By Matt Walker and Arun Menon

MTN Consulting’s Telco Opex Analyzer analyzes the opex trends of a subset of key telcos in the telecommunications sector. The report’s dashboard allows a user to dig into overall spending levels, network’s contribution to opex, network-related capex, and profitability for a group of 21 individual operators. The report is designed to help vendors understand and plan for the needs of their customers and help network operators deploy their technology budgets wisely. The report’s format is Excel.

ABSTRACT

Telcos have faced flat revenues for many years. After adjusting for exchange rate fluctuations and COVID-19, top-line growth has been in the 1-3% per year range, for many years. That compares to double digit growth rates in the webscale sector. As a consequence, telcos have been focused on their cost base in search of profitability growth. Costs include both capital expenditures (capex) and operating expenses (opex). Many MTN Consulting reports analyze capex. That’s in line with the traditional focus of most vendors, who historically sell more into capex budgets than opex. Opex is rising in importance to vendors, though, and as a cost category it is several times the size of capex. Further, for telcos seeking success, understanding and effectively managing opex is crucial. Telco earnings reports make this obvious, as they highlight things like opex transformation programs, careful opex management, cost optimization initiatives, network efficiencies, and process automation.

Peeling the opex onion

The problem is that opex is a bit of a mystery – it’s hard to understand across companies, countries, and over time. Reporting categories, definitions, and accounting standards vary widely. This report solves the problem. We have created a taxonomy of opex categories, examined a broad cross-section of telcos, and calculated a detailed opex profile for both the individual companies and the overall telecommunications industry. Key findings include:

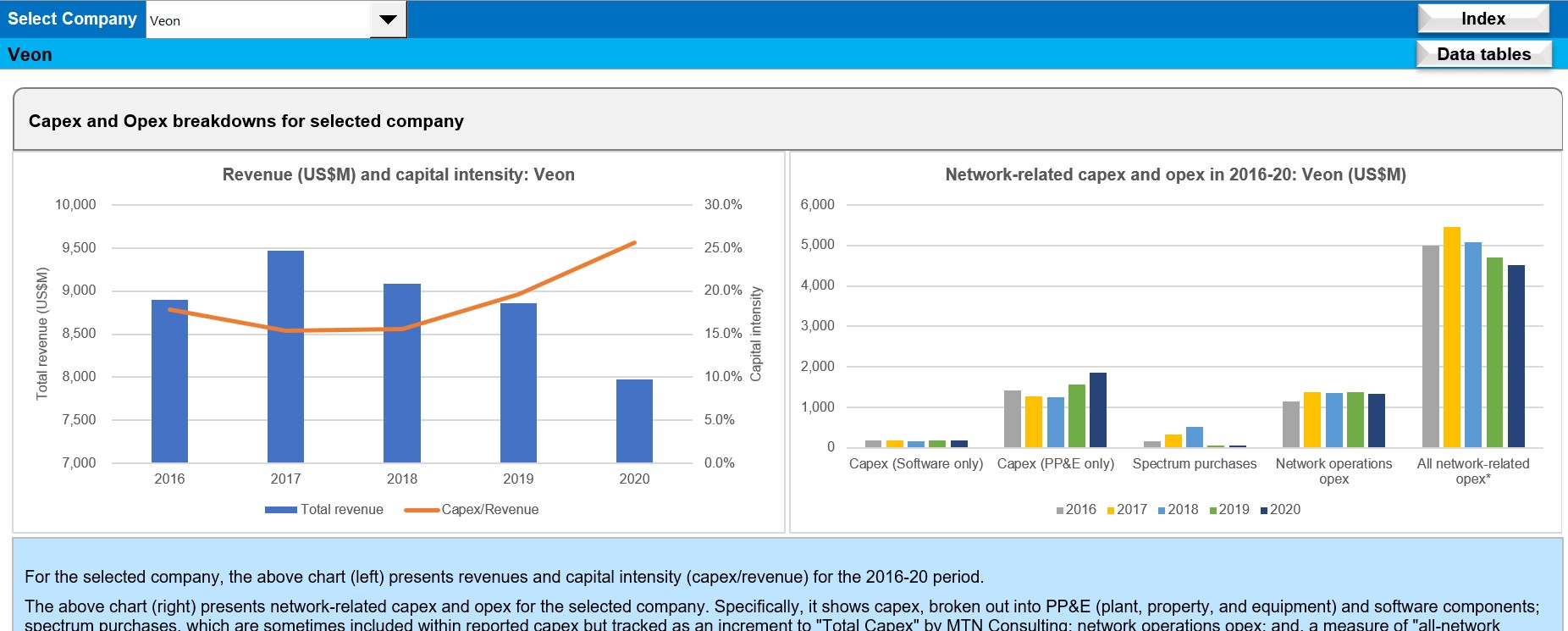

(1) The sum total of all network-related opex – including network operations, netinfra (leasing, interconnection, and spectrum fees), utilities (90%), and depreciation (85%) – amounts to a whopping 51% of total opex, on average. The network-related opex share can get as high as 70% (Veon) or 80% (Airtel) for some companies. For telcos, the network is their factory.

(2) Network operations opex alone accounted for an average 17.6% of total opex for telcos in the 2016-20 timeframe, and there is upwards pressure on this figure. Further, network operations opex can vary dramatically across companies, exceeding 20% of total opex for many companies, and over 30% for at least one telco in our study (Telkom Indonesia)

(3) Netinfra opex fell dramatically in 2019 due to implementation of a new accounting standard (IFRS 16), but increased depreciation and amortization expenses offset this decline.

(4) Utilities, content, and R&D opex average to 4%, 6%, and 1% of total opex, with lots of variation around these averages: Airtel spends about 11% of opex on utilities, content accounts for over 35% of total opex for Comcast, and BT is a big spender on innovation with R&D accounting for over 3.5% of total opex.

(5) Cost of devices, including both mobile and fixed CPE, averages to over 10% of total opex but surpasses 20% for some operators, mostly mobile-focused companies. Disentangling the revenues recorded from these devices from their costs, in order to calculate loss or gain, is nearly impossible due to telco reporting practices.

(6) Sales & Marketing (including non-network customer support) and G&A averaged to 16% and 12% of total opex, respectively, for 2016-20. The sales & marketing category, though, exceeds 20% of total opex for many companies, especially during new services rollouts. SK Telecom, for instance, spent approximately 37% of total opex on sales & marketing in 2020, as 5G was scaling. G&A has less variation, but can also exceed 20%; one factor is the degree to which companies rely on third-parties for core corporate functions, as well as the cost of insurance, HQ facilities, non-income taxes, and other factors.

(7) Depreciation and amortization (D&A), while a non-cash expense, is the single largest opex category, amounting to an average of 21.4% of total opex across 2016-20. The ratio grew from 20.6% in 2018 to 22.8% in 2020, due mainly to IFRS 16 implementation.

(8) Labor costs are a significant contributor to a telcos’ total opex (>18%), and they stretch across multiple categories of spending: network operations, sales & marketing, and G&A. Telcos are reshaping their workforces right now, cutting headcount, retraining existing employees, and hiring new ones with skills more attuned to the “software is eating the world” era. Variations in the average cost of an employee are one important factor in gauging the pace of automation within a telco.

Implications

Many of the above results will not be surprising to those who track telcos closely. However, putting a credible number on a “gut feel” is a leap forward from the status quo. Vendors need to be able to position themselves effectively to customers. Telcos and analysts tracking them need to have an apples to apples comparison of how their costs compare to peers.

As far as public reporting goes, this study alone may not impact telcos’ opacity and inconsistency around opex. These practices have historic roots, in some cases, and old habits can be hard to break. But observers should recognize that the practices are often self-serving, and just because a company says an initiative saved money, doesn’t mean it really did. Company execs in every industry tend to dress up their financial results to look as attractive as possible, and telecom is no different.

Next steps in our research

This study is based on a deep dive into the financials of 21 significant telcos*: their size, region, business model, cost structure and other factors vary, allowing us to generalize based on their results. However, we will be expanding the size of the sample in early 2022, and also updating the timeframe to include 2021 results.

___

*Companies included: Airtel, Batelco, BT, China Mobile, Chunghwa Telecom, Comcast, Du, Etisalat, Globe Telecom, KDDI, Megafon, MTN Group, Oi, Orange, Singtel, SK Telecom, StarHub, Swisscom, Telkom Indonesia, Telus, and Veon

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Results for Group of 21 Telcos

- Results by Company

- Taxonomy

- About

Figure & Charts

- Capex and Opex as % of Revenues – Group of 21

- Network-related capex and opex in 2016-20: Group of 21 (US$M)

- Opex by category, 2016-20 average

- Network-related opex categories as % of total opex, 2016-20

- All network-related opex, % total

- Profit margins for group of 21 telcos, 2016-20 average

- Labor costs as a % of total opex

- Labor costs per employee (US$K)

- Opex items by company, % total opex: 2020

- Profitability margins by company, 2020

- Company-level revenue (US$M) and capital intensity

- Company-level network-related capex and opex in 2016-20

- Company-level opex by category, 2016-20 average

- Company-level network-related opex categories, as % of total opex, 2016-20

- Company-level all network-related opex as % of total opex

- Labor costs per employee (US$K): company vs. global telco average

- Labor costs as a % of total opex: company vs. global telco average

- Average profit margins, 2016-20: company vs. global telco average

- Company-level profitability trends, 2016-20

Coverage

Operator coverage:

| Airtel |

| Batelco |

| BT |

| China Mobile |

| Chunghwa Telecom |

| Comcast |

| Du |

| Etisalat |

| Globe Telecom |

| KDDI |

| Megafon |

| MTN Group |

| Oi |

| Orange |

| Singtel |

| SK Telecom |

| StarHub |

| Swisscom |

| Veon |

Visuals