By Arun Menon

This report reviews the growth and development of the telecommunications network operator (TNO, or telco) market. The report tracks a wide range of financial stats for 139 telcos across the globe, from 1Q11 through 1Q23. In the annualized 1Q23 period, telcos represented $1.76 trillion (T) in revenues (-6.3% YoY), $253.8 billion (B) in labor costs (-5.4% YoY), and $322.6B in capex (-1.5% YoY). They employed approximately 4.55 million people as of March 2023, down 1.9% from the prior year.

Telco revenues register sixth consecutive YoY decline in 1Q23

Telco revenues declined by 3.5% on a YoY basis to post $448.3 billion (B) in the three-month period covered by 1Q23 (January – March 2023). The quarterly dip was also the sixth consecutive slump. However, the pace of decline is slowing down – the previous three quarters saw revenues sink by 6%, 6%, and 9% in 2Q22, 3Q22, and 4Q22, respectively. The comparatively modest slump in the latest quarter was supported by the big three Chinese telcos – China Mobile, China Telecom, China Unicom – all of whom recovered from the topline declines in 4Q22.

However, the sharp slides in the prior three quarters coupled with 1Q23’s decline impacted revenues and their growth rate for the annualized 1Q23 period – they were $1,763.4B, down 6.3% YoY over the previous year. This drop was the steepest decline recorded for a 12-month period since at least 2011. Currency fluctuations, inflationary pressures, and AT&T’s April 2022 spinoff of its WarnerMedia unit squeezed the market. Further, a strong dollar impacted many regions, but especially Japan: revenues for Softbank, KDDI, and NTT plummeted by 13.7%, 13.5%, and 10.2% YoY, respectively. Inflationary pressures and the energy crisis impacted telco giants such as BT (-12.5%) and Vodafone (-10.2%).

Among the top 20 companies based on annualized 1Q23 revenues, Airtel saw the strongest growth in revenues, up 10.4%. Airtel was the only telco among the top 20 to post double-digit growth for the annualized period. The growth came on the back of rising ARPU and growing service subscriptions in its domestic market, as it begins a shift to 5G. Other telcos among the top 20 to post revenue growth in the annualized 1Q23 period include Saudi Telecom (6%), Charter Communications (4%), China Mobile (2.9%), China Telecom (2.1%), China Unicom (1.7%), and Verizon (1.4%). Growth witnessed by the three Chinese telecom giants was largely due to a surge in their “emerging businesses” revenues. These businesses include cloud computing, big data, internet data centers, and Internet of Things (IoT). Growth witnessed by a few other operators was mostly an outcome of equipment revenues, as these have grown with 5G device sales in many markets. Telcos now hope that the 5G-enabled devices already deployed will help to generate new revenue streams in the forthcoming quarters of 2023 and beyond, but this seems unlikely. As such we expect telcos to be forced into major strategic changes and cost transformation programs in the near future. The worst annualized telco growth among the top 20 operators for the annualized 1Q23 period came from AT&T, down 30.8%, largely due to the WarnerMedia spinoff. However, 12 of the other top 20 operators posted a decline in revenues, without a big asset sale to explain the drop. Apart from the three Japanese telcos mentioned earlier, BT (-12.5%) and Vodafone (-10.2%) were among the top 20 to post a >10% decline in revenues in the annualized 1Q23 period.

Capital intensity hit fresh record high even as major telcos announce capex cuts

Telco spending staged a modest recovery of sorts in the latest single quarter after consecutive declines in the prior two quarters. Capex grew by 0.8% on a YoY basis to post $77.7B in 1Q23. The modest growth in the latest quarter was not enough to push annualized capex into growth territory. Annualized capex declined by 1.5% YoY to post $322.6B in 1Q23. Despite the decline in the latest annualized period, capital intensity reached a new all-time high of 18.3% in the annualized 1Q23 period. Increased fiber roll-out and upgrade activities to support fixed broadband and to connect all the new radio infra (including small cells) needed for 5G, coupled with continued expansion of 5G in major markets like India, have aided annualized capital intensity to conquer new heights.

As noted earlier, the market’s annualized capital intensity rose to a record high, from 17.4% in 1Q22 to 18.3% in 1Q23. For MTN Consulting’s coverage timeframe, 1Q11-1Q23, the previous high of 18.1% was recorded in 4Q22. To find a capital intensity higher than 18.3%, though, the pre-2011 timeframe must be considered; ITU data suggests that telecom capital intensity exceeded 20% in 2001. At the operator level, Rakuten’s capital intensity exceeds all other telcos handily with a roughly 187.6% capex/revenue ratio for 1Q23, on an annualized basis. Rakuten’s ratio has been declining in recent quarters as its greenfield network rollout is reaching its peak. Frontier Communications’ capital intensity stood at 59.6% for the annualized 1Q23 period, driven by increased spending for fiber upgrades to its existing copper network and aided by government support for rural broadband. Globe Telecom’s capital intensity for the annualized 1Q23 period stood at 55.6%, due to a network infrastructure buildup that includes 1,080 new cell sites, upgrades to at least 12,900 sites including both 4G LTE and 5G, and installation of over one million fiber-to-the-home lines. Consolidated Communications and PLDT’s annualized capital intensity stood at 50.9% and 47%, respectively, in 1Q23.

The biggest capex spender In the annualized 1Q23 period was China Mobile ($26.5B), but this was down 6% from annualized 1Q22 period due to the telco’s efforts to share costs on the network side enabled by a partnership with China Broadcasting Network. Five out of the top 20 operators by capex spend posted double-digit growth rates for the annualized 1Q23 period. These include: Frontier Communications (93.7%), Charter Communications (30.1%), Airtel (19.4%). Comcast (14.7%), and AT&T (10%).

Telcos adopt digital transformation and technology-enabled solutions to drive profitability

Amid declining topline, telcos have historically managed to keep costs in check, allowing for stable profitability margins – EBIT margins have been in the range of 13-18% while average EBITDA margins have never gone down below 30% since 2011. This continues to stretch out into annualized 1Q23 period despite the immense burden of investments, stagnating revenues, and macro pressures in the past several quarters. EBITDA margin for the industry was 34.5%, while EBIT (operating) margin stood at 15.2%, in the annualized 1Q23 period. Within the overall telco opex budget, telcos are having success in cutting their sales & marketing and G&A spending, as telcos adjust to working from home and accelerate the migration of sales & support to digital platforms. MTN Consulting expects telcos to continue reducing their headcount by revamping their processes, investing in digital transformation, and adopting automation. Meanwhile, many telcos are reporting that network operations is taking up a larger portion of the opex pie. To drive sweeping changes going forward, telcos will have to implement dramatic, strategic measures to optimize their cost structure in order to increase and sustain profitability. These strategic measures will be a mix of technology-enabled solutions and collaborations, some of which will transform the telco business model. While automation will continue to be a key enabler, other key strategic cost optimization measures that telcos will pursue over the next 2-3 years include core network sharing, network slicing, and partnerships with webscale cloud providers, each of which has the potential to hit multiple cost bases.

Telco headcount reduction efforts continue; labor costs come down

Telco industry headcount was 4.55 million in 1Q23, down from 4.65 million a year ago. MTN Consulting expects headcount reductions to continue via implementing automation, attrition, and voluntary retirement schemes, heading towards 4.122 million by 2027. Spending on employees (labor costs) on a per-person basis has fallen slightly from $57.3K in the annualized 1Q22 period to $55.3K in 1Q23 annualized. Our forecast calls for the opposite: steady increase in per-employee labor costs. Exchange rate volatility is the main factor here, as without US dollar appreciation in the annualized 1Q23 period, labor costs per employee would have risen. Also, big tech companies slowed hiring and/or engaged in layoffs in 2H22, which expanded the labor pool available to telcos and may have slowed salary growth. However, MTN Consulting expects the average telco employee salary to continue rising, reaching just above US$69.2K by 2027. Even as telcos cut headcount, they recognize how key their workforce is central to success. As such they are investing in training programs, and hiring a new generation of highly-skilled employees able to function in the telco of the future.

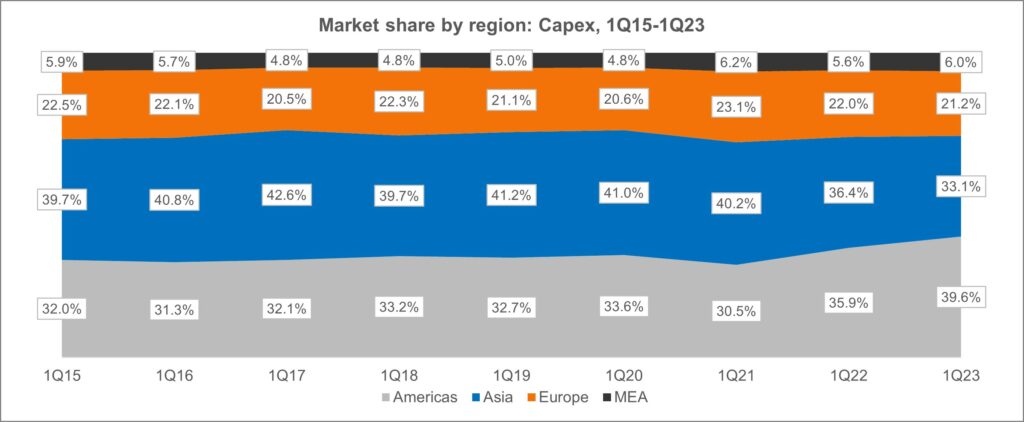

Asia beats Americas by revenues, but the latter outspends all other regions in capex terms

The Americas region, which maintained its dominance in the previous two quarters as the single largest region by revenues, slipped behind the Asia region in 1Q23. In terms of growth, all regions barring MEA registered revenue declines in 1Q23 with Europe declining the most by 5.4%. On a capex basis though, the Americas region continued to outspend the Asia region for the second straight quarter; cable companies and telcos in the region such as Comcast, Charter Communications, and Frontier Communications are responsible for most of this growth. Asia registered a steep YoY decline in capex spend of 8.2% in 1Q23, thanks to reduced spending by the three Chinese telcos – China Mobile, China Telecom, and China Unicom. Chinese 5G capex is waning and there is a greater focus on network sharing. Europe continued its lead into the latest quarter for having the highest regional capital intensity on an annualized basis, with 19.5% in 1Q23, followed by Americas (19%). The Americas and the MEA regions were the ones to witness an uptick in annualized capital intensity this quarter when compared to 1Q22, while Europe slipped slightly by 0.1 percentage point.

Forecast Outlook

All numeric references above to a forecast period are based on the December 2022 report, “Network Operator Forecast Through 2027”. These projections are currently being revised and a new forecast is expected to be published by August.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Market snapshot

- Analysis

- Key stats through 1Q23

- Labor stats

- Operator rankings

- Company Deepdive & Benchmarking

- Country breakouts

- Country breakouts by company

- Regional breakouts

- Raw Data

- Subs & traffic

- Exchange rates

- Methodology & Scope

- About

Figure & Charts

- TNO market size & growth by: Revenues, Capex, Employees – 1Q20-1Q23

- Regional trends by: Revenues, Capex – 1Q20-1Q23

- Opex & Cost trends

- Labor cost trends: 1Q20-1Q23

- Profitability margin trends: 1Q20-1Q23

- Spending (opex, labor costs, capex): annual and quarterly trend

- Key ratios: annual and quarterly trend

- Workforce & productivity trends: 1Q14-1Q23

- Operator rankings by revenue and capex: latest single-quarter and annualized periods

- Top 20 TNOs by capital intensity: latest single-quarter and annualized periods

- Top 20 TNOs by employee base: latest single-quarter

- TNOs: YoY growth in single quarter revenues

- TNOs: Annualized capital intensity, 1Q16-1Q23

- TNOs: Revenue and RPE, annualized 1Q16-1Q23

- TNOs: Capex and capital intensity (annualized), 1Q16-1Q23

- TNOs: Total headcount trends, 1Q16-1Q23

- TNOs: Revenue and RPE trends, 2011-22

- TNOs: Capex and capital intensity, 2011-22 ($ Mn)

- TNOs: Capex and capital intensity, 1Q16-1Q23 ($ Mn)

- TNOs: Revenue and RPE trends, 1Q16-1Q23

- Top 79 TNOs by total opex, 1Q23

- Top 79 TNOs by labor costs, 1Q23

- TNOs: Software as % of total capex

- TNOs: Software & spectrum spend

- TNOs: Total M&A, spectrum and capex (excl. spectrum)

- Top 79 TNOs by total debt: 2011-22

- Top 79 TNOs by total net debt: 2011-22

- Top 79 TNOs by long term debt: 2011-22

- Top 79 TNOs by short term debt: 2011-22

- Top 79 TNOs by total cash and short term investments ($M): 2011-22

Coverage

Operator coverage:

| A1 Telekom Austria | Advanced Info Service (AIS) | Airtel | Altice Europe | Altice USA | America Movil | AT&T | Axiata | Axtel | Batelco |

| BCE | Bezeq Israel | Bouygues Telecom | BSNL | BT | Cable ONE, Inc. | Cablevision | Cell C | Cellcom Israel | CenturyLink |

| Cequel Communications | Charter Communications | China Broadcasting Network | China Mobile | China Telecom | China Unicom | Chunghwa Telecom | Cincinatti Bell | CK Hutchison | Clearwire |

| Cogeco | Com Hem Holding AB | Comcast | Consolidated Communications | Cyfrowy Polsat | DEN Networks Limited | Deutsche Telekom | Digi Communications | DirecTV | Dish Network |

| Dish TV India Limited | DNA Ltd. | Du | EE | Elisa | Entel | Etisalat | Fairpoint Communications | Far EasTone Telecommunications Co., Ltd. | Frontier Communications |

| Globe Telecom | Grupo Clarin | Grupo Televisa | Hathway Cable & Datacom Limited | Idea Cellular Limited | Iliad SA | KDDI | KPN | KT | Leap Wireless |

| LG Uplus | Liberty Global | M1 | Manitoba Telecom Services | Maroc Telecom | Maxis Berhad | Megafon | MetroPCS Communications | Millicom | Mobile Telesystems |

| MTN Group | MTNL | NTT | Oi | Omantel | Ono | Ooredoo | Orange | PCCW | PLDT |

| Proximus | Quebecor Telecommunications | Rakuten | Reliance Communications Limited | Reliance Jio | Rogers | Rostelecom | Safaricom Limited | Sasktel | Shaw |

| Singtel | SITI Networks Limited | SK Telecom | Sky plc | SmarTone | SoftBank | Spark New Zealand Limited | Sprint | StarHub | STC (Saudi Telecom) |

| SureWest Communications | Swisscom | Taiwan Mobile | Tata Communications | Tata Teleservices | TDC | TDS | Tele2 AB | Telecom Argentina | Telecom Egypt |

| Telecom Italia | Telefonica | Telekom Malaysia Berhad | Telenor | Telia | Telkom Indonesia | Telkom SA | Telstra | Telus | Thaicom |

| Time Warner | Time Warner Cable | TPG Telecom Limited | True Corp | Turk Telekom | Turkcell | Veon | Verizon | Virgin Media | Vivendi |

| Vodafone | Vodafone Idea Limited | VodafoneZiggo | Wind Tre | Windstream | Zain | Zain KSA | Ziggo | ||

| Masmovil |

Regional coverage:

| Asia | Americas | Europe | MEA |

Visuals