in a number of geographies. Transport and IP infra spending is also looking up where 5G penetration is strong and traffic growth requires capacity increases further upstream. Huawei bans are an issue: some incremental capex was spent on rip and replace projects, but the bigger effect was less price competition without Huawei, causing some projects to grow. Finally, a small portion of the market’s measured growth can be explained by depreciation of the US dollar: the Chinese RMB and Swedish Kroner, for instance, gained 6.5% and 6.9% in value versus the dollar in 2021, versus 2020.

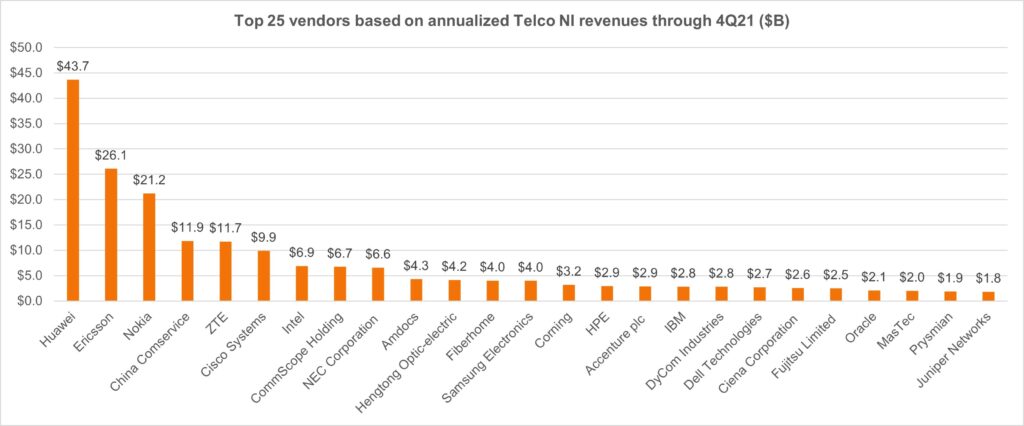

NEPs dominate top 10, but telcos rely on dozens of services, software and connectivity specialists

The top three vendors in 2021’s Telco NI market were the largest three traditional “network equipment providers” (NEPs), as usual: Huawei, Ericsson, and Nokia. Their 2021 shares were 18.8%, 11.2%, and 9.1% share, respectively. China Comservice is the largest non-NEP and ended the year in fourth place; most of its revenues come from Chinese network construction and maintenance projects. ZTE and Cisco, both NEPs, were ranked 5 and 6, respectively. Intel follows with a rank of 7. While we consider Intel an NEP, it is in a class of its own: some of its telco sales are via OEM relationships, and most of the value of its telco offerings are in chips and software. CommScope follows in 8th place. We consider CommScope a connectivity specialist, not an NEP, but it does provide telcos with equipment that goes well beyond connectivity (e.g. small cell baseband controllers). NEC ranked 9 in 2021, with its revenue base a mix of mobile infra, microwave transmission and wireline. The last vendor in the top 10 is Amdocs, considered an IT services provider for this study; its strengths are in telco software and managed services.

While the top 10 accounted for 64% of revenues, there is a long tail of smaller players with key positions in the telco NI market. In total, this study tracks 130 vendors over the 1Q13-4Q21 period. Some of these are no longer active due to acquisition, privatization, or bankruptcy, but 106 of them were active as of 4Q21. Eighty-nine (89) of these had telco NI revenues in excess of $100 million in 2021. Key suppliers of fiber and connectivity products to telcos, for instance, include Hengtong, Fiberhome and Corning, which ranked 11, 12, and 14 overall for 2021. Ciena and Juniper are powerful in the packet optical market, and placed 20th and 25th in 2021, respectively. At the end of the tail, the smallest telco NI vendors within our coverage are Allied Telesis, Net Insight, and SeaChange, with estimated revenues of $17M, $9M, and $20M in the 2021 telco NI market.

Cisco was the year’s big share winner; Huawei slides but remains #1

Contrasting 2021 Telco NI share with 2020, Cisco clearly came out on top, gaining 0.64% share in a market worth $232.1B. Cisco was helped both by a telco shift in 5G spending towards core networks, and Huawei’s entity list troubles. The next biggest winner was Samsung, which increased share by 0.32%. This was due to a big win with Verizon and a growing telco interest in seeking RAN alternatives beyond Ericsson and Nokia. ZTE increased share by 0.07%, a seemingly small figure but significant given the size of the market and ZTE’s large base period share. ZTE has escaped the US entity list to date, and picked up some unexpected 5G wins in 2021, but its growth is more broad-based due to optical, fixed broadband, and emerging market 4G business.

Microsoft, Amazon, Dell (including VMWare), and Alphabet also picked up share in 2021 as telcos have begun investing in 5G core and cloud technologies. Their growth has little to do with Huawei, and more to telcos’ ongoing changes to network architecture and service deployment patterns. Corning was an unexpected winner in 2021, gaining 0.17% share on the back of fiber-rich wireless deployments and government support for rural fiber builds.

On the flip side, both Nokia and Ericsson lost share in the overall telco NI market in 2021. Their RAN revenues benefited from Huawei’s troubles in 2020 but telco spending has since shifted towards product areas with more non-Huawei competition. Both vendors are attempting to diversify beyond the telco market, with Nokia so far having more success; its non-telco revenues grew 12% in 2021.

Finally, Huawei’s share of telco NI declined to 18.8% in 2021, down from a bit over 20% in each of the previous three years. The US Commerce Department’s entity list restrictions were issued in May 2019 but hit the hardest in late 2020 and 2021, after Huawei’s inventory stockpiles began running out.

M&A changes to market

Many vendors in our Telco NI database engaged in M&A in 2021, either buying other companies, going private, or selling assets. Most were not transformative, but a few were significant, including:

Ericsson acquired Vonage in 4Q21, a deal which the Swedish vendor hopes to help with 5G monetization

Ciena acquired AT&T’s Vyatta virtual routing & switching business, in 3Q21, aimed at supporting 5G and edge capabilities.

Cisco acquired Sedona Systems in 2Q21, and closed its purchase of Acacia in 1Q21; both improve Cisco’s position in the optical/IP space for telcos and other types of providers.

NEC acquired 5G radio/software company Blue Danube, in 1Q22, and expects to acquire more telco-focused companies in the coming years

Adtran announced the acquisition of ADVA in 3Q21, combing two important wireline (broadband and optical) vendors; deal is still pending

Sterlite acquired UK-based Clearcomm, a system integrator, in 3Q21, as part of its efforts to expand beyond connectivity and into new geographies

Tejas sold a controlling stake (43%) in the company to conglomerate Tata Sons in 3Q21, which may finally help it spread its wings

IBM spun off its managed infrastructure services business, as Kyndryl, in 4Q21

Dell Technologies spun off its VMWare holdings, also in 4Q21; both companies are now investing heavily to grow in the telco segment

Finally, there was one significant acquisition of a vendor by a telco. In 3Q21, Rakuten acquired open RAN specialist software vendor Altiostar. This deal aimed to support Rakuten’s efforts to become an open RAN-focused partner for other telcos. Telco buyouts of small vendors are not unprecedented. For instance, several years ago Jio acquired Radisys. The Indian telco giant has similar hopes for leveraging its expertise in network building to reap revenues from overseas telcos. At the moment, Rakuten is closer to making this a reality, especially with the Altiostar deal, and is certainly making much more noise publicly about its hopes.

Telco cloud collaborations continue expanding

As noted, key cloud providers AWS, Azure and GCP all saw their telco vertical revenues grow substantially in 2021. All three are investing heavily in telco-specific solutions and partnering with telco-focused vendors (e.g. Nokia, Ericsson, Amdocs) to supplement their own offerings. There is also some direct investment in telcos; for instance, Google acquired a 1.28% stake in Indian telco Airtel for $700M in January 2022. Telco cloud collaborations stretch across many areas, with 5G core transformation and new 5G and edge services especially appealing right now. The telco market is one of dozens of vertical markets being attacked by the cloud providers right now, and is not the biggest one. But the cloud providers clearly will continue to impact the market, and expand the range of technical options available to telcos as they evolve their networks.

2022 outlook

Many of the key vendors in the telco NI market have optimistic projections for 2022. Among the top 25, for instance, Cisco, Corning, Ciena and Juniper have all issued relatively bullish revenue predictions for the next few quarters. A strong market in the US for fiber and related products (e.g. optical transmission) is one factor. Telco deployment of 5G cores, wireline broadband upgrades, and private wireless networks are other factors. Another factor for some vendors is the opportunity to win “Huawei displacement” business. This was a factor in the mobile RAN in 2020 and to some extent in 2021. In 2022-23, the Huawei effect will begin spreading more clearly to IP infrastructure, optical, microwave, fixed broadband, and other areas. A number of vendors are eager to pursue new opportunities as this happens, including Adtran/ADVA, Ciena, Cisco, CommScope, DZS, and Infinera. As for overall telco spending, MTN Consulting’s late 2021 forecast called for capex in the ~$330B range for both 2022 and 2023, followed by a decline. We will maintain this forecast for now, but reevaluate in late 2Q22.

- Table of Contents

- Figures

- Coverage

- Visuals

Table of Contents

- ABSTRACT – Results commentary

- INTRODUCTION

- Telco NI Market – Latest Results

- TOP 25 VENDORS – Printable Tearsheets

- CHARTS – Single vendor snapshot

- CHARTS – 5 vendor comparisons

- R&D spending by vendors

- DATA – revenue estimates by company

- ABOUT – MTN Consulting and report methodology

Figures

Partial list:

- Telco NI vendor revenues, annualized (US$B)

- Telco NI revenues by company type, 4Q21 annualized

- Telco NI as share of total company revenues for top 25 vendors

- Telco NI as % of corporate revenues by company type

- Telco NI/Total

- Annualized Telco NI revenues vs. Capex and Opex (ex-D&A)

- Correlation between Telco NI revenues and Capex/Opex ex-D&A

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in single quarter sales

- Telco NI sales of top 6 vendors vs. all others, 4Q21 TTM (annualized)

- Telco NI vendor revenues, YoY % growth in single quarter

- Top 25 vendors based on Telco NI revenues in 4Q21 ($B)

- Top 25 vendors based on annualized Telco NI revenues through 4Q21 ($B)

- Telco NI market share changes, 4Q21 v. 4Q20

- Top 25 vendors based on 4Q21 YoY revenue growth rate in Telco NI

- Top 25 vendors: results highlights and growth outlook

- Top 25 vendors in Telco NI Hardware/Software: Annualized 4Q21 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 4Q21 Revenues (US$B)

- R&D spending as % of revenues for select Telco NI vendors, 2019-21 average

Coverage

| Company | Segment |

| 3M | CCV |

| A10 Networks | NEP |

| Accenture plc | ITSP |

| Accton Technology | NEP |

| ADTRAN | NEP |

| ADVA Optical Networking | NEP |

| Affirmed Networks | NSP |

| Airspan | NEP |

| Alcatel-Lucent | NEP |

| Allied Telesis | NEP |

| Allot Communications | NEP |

| Altran Technologies | ITSP |

| Amdocs | ITSP |

| Anritsu | T&M |

| Arista Networks | NEP |

| ARRIS International | CCV |

| AsiaInfo Technologies | NSP |

| Atos Origin | ITSP |

| Audiocodes | NSP |

| Avaya | ITSP |

| Aviat Networks | NEP |

| AWS (Amazon Web Services) | NSP |

| Azure (Microsoft) | NSP |

| Beijing Xinwei | NEP |

| Broadcom Limited | NEP |

| BroadSoft, Inc. | NSP |

| Brocade Communications Systems, Inc. | NEP |

| CA Technologies | NSP |

| Calix | NEP |

| Capgemini | ITSP |

| Casa Systems | NEP |

| Ceragon Networks | NEP |

| Check Point Software | NSP |

| China Communications Services Corporation Limited | ES |

| Ciena Corporation | NEP |

| Cisco Systems | NEP |

| Citrix Systems | ITSP |

| Clearfield | CCV |

| Comarch | ITSP |

| Comba Telecom | NEP |

| CommScope Holding | CCV |

| Commvault Systems | ITSP |

| Comptel | NSP |

| Convergys | ITSP |

| Coriant | NEP |

| Corning | CCV |

| CSG | NSP |

| Cyan | NSP |

| DASAN Zhone | NEP |

| Datang Telecom Technology | NEP |

| Dell Technologies | NSP |

| DragonWave Inc. | NEP |

| DXC Technology (aka CSC) | ITSP |

| DyCom Industries | ES |

| ECI Telecom | NEP |

| Ericsson | NEP |

| EXFO Inc | T&M |

| Extreme Networks | NEP |

| F5 Networks | ITSP |

| Fiberhome | NEP |

| FireEye | NSP |

| Fortinet | ITSP |

| Fujikura | CCV |

| Fujitsu Limited | NEP |

| Furukawa Electric | CCV |

| General Cable | CCV |

| GCP (Google Cloud Platform) | NSP |

| Harmonic Inc. | NEP |

| HCL Technologies | ITSP |

| Hengtong Optic-electric | CCV |

| Hitachi | NEP |

| HPE | NEP |

| Huawei | NEP |

| Huber+suhner AG | CCV |

| IBM | ITSP |

| Infinera | NEP |

| Infosys | ITSP |

| Inseego | NEP |

| Intel | NEP |

| Italtel | NEP |

| ITOCHU Techno-Solutions Corporation | ES |

| Juniper Networks | NEP |

| Kathrein | CCV |

| Kudelski | NEP |

| MasTec | ES |

| Mavenir | NSP |

| Metaswitch | NSP |

| Mitsubishi Electric | NEP |

| NEC Corporation | NEP |

| Net Insight | NEP |

| Netcomm | NEP |

| NetScout Systems | NSP |

| Nexans | CCV |

| Nokia | NEP |

| Openet | NSP |

| OPTIVA | NSP |

| Oracle | NSP |

| Pace plc | NEP |

| Palo Alto Networks | NEP |

| Prysmian | CCV |

| Quantenna Communications | NEP |

| Radcom | NSP |

| Radisys | NSP |

| Radware | NEP |

| Red Hat | NSP |

| Ribbon Communications | NEP |

| Ruckus Wireless | NEP |

| Samsung Electronics | NEP |

| SAP SE | NSP |

| SeaChange International, Inc. | NSP |

| Sopra Steria | ITSP |

| Spirent Communications | T&M |

| Sterlite Technologies | CCV |

| Subex | NSP |

| Sumitomo Electric | NEP |

| SYNNEX Corporation | ITSP |

| Tata Consultancy Services | ITSP |

| TE Connectivity | CCV |

| Tech Mahindra | ITSP |

| Technicolor | NEP |

| Tejas Networks | NEP |

| Transmode | NEP |

| Trigiant Group | CCV |

| Virtusa | ITSP |

| Vubiquity | ITSP |

| Westell | CCV |

| Wipro | ITSP |

| Wiwynn | NEP |

| YOFC | CCV |

| ZTE | NEP |

Visuals