By Matt Walker

This forecast spreadsheet details MTN Consulting’s forecast for revenues, capex, headcount, and other metrics across three segments of network operators: telecom operators (telcos), webscale network operators (webscalers), and carrier-neutral operators (CNNOs). In 2022, these three groups accounted for $4.1 trillion (T) in revenues, $559 billion (B) in capex, and 8.87 million employees. The report provides 2011-22 actuals and projections through 2027, and includes projections from past forecasts for reference.

Key changes since last forecast

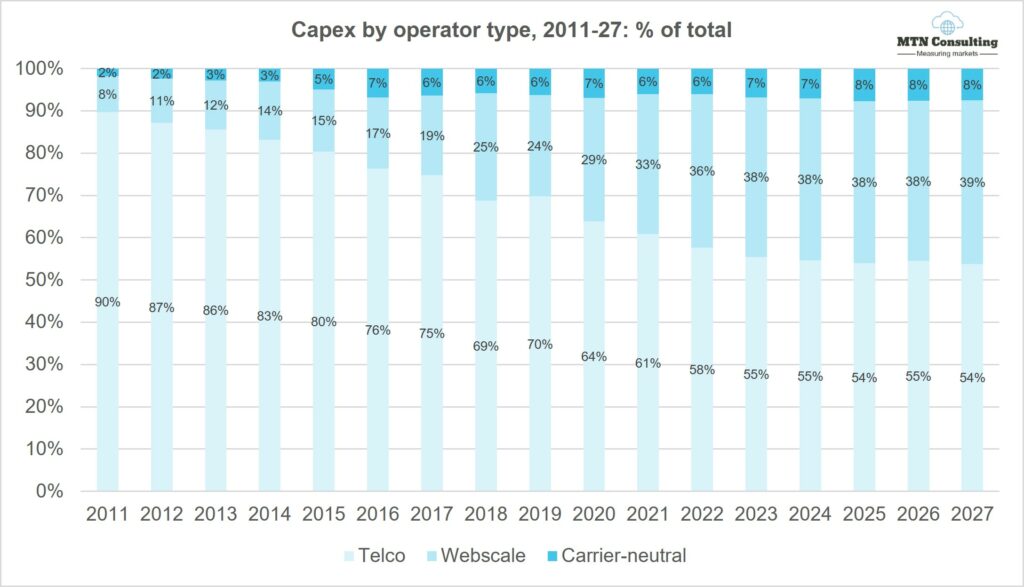

Relative to the previous (12/22) forecast, there are a few changes in the results: a lower revenue growth trajectory, for both telcos and webscalers; faster headcount decline for telcos and a flattening of webscalers’ overall headcount; and, a slight reduction in overall projected capex. Total capex for the group came in at $559B in 2022, a few $B less than we expected. For the 2023-27 forecast period, we now expect capex to total $2,889 billion versus $3,005B in the 12/22 forecast. Of this new five-year capex total, the splits are unchanged: telcos account for 54.5% of the total, webscalers 38.2%, and CNNOs the final 7.3%.

Top line quantitative results

Revenues from the aggregate of our three segments – telco, webscale, and carrier-neutral – were $4,109 billion (B) in 2022, and will grow to $5,052B by 2027. Three segment capex ended 2022 at $559B, will step up to $577B in 2023, and will likely hit $596B in 2027. Webscale growth eased in 2022 but over the longer timeframe this sector accounts for most network operator growth. In 2011, webscale was less than 10% of capex, but had grown to 36.3% in 2022 and will be about 39% in 2027; CNNOs will represent 8% of 2027 capex, while telcos will constitute about 54%. Telco capital intensity peaked in 2022 at 18.1% amidst 5G buildouts but will end 2027 at about 16.5%. Regional variations will remain; the capex/revenue ratio for US telcos will average to 14.7% in 2023-27, for instance, while India will average 25.1%. Webscale capital intensity averages around 8% for the forecast period; a capex boom at Meta/Facebook has been a big plus in recent quarters, but spending from Microsoft and Alphabet related to AI (including new generative AI platforms) will also lift webscale capex in the next 1-2 years. Capital intensity is highest in carrier-neutral, as usual, well over 30% for the whole forecast period.

Headcount across the three operator segments has grown dramatically in the last decade, from 6.48 million in 2011 to 8.87M in 2022. That is roughly the same as the 2021 figure: telcos accelerated headcount reductions in 2022, and several webscalers announced layoffs. By 2027, headcount will grow to 9.1 million, but this is a sizable drop from the 10.2M we expected late last year. Automation and AI efforts will facilitate this more modest headcount expansion. Nearly all future growth is from webscale, with a good portion coming from the ecommerce side (e.g. Amazon, Alibaba, and JD.COM). Revenue per employee is highest in carrier-neutral, and will see the fastest growth during the forecast as data center-focused CNNO companies account for more growth. Telcos, though, will also grow revenue per employee from about $389K in 2022 to $467K in 2027 as they learn how to do more with less, implementing automation across their operations.

Network operator interdependence

The three groups of operators we track pursue a range of different business models, even within segments. Webscale revenue models revolve around a diverse mix of advertising, devices, software, cloud services, and ecommerce. Carrier-neutral providers, to simplify, rent network infrastructure to other businesses. Telcos sell subscription and pay-as-you-go services for communications services, including bandwidth, video, mobility, and enterprise services. There is a huge amount of variety in these discrete market segments. What’s more important, though, is that the three segments rely on each other in important ways. Carrier-neutral players get most of their revenues from telcos & webscalers needing to fill gaps in network coverage and accelerate time to market. Telcos rely on CNNOs to lower their cost of operations, and need webscalers to provide services and apps which make their network worth using beyond telephony. Webscalers lack last mile access networks and can only deliver their services to the mass market over telco infrastructure. Webscalers also, despite big capex outlays, can only blanket the globe with data centers by partnering with CNNOs for collocation.

This interdependence will grow. The big cloud providers in the webscale market, for instance, have targeted the telecom vertical and found success; AWS, Azure and GCP combined for about $5.0B in revenues from telcos for the latest annualized period (2Q22-1Q23), up 65% YoY. Telcos are making some big bets on cloud technology as they deploy 5G core networks. Both telcos and webscalers want to provide seamless, resilient network coverage, including at the edge, and can’t build it all themselves. As a result, they’ll need to scale up their partnerships with carrier-neutral players like Equinix and American Tower/CoreSite. CNNOs are increasingly taking over the “dumb pipe” aspects of the network, and to be competitive and upsell they will integrate assets across fiber, cell tower and data center.

Key findings by network operator type

This forecast includes detailed breakouts for each of the three network operator types. Here is a summary of some of the key findings, by segment:

Telcos: telecom is essentially a zero-growth industry. Specific countries and companies do grow from time to time, in part from market share shifts, the different timing of growth cycles, or M&A. But global telco revenues have hovered in a narrow range ($1.7-$1.9 trillion) since 2011, and this will likely remain true through 2027. In 2022, revenues were $1.78T, and will grow an average annual rate of 1.8% to reach $1.95T by 2027. Capex continues to vary with technology upgrade cycles (e.g. 5G) and government actions (e.g. newly issued spectrum, or rural fiber subsidies). In 2022, capex totaled $322B, or 18.1% of revenues; that’s an all-time high capital intensity, for our coverage timeframe (2011-present). Capex will decline slightly through 2025, though, and then rise modestly again to reach $321B in 2027, which would be a 16.5% capital intensity. US capex surged in 2022, but will drop dramatically in 2023; we already expected this, though, so the current forecast is not significantly different. Software capex is growing more slowly than expected, and now likely to remain under 20% of total capex for the forecast period. Headcount in telecom is declining faster than expected, and now likely to fall below 4.2 million in 2027, from just under 4.6 million in 2022. Labor costs per head will revert to a growth trajectory in 2023, as telcos develop a more IT/software-centric workforce.

Webscalers: growth from webscale has lifted the overall network operator market over the last decade. Webscalers surged during COVID, by all measures – revenues, capex, employment. Demand for data center chips and related gear also surged. Now, parts of the sector are cutting back slightly. In 2022, revenues were $2.23 trillion, up just 4% YoY, far less than the average growth of 12% per year from 2011-22. We expect revenues to grow at a ~6% CAGR through 2027. Webscale capex was $203B in 2022, a healthy increase from 2021; due in part to generative AI interest, capex will grow again in 2023 and 2024, dip for a couple years of capacity absorption, and then end 2027 at around $231B. A larger portion of this capex will be for Network/IT/software investments: around 46%, from 44% in 2022. R&D spending by webscalers will remain high but fall from the record-breaking level of 2022 (12.0% of revenues), to about 10% in 2027. As topline growth gets harder for webscalers, they will become more cost conscious and short-term oriented.

CNNOs: the carrier-neutral sector remains tiny, with just $95B in 2022 revenues, but will grow to about $132B by 2027. Webscalers and telcos alike will both rely more on CNNOs over time for expansion of their data center, tower and fiber footprints. Telcos will continue to spin out portions of their infrastructure to third-parties – both traditional CNNOs, and joint ventures like Gigapower, the AT&T-Blackrock partnership. Total CNNO capex for 2022 was $34B, and will grow to about $45B by 2027; a large chunk of the CNNO sector’s expansion will be inorganic, though, via acquisition of existing assets from other sectors. By 2027, the CNNO sector will have under its management approximately 3.7 million cell towers (2022: 3.3M), 1,607 data centers (2022: 1,224), and 1.1M route miles of fiber (2022: 960K).

Market drivers, constraints and risk factors

This forecast represents only a modest revision from the edition published in December 2022. Most of the realities facing the operator market today were anticipated by our last forecast. For instance, we already expected that service revenues were not growing for telcos, and that 5G device sales distorted the market; an MTN Consulting report published in 2Q23 confirmed this fact, and supports a more cautious outlook for telco spending. We also thought that open RAN was overhyped, and was not likely to change the capex calculus for most established mobile operators. The 2023 dip in US telco capex was baked into our old forecast. The one big sector-specific change from the last forecast to this one is, the recent spike in interest in generative AI. This is a plus for the webscale market’s capex outlook, even if new revenue models are unclear and government regulations will slow adoption.

What about the macroeconomic climate? Wars, economic growth, inflation, interest rates, climate change, etc. Russia’s war on Ukraine remains ongoing, but hasn’t expanded to new countries. China has not invaded Taiwan as of yet, although this is a serious risk over the 5-year forecast horizon. Global economic growth is weaker than historic averages – about 3% this year and next, per the IMF – but inflation is easing, and the IMF’s GDP growth outlook improved slightly from April to July 2023. Interest rates continue to rise; the US federal funds rate has risen from 3.83% to 5.08% between 12/22 and 7/23, and further increases seem likely. Rising interest rates were already assumed to modestly depress 2023-24 capex, though.

Climate change is the one macro area that is quite a bit different than 8 months ago. The news gets worse each week. Government action continues to be gradual and consensus is hard to achieve. Increasingly the pressure will be on private companies to make voluntary, verifiable changes in how they operate. This doesn’t impact the forecast directly, but will impact how operators spend their tech budgets, as we have discussed in separate reports. Energy, sustainability and climate change will continue to be key themes in MTN Consulting research.

- Table Of Contents

- Figures & Charts

- Coverage

- Visuals

Table Of Contents

Key sections include:

- Abstract

- Total Network Operator Market Projections

- TNO Projections

- TNO Regional Split Projections

- WNO Projections

- CNNO Projections

- Top spenders – spending outlook

- About

Figures & Charts

- Revenue by operator type, 2011-27 (US$B)

- Capex by operator type, 2011-27 (US$B)

- Capex by operator type, 2011-27: % of total

- Capital intensity by operator type, 2011-27

- Employees by operator type (M)

- Revenues/employee by operator type (US$K)

- Capex forecast by segment: July 2023 v. Dec. 2022 outlook, % difference

- Capex forecast by segment: July 2023 v. Dec. 2022 outlook, $B difference

- Top 50 spending operators, annualized 1Q23 capex ($B)

- Telcos: Revenues ($B) vs. capital intensity

- Software capex in US$B and as % of total capex

- Capital intensity variation: Telenor Norway vs global average

- Telco opex components: 2017, 2022 and 2027

- Telcos: Capex and network operations opex ($B)

- Telcos: Employees vs. average labor cost per employee ($K)

- Telcos: Labor cost opex in US$B and as % of Opex ex-D&A

- Telco margins, actual and forecast

- July 2023 vs. Dec 2022 forecast: % changes in key metrics

- Revenues by region: 2017, 2021, and 2027 (US$B)

- Telco capex by region, select years (US$B)

- Telcos: capital intensity by region

- Capex by region, % global

- Capex by region: July 2023 vs. Dec 2022 Forecast

- Capital intensity projections by forecast vintage

- Webscale revenues and capital intensity

- Webscale capital intensity by company HQ

- Webscale capex by company HQ (US$B)

- Webscale capex by type (US$B)

- Webscale R&D as % of revenues by company HQ

- Webscale revenue per employee ($K) by company HQ

- Percent change in outlook, July 2023 vs. Dec 2022 forecast

- China as a % of the global market, by metric (7/23 forecast)

- Carrier-neutral operators: Revenues and capital intensity

- CNNO employees and revenues per employee

- CNNO Towers and Tenancy Ratio, global ex-China

- Number of data centers and average net rentable floorspace (in square feet) per data center

- % difference in key metrics: July 2023 vs. Dec 2022 forecast

- CNNO capex by forecast vintage ($B)

- Capital intensity: 2011-22 by segment and 2023-27 average

- CNNO capex by segment, 2011-22 (US$B)

Coverage

Companies mentioned:

21Vianet

A1 Telekom Austria

Advanced Info Service (AIS)

Airtel

Alibaba

Alphabet

Altice Europe

Altice USA

Amazon

America Movil

American Tower

Apple

AT&T

Axiata

Axtel

Baidu

Balitower

Batelco

BCE

Bezeq Israel

Bharti Infratel

Bouygues Telecom

BSNL

BT

Cable ONE, Inc.

Cell C

Cellcom Israel

Cellnex

CenturyLink

Charter Comms

China Broadcasting

China Mobile

China Telecom

China Tower

China Unicom

ChinaCache

ChinData

Chorus Limited

Chunghwa Telecom

Cincinatti Bell

CK Hutchison

Cogeco

Cogent

Cognizant

Comcast

Consolidated Communications

CoreSite Realty

Crown Castle

Cyfrowy Polsat

CyrusOne

Cyxtera

DEN Networks Limited

Digi Communications

Digital Realty

Dish Network

Dish TV India Limited

DT

Du

eBay

EI Towers

Elisa

Entel

Equinix

Etisalat

Facebook

Far EasTone Telecommunications Co., Ltd.

Frontier Communications

Fujitsu

GDS Data Centers

Globe Telecom

Grupo Clarin

Grupo Televisa

GTL Infrastructure

GTT Communications

Hathway Cable & Datacom Limited

HPE

IBM

IHS Towers

Iliad SA

Internap

Inti Bangun Sejahtera

Inwit

JD.COM

KDDI

Keppel DC REIT

KPN

KT

Level 3

LG Uplus

Liberty Global

M1

Maroc Telecom

Maxis Berhad

Megafon

Microsoft

Millicom

Mobile Telesystems

MTN Group

MTNL

NBN Australia

NEXTDC

NTT

Oi

Omantel

Ooredoo

Oracle

Orange

PCCW

PLDT

Proximus

QTS Realty

Quebecor Telecommunications

Rakuten

Reliance Communications Limited

Reliance Jio

Rogers

Rostelecom

Safaricom Limited

SAP

Sarana Menara Nusantara

Sasktel

SBA Communications

Shaw

Singtel

SITI Networks Limited

SK Telecom

SmarTone

SoftBank

Solusi Tunas Pratama

Spark New Zealand Limited

StarHub

STC (Saudi Telecom)

Summit Digitel

Sunevision

Superloop

Swisscom

Switch

Taiwan Mobile

Tata Communications

Tata Teleservices

TDC

TDF Infrastructure/Arcus

TDS

Tele2 AB

Telecom Argentina

Telecom Egypt

Telecom Italia

Telefonica

Telekom Malaysia Berhad

Telenor

Telesites

Telia

Telkom Indonesia

Telkom SA

Telstra

Telus

Tencent

Thaicom

Tower Bersama Infrastructure

TPG Telecom Limited

True Corp

Turk Telekom

Turkcell

Twitter

Uniti Group

Veon

Verizon

Vodafone

Vodafone Idea Limited

VodafoneZiggo

Windstream

Yandex

Zain

Zain KSA

Zayo

Visuals