By Matt Walker

Telco markets are rising again. Vendor revenues in the telco network infrastructure (telco NI) market totaled $54.9B in 3Q21, up 5.7% YoY. Annualized telco NI revenues through 3Q21 were $225.8 billion, up 5.8% YoY. Some of this growth is compensating for a weak 2020 hit by COVID’s initial spread, and some of the growth is due to depreciation of the US dollar. But there is also an uptick in telco spending across multiple segments and geographies. A large number of vendors are benefiting from this growth. The biggest share gains in 3Q21, though, are for Ericsson, ZTE, Dell/VMWare, Samsung and Microsoft (Azure). Ciena, Cisco, Corning and Fujitsu are also improving their share position.

MTN Consulting’s telco NI share study includes a wide range of vendor types and cuts across services, hardware, and software. If you only consider hardware & software revenues from one specific category of vendors, network equipment providers (NEPs), total revenues were $121.3 billion for the 3Q21 annualized period. The top ten providers for this market are Huawei, Nokia, Ericsson, ZTE, Intel, Cisco, NEC, Samsung, Fiberhome, and Fujitsu. This category (NEP hardware & software) most directly maps into what is sometimes reported as the “telecom equipment” market.

Changes in coverage in 2021

In the 1Q21 edition of MTN Consulting’s “Telecom’s Biggest Vendors” series, we added four suppliers: Airspan, Alphabet (GCP), Amazon (AWS), and Microsoft (Azure). Airspan is an important supplier in the open RAN market, and claims customer relationships in over 100 countries. AWS, Azure, and GCP are cloud services providers who have taken on an increasingly important role in the telecom sector, supporting telcos with core network functions, providing digital transformation services, and collaborating on service development and delivery.

No further changes to coverage were made in the last two quarters. However, it is notable that organizational changes are underway at a large number of vendors active in the telco market. These include: Dell’s spinoff of VMWare completed on November 1; IBM’s spinoff of its managed infrastructure services arm as a new company, Kyndryl, is also now complete; Tejas Networks sold a controlling stake to Tata Sons in July; Adtran’s acquisition of ADVA is pending; EXFO went private in September; and, CommScope is in the process of spinning off its Home division.

Telco capex has grown 10% in the first three quarters of 2021

Telco NI vendor revenues are fed by a mix of telco capex and opex budgets. For the first three quarters of 2021, based on preliminary 3Q21 data, total capex grew 10.3% on a YoY basis, while opex (excluding depreciation & amortization) grew by 10.9%.There is evidence that a growing % of telcos’ opex budgets are being directed towards external suppliers, including cloud providers selling software-based services.

Within the overall telco opex budget, telcos are having success in cutting their sales & marketing and G&A spending, as telcos adjust to working from home and accelerate the migration of sales & support to digital platforms. Labor costs are a big part of telco opex (and rising), and automation is a key area of investment in 2021 for nearly all major telcos. Numerous telcos are reporting that network operations is taking up a larger portion of the opex pie. This is important because vendors are increasingly selling into opex budgets within their telco customers, not just capex budgets. That’s especially true on the services and software sides. Webscale operators’ sales of software licenses to telcos are growing, and starting to bump up competitively against the more traditional telco-centric vendors like Cisco and Nokia.

If you can’t beat them, join them

One of the biggest stories in telecom over the last few quarters is the cloud providers’ growing success in collaborations with telcos. The three big players now account for over $2.1B in annualized telco NI revenues, from $1.1B a year ago. Webscale operators help telcos with service and application development, shifting of workloads, and developing, enabling and marketing cloud-based services. Collaborations can involve delivery of a portfolio of 5G edge computing solutions that leverage the telco’s 5G network and the webscale operator’s global cloud coverage, as well as its expertise in areas like Kubernetes, AI/ML, and data analytics. Managing costs is a central purpose of telcos’ willingness to partner with webscale providers. Increasingly, the webscale operators who deliver cloud services are competing alongside traditional telco-facing vendors like Amdocs, Citrix, CSG and Nokia.

As telcos lean on webscalers more, most of the big NEPs, including Ericsson, Nokia, NEC, Fujitsu, Cisco and others, have entered into various forms of collaboration (usually joint development) with the cloud players. Ericsson, for instance, announced in June that it would partner with GCP to “jointly develop 5G and edge cloud solutions to help CSPs digitally transform and to unlock new enterprise and consumer use cases.” A month prior to that, Ericsson partnered with AWS to make AWS available as a “certified platform” for the Swedish vendor’s BSS portfolio. Such partnerships are not limited to the biggest NEPs. Amdocs, for instance, has strategic cooperation deals in place with each of the big three.

Market share: Leaderboard largely unchanged but Huawei is slipping

On a 3Q21 annualized basis, Huawei’s $41.7B in Telco NI revenues easily beats all rivals, but this has been below the sum of second and third ranked vendors Ericsson and Nokia for several quarters. Ericsson remains in second place and saw the largest individual share increase between the 3Q21 and 3Q20 annualized periods. That’s due to broad-based success in 5G infrastructure markets. After Ericsson, Nokia remains a strong #3, and its share position has seemed to stabilize after some recent erosion. Nokia’s share in the hardware/software segment of telco NI is actually higher than Ericsson, due to Nokia’s strength in optical/IP and fiber access markets. ZTE ranks fourth on both a single quarter and annualized basis, due both to sales in the China 5G market and its ability to circumvent some of the supply chain restrictions faced by Huawei. ZTE’s share gain was second only to Ericsson. China Comservice slipped back to a rank of 5 due in part to Huawei’s more aggressive stance in the services market.

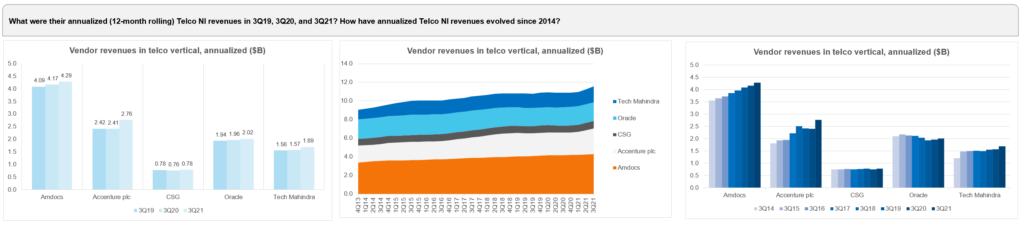

Cisco is 6th on an annualized basis, and its reported “service provider” revenues are on the rise again – but webscale SP/operator revenues account for much of the growth to date. Cisco is still betting on a strong position in 5G stand-alone core networks to grow telco revenues in 2022 and beyond. NEC places 7th on an annualized basis, but was 9th for 3Q21 alone. NEC has benefited from Japanese 5G spending but also has a number of important contracts overseas (e.g. Telefonica) as open RAN spending begins to ramp. NEC is working with Rakuten and NTT on global open RAN marketing and has ambitious growth goals. CommScope ranks 8 on an annualized and 3Q21 basis, despite losing quite a bit of share over the last few quarters. The company is still planning to spin off its Home division assets but for now is benefiting from a growing FTTx market, and RAN buildouts. Intel ranks 9 on an annualized basis but a stronger 7th for 3Q21 alone. Intel continues to announce new partnerships and products aimed at improving its position in telco NI. Amdocs rounds out the top 10. It has held its share relatively steady over the last year, however, it is one of the many vendors vulnerable to cloud providers’ telecom push; its 3Q21 single quarter rank was 11.

In terms of share growth, Ericsson easily beat all others in 3Q21 due to a broad base of 5G contracts. ZTE, Dell/VMWare, and Samsung also saw significant share growth versus 3Q20, as did Capgemini (due mainly to acquiring Altran) and Fujitsu (due to Japanese 5G base station sales). Huawei’s share drop was by far the worst, as it fell over 2 full percentage points in share.

Effects of the Huawei bans

While Ericsson and Nokia have clearly benefited from Huawei’s troubles, this displacement is only starting to help smaller vendors focused on areas like optical transmission and IP infrastructure. There is strong demand in these categories to support upgraded 5G radio and fiber access connectivity, however. As telco spending picks up in core networks, smaller vendors aim to pick off more of Huawei’s business in the next 1-2 years. Infinera notes an “acceleration in the pace of Huawei replacement opportunities.” Ciena, ADVA, Ribbon, and Arista should also benefit. Ciena’s strong 3Q21 results may be indicative of some share gain from Huawei, but also is due to a telco spending shift towards transport network upgrades.

Supply chain issues prove troublesome

A large number of vendors pointed to supply chain bottlenecks in 3Q21 earnings reports and calls. Order backlogs have increased. The general consensus is that there will continue to be problems for several quarters. These impact most directly the vendors selling hardware. Vendors focused more on selling software and services to telcos have not complained of supply chain issues. Some, in fact, see the shortage as an opportunity to push telcos faster towards software-centric networks.

Telco spending outlook for remainder of 2021

The telco industry put up big numbers so far this year. Our official guidance for 2021 telco capex is $300B, up only slightly from $295B in 2019, but that is likely to be too pessimistic. Annualized capex through 3Q21 is over $315B, based on preliminary 3Q21 figures. Some of this is due to US dollar depreciation, however, and the industry’s vigorous bounce back from the COVID-plagued 2020. Further, annualized capital intensity was 16.4% in 3Q21, a bit lower than the 16.7% recorded in 3Q20. We will be updating our network spending forecast in the next two weeks.

- Table of Contents

- Figures

- Coverage

- Visuals

Table of Contents

- ABSTRACT – Results commentary

- INTRODUCTION

- Telco NI Market – Latest Results

- TOP 25 VENDORS – Printable Tearsheets

- CHARTS – Single vendor snapshot

- CHARTS – 5 vendor comparisons

- DATA – revenue estimates by company

- ABOUT – MTN Consulting and report methodology

Figures

Partial list:

- Telco NI vendor revenues, annualized (US$B)

- Telco NI revenues by company type, 3Q21 annualized

- Telco NI as share of total company revenues for top 25 vendors

- Telco NI as % of corporate revenues by company type

- Telco NI/Total

- Annualized Telco NI revenues vs. Capex and Opex (ex-D&A)

- Correlation between Telco NI revenues and Capex/Opex ex-D&A

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in single quarter sales

- Telco NI sales of top 6 vendors vs. all others, 3Q21 TTM (annualized)

- Telco NI vendor revenues, YoY % growth in single quarter

- Top 25 vendors based on Telco NI revenues in 3Q21 ($B)

- Top 25 vendors based on annualized Telco NI revenues through 3Q21 ($B)

- Telco NI market share changes, 3Q21 v. 3Q20

- Top 25 vendors based on 3Q21 YoY revenue growth rate in Telco NI

- Top 25 vendors: results highlights and growth outlook

- Top 25 vendors in Telco NI Hardware/Software: Annualized 3Q21 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 3Q21 Revenues (US$B)

Coverage

| Company | Segment |

| 3M | CCV |

| A10 Networks | NEP |

| Accenture plc | ITSP |

| Accton Technology | NEP |

| ADTRAN | NEP |

| ADVA Optical Networking | NEP |

| Affirmed Networks | NSP |

| Airspan | NEP |

| Alcatel-Lucent | NEP |

| Allied Telesis | NEP |

| Allot Communications | NEP |

| Altran Technologies | ITSP |

| Amdocs | ITSP |

| Anritsu | T&M |

| Arista Networks | NEP |

| ARRIS International | CCV |

| AsiaInfo Technologies | NSP |

| Atos Origin | ITSP |

| Audiocodes | NSP |

| Avaya | ITSP |

| Aviat Networks | NEP |

| AWS (Amazon Web Services) | NSP |

| Azure (Microsoft) | NSP |

| Beijing Xinwei | NEP |

| Broadcom Limited | NEP |

| BroadSoft, Inc. | NSP |

| Brocade Communications Systems, Inc. | NEP |

| CA Technologies | NSP |

| Calix | NEP |

| Capgemini | ITSP |

| Casa Systems | NEP |

| Ceragon Networks | NEP |

| Check Point Software | NSP |

| China Communications Services Corporation Limited | ES |

| Ciena Corporation | NEP |

| Cisco Systems | NEP |

| Citrix Systems | ITSP |

| Clearfield | CCV |

| Comarch | ITSP |

| Comba Telecom | NEP |

| CommScope Holding | CCV |

| Commvault Systems | ITSP |

| Comptel | NSP |

| Convergys | ITSP |

| Coriant | NEP |

| Corning | CCV |

| CSG | NSP |

| Cyan | NSP |

| DASAN Zhone | NEP |

| Datang Telecom Technology | NEP |

| Dell Technologies | NSP |

| DragonWave Inc. | NEP |

| DXC Technology (aka CSC) | ITSP |

| DyCom Industries | ES |

| ECI Telecom | NEP |

| Ericsson | NEP |

| EXFO Inc | T&M |

| Extreme Networks | NEP |

| F5 Networks | ITSP |

| Fiberhome | NEP |

| FireEye | NSP |

| Fortinet | ITSP |

| Fujikura | CCV |

| Fujitsu Limited | NEP |

| Furukawa Electric | CCV |

| General Cable | CCV |

| GCP (Google Cloud Platform) | NSP |

| Harmonic Inc. | NEP |

| HCL Technologies | ITSP |

| Hengtong Optic-electric | CCV |

| Hitachi | NEP |

| HPE | NEP |

| Huawei | NEP |

| Huber+suhner AG | CCV |

| IBM | ITSP |

| Infinera | NEP |

| Infosys | ITSP |

| Inseego | NEP |

| Intel | NEP |

| Italtel | NEP |

| ITOCHU Techno-Solutions Corporation | ES |

| Juniper Networks | NEP |

| Kathrein | CCV |

| Kudelski | NEP |

| MasTec | ES |

| Mavenir | NSP |

| Metaswitch | NSP |

| Mitsubishi Electric | NEP |

| NEC Corporation | NEP |

| Net Insight | NEP |

| Netcomm | NEP |

| NetScout Systems | NSP |

| Nexans | CCV |

| Nokia | NEP |

| Openet | NSP |

| OPTIVA | NSP |

| Oracle | NSP |

| Pace plc | NEP |

| Palo Alto Networks | NEP |

| Prysmian | CCV |

| Quantenna Communications | NEP |

| Radcom | NSP |

| Radisys | NSP |

| Radware | NEP |

| Red Hat | NSP |

| Ribbon Communications | NEP |

| Ruckus Wireless | NEP |

| Samsung Electronics | NEP |

| SAP SE | NSP |

| SeaChange International, Inc. | NSP |

| Sopra Steria | ITSP |

| Spirent Communications | T&M |

| Sterlite Technologies | CCV |

| Subex | NSP |

| Sumitomo Electric | NEP |

| SYNNEX Corporation | ITSP |

| Tata Consultancy Services | ITSP |

| TE Connectivity | CCV |

| Tech Mahindra | ITSP |

| Technicolor | NEP |

| Tejas Networks | NEP |

| Transmode | NEP |

| Trigiant Group | CCV |

| Virtusa | ITSP |

| Vubiquity | ITSP |

| Westell | CCV |

| Wipro | ITSP |

| Wiwynn | NEP |

| YOFC | CCV |

| ZTE | NEP |

Visuals