This report is the third in MTN Consulting’s Webscale Playbook series, which analyze the “Super 8” webscale network operators (WNOs), i.e. Alibaba, Alphabet, Amazon, Apple, Baidu, Facebook, Microsoft, and Tencent. The objective of this report is to assess Alphabet’s:

- latest quarterly key performance indicators including revenues, capex, opex, R&D, etc.

- top 3 spending-related (capex and R&D) priorities

- network vendor relationships, M&A, and partnerships across different network product categories

- network-related strategy

- disruptive impact on the network infrastructure market

—–

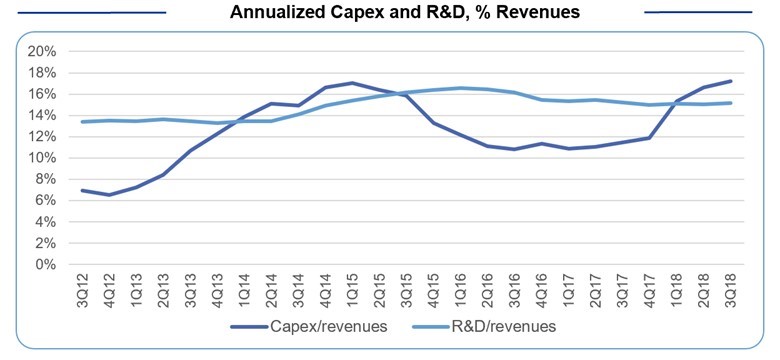

Alphabet is out to prove that it is more than just an advertising business. That’s important as the company remains heavily exposed to ads, which accounted for about 86% of 2017 revenues. Yet, Alphabet is facing new competition in ads from Amazon, plus ongoing regulatory scrutiny in Europe. Fortunately the company is generating incredible amounts of cash each quarter, and now has just under $102B in cash & stocks on hand. That has allowed the company to invest heavily in its network, with capex amounting to a telco-like 17.2% of revenues over the last four quarters. Alphabet also spends another ~15% of revenues on R&D. The goal of these investments is help the company enter (or create) new markets, with less ad-dependent business models. Alphabet’s vast network infra supports the company’s cloud computing and device portfolio, as well as AI-based projects in transportation (Waymo), logistics (Project Wing), and healthcare (Verily). As a result, Alphabet’s network, IT & software capex has soared, to $8.2B over the 4Q17-3Q18 period (from $4.1B the year prior).

Below are a few highlights from the report:

- Alphabet has been spending more on capex than R&D in the recent times, as it builds data centers, submarine cables, and machines with improved compute capacity. At least some of the capex surge also comes from land purchases (e.g. Chelsea Market)

- Alphabet’s mission to achieve quantum supremacy is driving its R&D quest, which includes recent tests of a 72 qubits quantum processor dubbed “Bristlecone”

- The tech giant is also making exceptional progress in the AI accelerator space which includes manufacturing alternatives to CPUs and GPUs offered by network vendors such as NVIDIA and Intel

Format: PDF (available in PPT upon request)

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Latest earnings takeaways

- Revenue Analysis

- Capex & R&D: Spend analysis

- Capex & R&D: Top 3 priorities

- Key technology relationships

- Data center locations

- Alphabet’s network strategy

- Alphabet’s disruptive effect

Figure & Charts

- Alphabet Revenues: 2Q17 – 3Q18

- YoY Growth Rate (CAPEX vs OPEX): 2Q17 – 3Q18

- Profitability Margins: 2Q17 – 3Q18

- Revenues (Annualized & Single Quarter), & YoY Growth

- FY2017 Revenue Split (MTN Consulting estimates*)

- Annualized Capex and R&D, % Revenues

- Alphabet’s annualized share of WNO network & IT capex

Coverage

Visuals