By Matt Walker

This brief report provides a preliminary review of the 3Q22 vendor market for Telco Network Infrastructure.

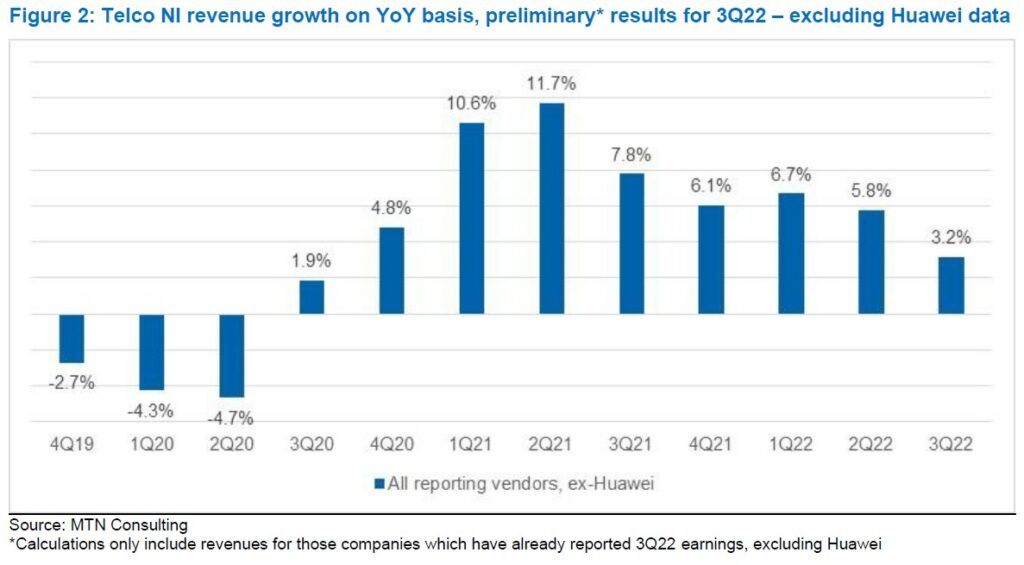

As of November 9, third quarter 2022 (3Q22) earnings results are available for approximately 89% of the vendors active in the Telco Network Infrastructure (Telco NI) market. Results to date show a modest slowdown in growth. For 1Q22 and 2Q22, Telco NI revenues grew for these vendors by 6.1% and 5.3%, respectively. For the same vendors, Telco NI revenues grew by about 2.9% YoY in 3Q22. Looking to 4Q22, usually telco spending is strong cyclically at year-end, and vendor revenues follow this. However, 4Q22 seems likely to be on the light side. Several vendors expect sequential declines, macroeconomic jitters remain, and spending has been strong for several quarters now. On the plus side, many vendors are seeing supply chain constraints start to ebb, and significant improvement seems likely by 2Q23. MTN Consulting will formally update its network spending forecast next month. Currently the telco capex forecast appears broadly on track.

- Table Of Contents

- Figures

- Coverage

- Visuals

Table Of Contents

- Telco spending climate still good but supply chain and macroeconomic worries persist – page 2

- Summary – page 2

- Vendor revenues in 3Q22 up 2.9% YoY based on preliminary results – page 2

- Company-level growth results – page 3

- Supply chain bottlenecks are easing, but not gone yet – page 5

- Forecast outlook – page 7

- Appendix – page 8

Figures

Figure 1: Telco NI revenue growth on YoY basis, preliminary results for 3Q22*

Figure 2: Telco NI revenue growth on YoY basis, preliminary* results for 3Q22 – excluding Huawei data

Figure 3: Telco NI YoY % revenue growth in 3Q22 for select vendors

Table 1: Supply chain comments and outlook from a few key Telco NI vendors

Coverage

Companies and organizations mentioned in this report include:

3M

Accenture

Alcatel-Lucent

Amdocs

Baring Private Equity

Broadsoft

Calix

Ciena

Cisco

CommScope

Corning

Cyan

Dragonwave

ECI Telecom

Ericsson

EXFO

Fiberhome

Fujitsu

Hengtong

Huawei

IBM

Infinera

Intel

Jio

Juniper

MasTec

Metaswitch

Microsoft

NEC

Nokia

Openet

Oracle

Radisys

Ribbon

Samsung

Transform-X

Virtusa

ZTE

Visuals