By Arun Menon

This market review provides a comprehensive assessment of the global telecommunications industry based on financial results through September 2020 (3Q20). The report tracks revenue, capex and employee for 138 individual telecommunications network operators (TNOs). For a sub-group of 50 large TNOs, the report also assesses labor cost, opex and operating profit trends. The report also covers annual data for other financial metrics such as debt, cash & short term investments, M&A spend and cash flow from operations for the TNO-50. Our coverage timeframe spans 1Q11-3Q20 (39 quarters). The report’s format is Excel.

ABSTRACT

3Q20 RESULTS SUMMARY

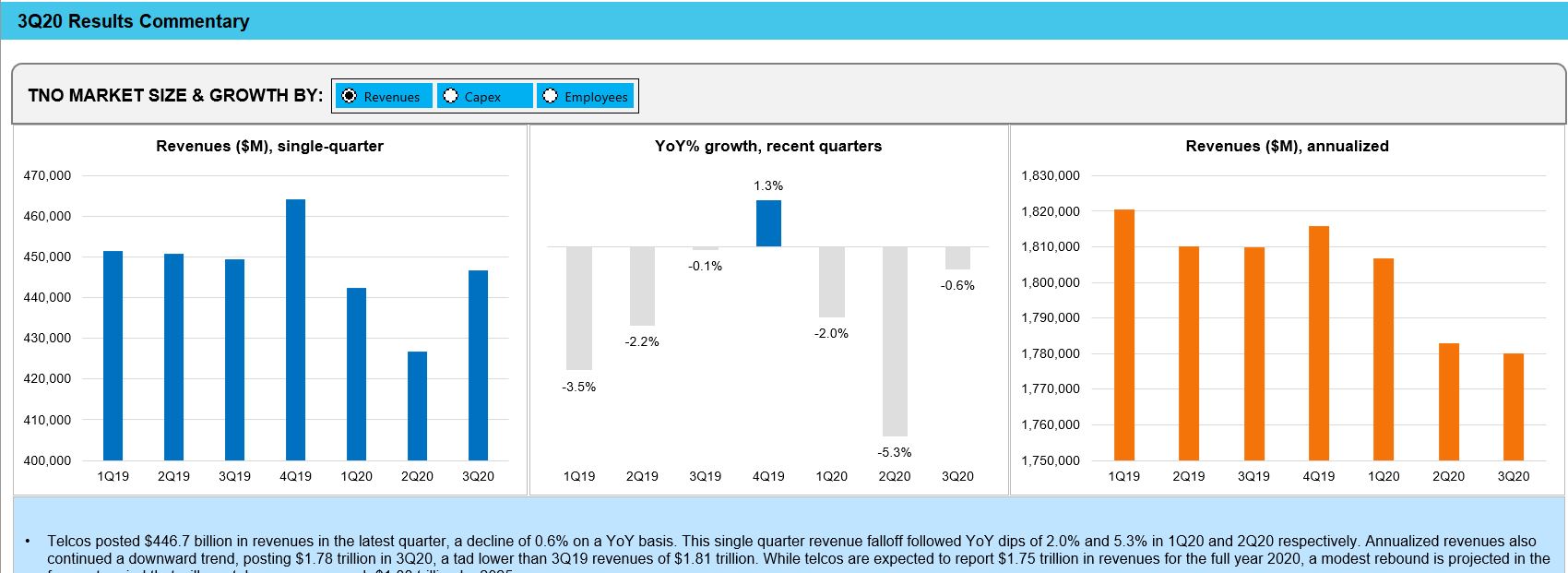

Annualized telecom network operator (telco) revenues in 3Q20 were $1.78 trillion, down slightly from the 3Q19 figure of $1.81 trillion. Single quarter revenues fell for the third consecutive quarter on a YoY basis in 3Q20. However, the decline was relatively modest: down 0.6% versus 3Q19, after drops of 2.0% and 5.3% in 1Q20 and 2Q20 respectively.

For the first nine months of 2020, the globe’s worst performing large telcos at the top line include Telefonica (revenues down 10.8% vs. first nine months of 2019), America Movil (-10.2%), AT&T (-6.2%), BT (-6.0%), KT (-5.5%), and Verizon (-3.6%). By the same criteria, the best big telco growth stories in 1Q-3Q20 were Charter Communications (+4.3% YoY), China Unicom (+1.8%), KDDI and China Telecom (both +1.4%), Orange (+0.7%), and Comcast (+0.4%).

Exchange rates always play a role in growth as measured in USD, and that includes telco market revenues. In a fixed exchange rate scenario, where all currency exchange rates are held constant to the 1Q11 value, YoY revenue growth has been much more stable in the telecom sector than when using actual rates. Over the 2011-20 period, YoY growth in global telecom revenues hovered in the 1-3% range. However, even in the fixed rate case, growth was noticeably weaker for the sector in 2020 during the COVID-19 pandemic. Revenues declined by 2.0% and 0.5% YoY in 2Q20 and 3Q20, respectively, in the fixed exchange rate scenario.

Despite top-line weakness, profitability for the telecom sector has strengthened over the last few quarters. Annualized operating margins ended 3Q20 at 14.5%, up from 13.5%. Annualized EBITDA margins improved even more, up from 32.1% in 3Q19 to 34.1% in 3Q20. Telcos have used the COVID crisis to tighten their belts considerably. On the network side, capex has been surprisingly steady, remaining in the narrow range of 16.1-16.2% range for five straight quarters. However, opex budgets have been hit hard. Industry-wide, opex (excluding D&A) as a share of revenues were 65.9% of revenues in 3Q20, on an annualized basis, versus 67.9% in 3Q19. Shutting offices, moving sales and support functions online, automating a wide range of processes, and seeking out savings in network leasing & interconnect costs have all borne fruit over the last few quarters.

Notably, telcos have NOT made significant progress in 2020 in lowering their labor cost burden. Industry headcount was 4.94 billion, down from 5.10 billion in 3Q19, but most of the drop came from BSNL and MTNL. Their combined headcount reduction of 104K accounted for 63% of the industry’s reduction in this time frame. This decline is due to long-delayed implementation of voluntary retirement programs at the bloated state telcos. Some large operators in advanced economies, including Verizon and AT&T, are also seeing headcount drops, but nothing too aggressive. Government programs aimed at maintaining employment during the crisis had some effect.

More important than headcount, though, is spending on employees. Telcos are in the midst of reshaping their workforce, hiring more costly software developers and others with IT/database and similar skillsets, which don’t come cheap. Telco labor costs as a percentage of opex (ex-D&A) has been rising gradually for several years, and that continued in 3Q20: from 23.5% in 3Q19, to 24.1% in 3Q20. On an absolute basis, labor costs represent $283 billion in annualized costs through 3Q20, just below the annualized capex figure of $289 billion.

Capex had an unusually good quarter in 3Q20, rising 3.6% from 3Q19 to $72 billion. That follows several consecutive YoY drops, including a 6.1% decline in 2Q20. However, peel the onion a bit and you realize it’s all China. Telco capex excluding China declined in 3Q20 by 1% on a YoY basis, after declines of 4% and 10% in 1Q20 and 2Q20 respectively. The Chinese government’s decision to pump the accelerator on 5G base station upgrades and new construction is all that lifted telecom spending in 3Q20, and it also saved the global market from a worse fate in 1H20. Capex growth rates for some of the major telcos in 3Q20 include: China Mobile (+57% vs. 3Q19), Charter Communications (+22%), Vodafone (+18%), Orange (+5%), Verizon (-0.8%), Telefonica (-24%), AT&T (-26%), and America Movil (-29%). Telcos have avoided unnecessary spending during the crisis, postponed upgrades, faced delays in 5G auctions, leaned more on the webscale sector and carrier-neutral providers, and pushed suppliers hard. While in theory Huawei’s forced pullback from the global market gives the remaining vendors more bargaining power, the effect has been modest in the midst of global economic collapse.

In 3Q20, the top telcos accounted for 70.1% of total industry revenues, and 68.8% of capex. The largest single operator in 3Q20 based on capex was China Mobile, whose $9.0 billion far exceeds 2nd ranked Deutsche Telekom with $5.2 billion. The next 18 biggest capex spenders for the quarter were Verizon, AT&T, NTT, China Telecom, SoftBank, Charter Communications, Orange, Comcast, Vodafone, China Unicom, Telefonica, KDDI, BT, America Movil, Altice Europe, Airtel, Telecom Italia, and Rakuten. On a capital intensity basis, Rakuten beats all other telcos handily with a roughly 200% capex/revenue ratio for the quarter; its greenfield network rollout is reaching its peak. Most of the other capital intensity standouts are engaged in some level of 5G buildout, or related prep work: Oi (43%), True Corp (42%), Zain KSA (39%), Turkcell (38%), Jio (36%), China Mobile (34%), TDC (32%), Globe Telecom (31%), and Digi Communications (30%).

FORECAST OUTLOOK

MTN Consulting published its annual network operator forecast in late December, 2020, and that reflected a detailed preliminary view of 3Q20 results. Our outlook remains unchanged, and is summarized below.

Telco revenues fall to $1.75 trillion in 2020 but will rebound modestly and reach $1.88T in 2025

Telecom revenues have been flat for most of the last decade despite a rapid adoption of higher-speed, higher value services such as 4G broadband. In 2011-19, average annual growth was -0.4%. Revenues will dip approximately 3.7% in 2020, due largely to economic dislocations from the COVID-19 pandemic. This will be followed by two positive years, however. We expect revenues to grow 2.3% in 2021 as economies open up again, and another 2.0% due to a blend of 5G-based services beginning to scale and continued opening of economies post-COVID-19.

Capex will climb slightly in 2021 but steadily fall after 2022 to $277B in 2025

During the 2011-15 period, LTE buildouts supported capex of over $300B per year. Spending moderated in 2016-17 as telcos absorbed capacity, and surged slightly to exceed $300B again in 2018. The 2018 growth was due to a mix of Jio’s huge buildout in India, fixed broadband upgrades in developed markets, and 4G expansions in emerging markets. Capex fell again slightly in 2019, and then COVID-19 hit earlier this year.

We don’t expect telco capex to again see $300B during our forecast period. Total capex for 2020, even with China’s 5G push, should amount to roughly $280B (from $290B in 2019). Economic recovery from the worst of COVID-19 and 5G buildouts on newly issued spectrum will power modest capex growth in 2021 and 2022. After that, we expect capex to gradually decline to roughly $277B by 2025.

Opex to grow modestly to 70% of revenues by 2025 as cloud services spend rises

Telecom will continue to be a capital intensive industry for many years. However, the long-term trend of shifting capex to opex will bear some fruit during the forecast period. While capex will fall from 16.0% of revenues in 2019 to 15.0% by 2025, opex will rise. Over the last four years (2016-19), opex ex-D&A averaged roughly 69% of telco revenues; 2019 alone was relatively low, at 67%. We expect the ratio to rise to 70% by 2025. Increased spend on cloud services which can be booked as opex is a factor. Another factor is an increase in the prevalence of leasing towers and data center space, leveraging carrier-neutral facilities. Telcos’ need to do more of their R&D and systems integration to cope with a changing, less full-service vendor landscape as well as the rise of open networking (including open RAN) is another important factor.

Headcount will drop to 4.5 million by 2025, but average employee will get much more expensive

Since 2011 the level of employment in the telecom industry has been surprisingly stable: from 5.20 million in 2011, telco employees totaled 5.13 million at the end of 2019. There has been significant churn in the employee base, however. Telcos are shedding older employees whose skillsets are more in line with legacy network operations and sales methods, and focus new hiring on those with software and online skills.

MTN Consulting expects headcount to drop significantly by 2025. Telcos have been deploying various types of automation for years, and pushing both sales and customer service towards online channels. The COVID-19 crisis of 2020, though, accelerated these trends. By 2025, we expect telco industry employment to drop to 4.5 million, down 12% from the 2019 headcount level. One factor is that India’s two state-run operators, BSNL and MTNL, and finally whittling down their bloated workforces. The bigger factor is that all telcos are looking for ways to automate networks and move customer interactions online. Voluntary separation programs, early retirement buyouts and a range of other options will be pursued to push down headcount. There will also be retraining of existing employees, but large multi-country telcos don’t always do this effectively. There will be lots of new hiring, though, aimed at new, younger staff, some of whom will have experience working for software companies and/or cloud providers.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Market snapshot

- Analysis

- Key stats through 3Q20

- Operator rankings

- Company Deepdive & Benchmarking

- Country breakouts

- Regional breakouts

- Raw Data

- Subs & traffic

- Exchange rates

- Methodology & Scope

- About

Figure & Charts

- TNO market size & growth by: Revenues, Capex, Employees – 1Q19-3Q20

- Regional trends by: Revenues, Capex – 3Q16-3Q20

- Opex & Cost trends

- Labor cost trends: 1Q19-3Q20

- Profitability margin trends: 1Q19-3Q20

- Spending (opex, labor costs, capex): annual and quarterly trend

- Key ratios: annual and quarterly trend

- Workforce & productivity trends: 1Q14-3Q20

- Operator rankings by revenue and capex: latest single-quarter and annualized periods

- Top 20 TNOs by capital intensity: latest single-quarter and annualized periods

- Top 20 TNOs by employee base: latest single-quarter

- TNOs: YoY growth in single quarter revenues

- TNOs: Annualized capital intensity, 2Q15-3Q20

- TNOs: Revenue and RPE, annualized 2Q15-3Q20

- TNOs: Capex and capital intensity (annualized), 2Q15-3Q20

- TNOs: Total headcount trends, 2Q15-3Q20

- TNOs: Revenue and RPE trends, 2011-19

- TNOs: Capex and capital intensity, 2011-19 ($ Mn)

- TNOs: Capex and capital intensity, 2Q15-3Q20 ($ Mn)

- TNOs: Revenue and RPE trends, 2Q15-3Q20

- Top 50 TNOs by total opex, 3Q20

- Top 50 TNOs by labor costs, 3Q20

- TNOs: Software as % of total capex

- TNOs: Software & spectrum spend

- TNOs: Total M&A, spectrum and capex (excl. spectrum)

- Top 50 TNOs by total debt: 2011-19

- Top 50 TNOs by total net debt: 2011-19

- Top 50 TNOs by long term debt: 2011-19

- Top 50 TNOs by short term debt: 2011-19

- Top 50 TNOs by total cash and short term investments ($M): 2011-19

Coverage

Operator coverage:

| A1 Telekom Austria | Advanced Info Service (AIS) | Airtel | Altice Europe | Altice USA | America Movil | AT&T | Axiata | Axtel | Batelco |

| BCE | Bezeq Israel | Bouygues Telecom | BSNL | BT | Cable ONE, Inc. | Cablevision | Cell C | Cellcom Israel | CenturyLink |

| Cequel Communications | Charter Communications | China Broadcasting Network | China Mobile | China Telecom | China Unicom | Chunghwa Telecom | Cincinatti Bell | CK Hutchison | Clearwire |

| Cogeco | Com Hem Holding AB | Comcast | Consolidated Communications | Cyfrowy Polsat | DEN Networks Limited | Deutsche Telekom | Digi Communications | DirecTV | Dish Network |

| Dish TV India Limited | DNA Ltd. | Du | EE | Elisa | Entel | Etisalat | Fairpoint Communications | Far EasTone Telecommunications Co., Ltd. | Frontier Communications |

| Globe Telecom | Grupo Clarin | Grupo Televisa | Hathway Cable & Datacom Limited | Idea Cellular Limited | Iliad SA | KDDI | KPN | KT | Leap Wireless |

| LG Uplus | Liberty Global | M1 | Manitoba Telecom Services | Maroc Telecom | Maxis Berhad | Megafon | MetroPCS Communications | Millicom | Mobile Telesystems |

| MTN Group | MTNL | NTT | Oi | Omantel | Ono | Ooredoo | Orange | PCCW | PLDT |

| Proximus | Quebecor Telecommunications | Rakuten | Reliance Communications Limited | Reliance Jio | Rogers | Rostelecom | Safaricom Limited | Sasktel | Shaw |

| Singtel | SITI Networks Limited | SK Telecom | Sky plc | SmarTone | SoftBank | Spark New Zealand Limited | Sprint | StarHub | STC (Saudi Telecom) |

| SureWest Communications | Swisscom | Taiwan Mobile | Tata Communications | Tata Teleservices | TDC | TDS | Tele2 AB | Telecom Argentina | Telecom Egypt |

| Telecom Italia | Telefonica | Telekom Malaysia Berhad | Telenor | Telia | Telkom Indonesia | Telkom SA | Telstra | Telus | Thaicom |

| Time Warner | Time Warner Cable | TPG Telecom Limited | True Corp | Turk Telekom | Turkcell | Veon | Verizon | Virgin Media | Vivendi |

| Vodafone | Vodafone Idea Limited | VodafoneZiggo | Wind Tre | Windstream | Zain | Zain KSA | Ziggo |

Regional coverage:

| Asia | Americas | Europe | MEA |

Visuals