By Arun Menon

Summary

After years of delay with 10nm chips, production roadblocks are again haunting Intel. The company has confirmed that its new line of server processors and chips based on 7nm process nodes have been delayed until 2022. The setback has sent Intel into a tizzy as rivals see a rare chance to knock Intel off its perch. On the rivals’ radar is the high-margin data center (DC) chips market, which is often touted as Intel’s “crown jewel,” as its market share is over 90 percent.

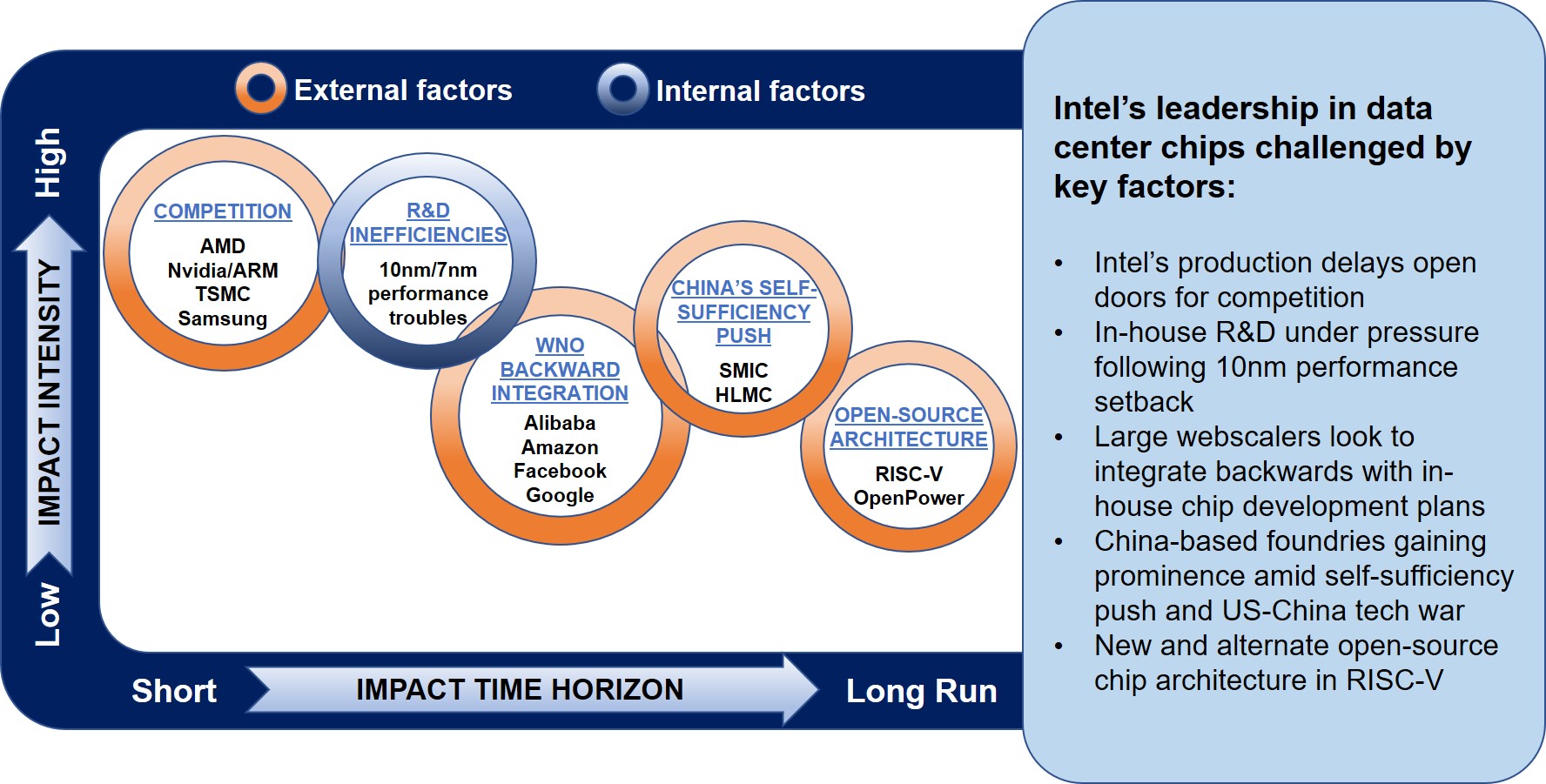

Hard-pressed by the current production upheaval, a combination of internal and external factors is expected to dent Intel’s share of the DC chips pie. Among the factors impacting Intel, the most obvious is the increased competition from rivals across the value chain which includes fabless chipmakers (AMD, Nvidia), pure-play design houses (Arm), and foundries/fabs (TSMC, Samsung). There is also a big in-house problem – Intel’s R&D, which previously failed to keep up with the standard two-year time frame to develop a new chip under “Moore’s Law”, is now battling with the current three-element process cycle that usually follows a three-year timeframe. In the medium-to-long run, several other factors — such as backward integration of webscalers, China’s self-sufficiency drive in semiconductors, and the emergence of open-source architecture such as RISC-V — are threatening to cut into Intel’s forte in the DC realm.

To sustain its market leadership in the DC chips market, Intel needs to turn around the production troubles by partly outsourcing its manufacturing load to external foundries, instead of remaining completely “fabless,” or transitioning to a “fab-lite” model. But that may not be enough, as the underlying trigger of never-ending production delays is tied to its struggling R&D. It is imperative for Intel to address the bigger problem of R&D fairly soon in order to close the generation gap with its rivals in terms of chip manufacturing technology.

- Table Of Contents

- Figure & Tables

- Coverage

- Visuals

Table Of Contents

- Summary (p2)

- The chips are down for Intel, marred by transition delay to next-generation fab processes (p2)

- Five key factors confront Intel’s dominance in DC chips market (p3)

- Intel competes with diverse rivals across the chip value chain (p4)

- Intel’s production roadblock open doors for rival incumbents eying DC chips pie (p5)

- Enterprise customers could switch to vendors offering chips built on more advanced 7nm process (p7)

- 10nm performance troubles expose Intel’s R&D struggles (p8)

- Backward integration by webscale network operators add to Intel’s agonies (p10)

- China’s aggressive push for chip self-sufficiency could unsettle Intel in the medium to long run (p11)

- Open-source architectures such as RISC-V poses further risks for Intel in the long run (p12)

- Intel’s DC chips leadership is closely tied to its overall turnaround, which lies beyond fab dilemma (p13)

- Appendix (p15)

Figure & Tables

Figures

- Figure 1: Intel’s Data Center Group, Annualized Revenues (US$M): Segment contribution to total annualized revenues (%); and YoY annualized revenue growth (%): 2Q16 – 2Q20

- Figure 2: A framework of key factors challenging Intel

- Figure 3: The semiconductor value chain

- Figure 4: Rebased stock price performance

- Figure 5: Intel’s key relationships with WNOs

- Figure 6: R&D/revenues: Intel, AMD, Nvidia

- Figure 7: Intel’s revenue contribution trend by key geographies

Tables

- Table 1: Summary of strategic actions taken by Intel’s rivals

- Table 2: In-house chip development plans of WNOs

Coverage

Organizations mentioned in this report include:

Alibaba

Amazon (AWS)

AMD

Apple

Arm

Baidu

ByteDance

Facebook

Fujian Jinhua Integrated Circuit

GlobalFoundries

Google

Huawei

IBM

Inspur

Intel

Microsoft

Nvidia

Samsung

Shanghai Huali Microelectronics Corporation (HLMC)

SiFive

SMIC

Tencent

Tsinghua Unigroup

TSMC

Twitter

ZTE

Visuals