By Matt Walker

The November 2020 election of Joe Biden to become the 46th President of the United States is having a number of sweeping effects. The most crucial one relates to the COVID-19 pandemic: Biden’s team has changed both tone and policy, and launched an aggressive, coordinated rollout of vaccines across the US population. Biden’s election will also have important impacts on communications network infrastructure markets, in at least two important ways.

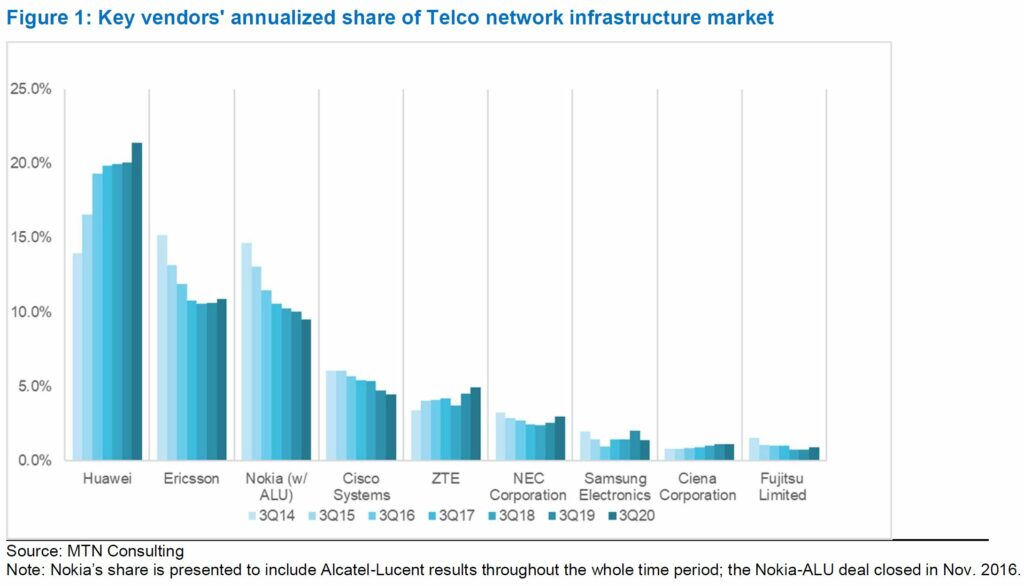

First, US policy will continue to restrict much of the Chinese technology sector’s access to US supply chains; the US government will aim to minimize deployment of Chinese technology in both US communications networks and those in allied countries; and, US policy will support alternative technologies and companies that can help smooth the transition away from China. Implications: Huawei will see market share in the telecom sector decline markedly over the next 2 years; China will push harder on its own allies to purchase Huawei/ZTE gear; Huawei and ZTE will emphasize services and software more, and hardware less; China will explore many ways around the rules but see limited success without crucial chipmaking technology; Open RAN will see an accelerated adoption curve; US companies like Ciena, Cisco, and Infinera, and others (e.g. Fujitsu and NEC), will see telecom opportunities pick up significantly in 2H21 and 2022.

Second, the US will actively support the development of a semiconductor supply chain with more firm roots in the US mainland, and also aim to offset the growing global dependence on a single contract manufacturer (foundry), Taiwan-based TSMC. Implications: China will accelerate development of its own chipmaking industry and simultaneously use all means of political persuasion and bullying to bypass supply chain restrictions; Chinese hacking of the semiconductor sector will be more vigorous and aggressive than usual, both aimed at theft and at sabotage; China’s threats to invade Taiwan will get increasingly boisterous but not result in invasion through at least November 2022, instead remain aimed at extracting concessions; Intel and, to a much smaller extent, Samsung will benefit as the apparent risk of over-reliance on TSMC becomes clear; both US and European governments will focus R&D efforts at supporting alternatives to TSMC.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- Huawei likely to fall below 20% share of telco network infra market in 2021 – 2

- US is poised to support semiconductor supply chain in big ways – 7

- Appendix – page 10

- About MTN Consulting

- Terms of Use

Figure & Charts

Figure 1: Key vendors’ annualized share of Telco network infrastructure market

Figure 2: Top 25 vendors in Telco NI Hardware/Software*: Annualized 3Q20 Revenues (US$B)

Figure 3: Price change for key chip players and NASDAQ, April 5, 2019 – March 15, 2021

Coverage

Companies and organizations mentioned in this report include:

Advanced Micro-Fabrication Equipment

AGCU Scientech

Airtel

Aksu Huafu Textiles

Alipay

AMD

Applied Materials

Arm Ltd.

Beijing University of Posts and Telecommunications

Beijing Zhongguancun Development Investment Center

CamScanner

China Communications Construction Company

China Electronics Technology Group Corporation, 7th Research Institute (CETC-7)

China National Aviation Holding

China State Shipbuilding

Ciena

Cisco

CloudWalk Technology

Commercial Aircraft Corporation of China

Dahua Technology

Deep Network Vision

Deutsche Telekom

DJI

Ericsson

Federal Communications Commission

FiberHome

Fujitsu

Global Tone Communication

GlobalFoundries

Gowin Semiconductor

Grand China Aie

Guangzhou Haige Communication Group Co., Ltd.

Hangzhou Hikvision

Hikvision

HiSilicon

Huawei

Hytera

IFLYTEK

Infinera

Intel

Intellifusion

KDDI

Lam Research

Luokong Technology

Megvii Technology

NEC

NetPosa

Nokia

NVIDIA

QQ Wallet

Samsung

SaskTel

Semiconductor Manufacturing International Corp (SMIC)

Sense Time

SenseNets

SHAREit

Shenzhen Net Vision

Spark

Taiwan Semiconductor Manufacturing Company (TSMC)

Tencent QQ

Tianjin Broadcasting Equipment Co., Ltd.

UMC

US House Intelligence Committee

US National Security Commission on Artificial Intelligence

Verizon

Videotron

VMate

Vodafone Idea

WeChat Pay

WPS Office

Xiamen Meiya Pico

Xiaomi

Xinjiang Uighur Autonomous Region People’s Government Public Security Bureau

Yitu Technologies

Yixin Science and Technology Co. Ltd.

Zhejiang Dahua

ZTE

Visuals