By Matt Walker

This note addresses carbon footprint trends in the telecom industry. We present data on emissions by the telecom services sector and their major suppliers in the 2020-22 period, and assess industry trends.

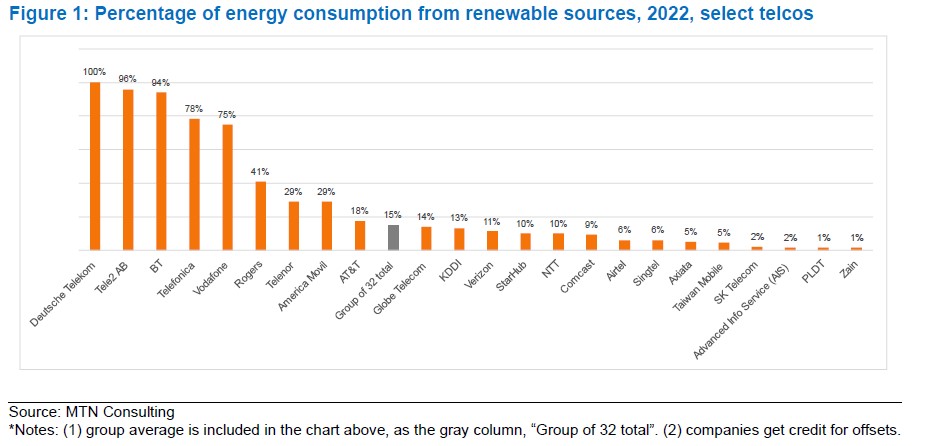

Telecom is not big enough to save the planet, but every industry sector needs to do its part (and then some) to ease global warming. Unfortunately, beyond the fluffy rhetoric, the telecom industry is underperforming. In 2022, based on a large sample of telcos, the sum of scope 1 and 2 carbon emissions was 132 million metric tons of CO2 equivalent (MT CO2e). That is flat relative to 2021. Energy consumption continues to grow by 3-4% per year in telco services, and the use of renewables is growing only modestly: from about 10% of total consumption in 2020, to 15% in 2022. A few telcos have made concerted efforts to buy credits or offsets for Scope 2 emissions, and are able to report “market-based” scope 2 emissions which are declining rapidly. But, these are exceptions and almost all in Europe; notable examples are BT, Deutsche Telekom, and Vodafone.

In addition to scope 1 and 2 emissions, telcos also generate scope 3 emissions, like all industry sectors. Scope 3 is usually 70-80% of total scope 1/2/3 emissions, and in telecom due largely to the supply chain, i.e. the vendors. Vendors are in a much better position than telcos to go green quickly, as they don’t operate vast networks with 10-20+ year depreciation cycles. Based on a review of 25 companies, which collectively capture well over 70% of telco tech spending, some vendors are doing well: improving the energy efficiency of their own operations, and progressing with investment in renewable sources through various tools (credits, offsets, PPAs, direct investment, etc.). Ciena, for instance, gets well over 50% of its energy from renewables, and emitted just 55 metric tons of CO2-equivalent (MT CO2e) per GWh of energy consumed in 2022 (estimated). Chinese vendors are laggards. Most important, Huawei and ZTE have very high carbon footprints per unit of energy consumed, as they invest little in renewables and the Chinese grid is dependent on coal. A greater reliance on Chinese supply chains will tend to make it harder for telcos to meet climate goals.

As of today, the typical big telco is targeting carbon neutrality (over scopes 1 and 2) by 2035, with 2050 the target year for net zero across all scopes. These targets are overly conservative for an industry built on technology. Telecom has the potential to lead, but it is just barely keeping up right now. More needs to be done in 2024.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary: page 1

- Measuring progress: page 1

- Telco use of renewable energy in 2022: 15% of total – page 2

- Vendors get >50% from renewables but China lags – page 5

- Now is the time to push faster – page 8

- Appendix – page 9

Figures and Tables

Table 1: Energy and emissions metrics for the global* telco industry, 2020-22

Figure 1: Percentage of energy consumption from renewable sources, 2022, select telcos

Figure 2: Scope 1 & 2 (market-based) emissions (MT CO2e) per GWh of energy, 2022, select telcos

Figure 3: Renewable energy use and emissions (MT CO2e) per GWh used, 2022, 32 telcos

Figure 4: Scope 1 and 2 (market-based) emissions in MT CO2e per $1M in revenue – vendors

Figure 5: Scope 1 and 2 (market-based) emissions in MT CO2e per GWh consumed – vendors

Figure 6: Renewable energy as a percent of total consumption, vendors

Coverage

Companies mentioned:

Accenture plc

Advanced Info Service (AIS)

Airtel

Alphabet

Amazon

Amdocs

America Movil

Arista Networks

AT&T

Axiata

BT

Charter Communications

China Comservice

China Mobile

China Telecom

China Unicom

Ciena

Cisco Systems

Comcast

CommScope

Corning

Deutsche Telekom

Entel

Ericsson

Fujitsu Limited

Globe Telecom

Huawei

IBM

Infinera

Intel

Juniper Networks

KDDI

KT

LG Uplus

Microsoft

Mobile Telesystems

MTN Group

NEC Corp

Nokia

NTT

PLDT

Ribbon

Rogers

Safaricom

Samsung Electronics

Singtel

SK Telecom

StarHub

STC (Saudi Telecom)

Taiwan Mobile

Tech Mahindra

Tele2 AB

Telefonica

Telenor

Turkcell

Verizon

VMWare

Vodafone

Zain

ZTE

Visuals