By Matt Walker

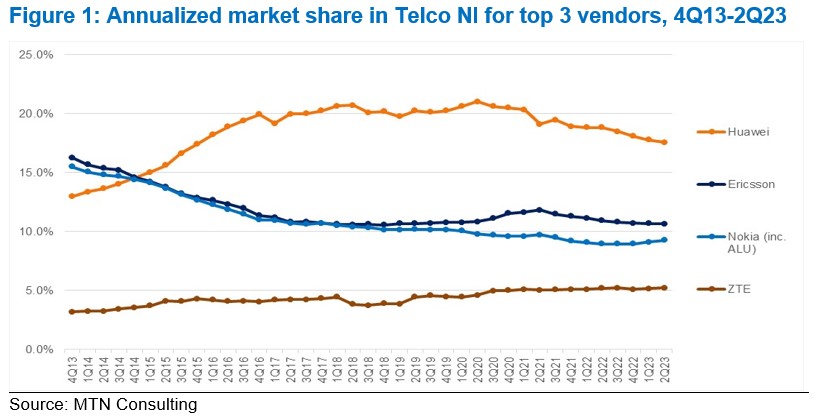

This brief addresses the enduring power of Huawei in the market for telecommunications network infrastructure (Telco NI). Per MTN Consulting’s latest Telco NI vendor share report, Huawei retains over 17% of this market globally, far ahead of the next two rivals, Ericsson and Nokia. Huawei’s top spot is only slightly down from the ~20% share it recorded in 2017-19. Yet starting 2019, Huawei was hit with strict limits on its ability to buy US-dependent technology (i.e. the entity list restrictions) and key customers in Europe, Asia and the Americas began taking more seriously the political and security risks of dependence on a Chinese vendor. Back in 2019-20, it was clear that Huawei stockpiled some inventory to help survive the early months of the entity list rules. That was only a stopgap solution, though. Moreover, Chinese government actions since 2019 have raised more concerns about the relationship with Huawei, rather than resolving doubts. How has Huawei managed to keep its leading position in Telco NI despite all of these new obstacles? And what are the implications for Huawei’s prospects in the next few years in this market?

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- How did we get here? – page 2

- It’s nice to be private, but it comes with a higher burden of proof – page 3

- What is the Digital Silk Road? – page 4

- Huawei changes revenue reporting segments – page 6

- Why did Huawei resegment, and why now? – page 6

- How to cope with this reality? – page 7

- Appendix – page 8

Figures and Tables

Figure 1: Annualized market share in Telco NI for top 3 vendors, 4Q13-2Q23

Figure 2: Geographic scope of China’s Belt and Road Initiative (BRI)

Coverage

Organizations mentioned:

America Movil

China Communications Construction Co

China Communications Services

China Development Bank (CDB)

China ExIm Bank

China Tower

China Unicom

Ericsson

Fiberhome

Hengtong

Hikvision

HMN Technologies

Huawei

Hyalroute

Japan Bank for International Cooperation

Nokia

Reliance Communications

Tele Norte Leste Participacoes

Telefonica

Ukrtelecom

Uzbektelecom

ZTE

Visuals