By Matt Walker

Software is central to telco efforts to compete

Over the last two decades, software has become the key ingredient to delivering value in networks. That has accelerated in the last five years with the rise of webscale networks, and the ongoing profitability challenge facing telecommunications network operators (telcos). Sources of telco software spending include:

Vendors, who have invested heavily in software-defined networking and network functions virtualization. A broad range of hardware products are now engineered to provide functions, features and capacity through software. That change has many benefits: it allows a pay as you grow approach to investment, lowers maintenance and installation costs, simplifies customer management, and enables new service offerings.

Telco employees, through internal software development. Building your own software is a challenge for all but the largest few companies with access to the right talent pools, however. Most smaller telcos would prefer to rely on vendors when possible, benefiting from their scale.

Webscale operators, as telcos are spending more on cloud-based software solutions, including software-as-a-service (SaaS) and similar offerings from the webscale sector. These transactions are evolving into large multi-year arrangements where a telco effectively outsources key network functions to cloud providers. Telcos’ growing interest in mobile edge computing (MEC) to complement 5G is driving some of this partnership activity.

In 2019, software investments represented 16.8% of telco capital expenditures (capex), from 11.7% in 2015. This upwards trend coincides with telcos’ increased adoption of SDN/NFV, and preparatory work for 5G deployment. SDN/NFV and 5G will continue to drive up telco software spending over time.

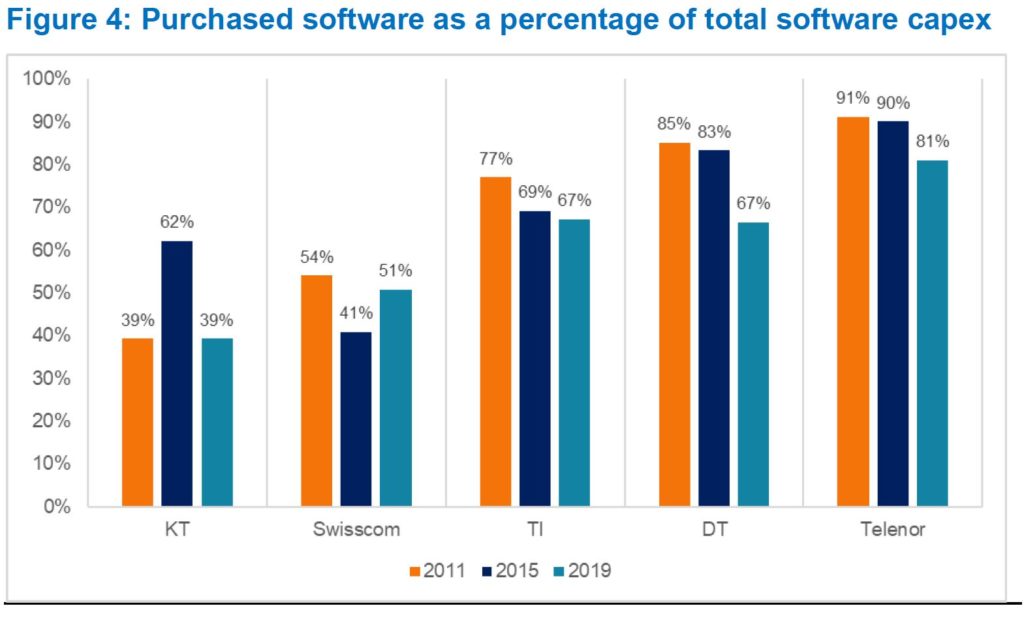

Some large telcos, such as DT, are ramping up their internal software spend relative to software purchased from third parties. While in theory that may enable differentiation and faster time to market, it will be difficult to sustain in the current economic climate. As telco layoffs begin to ramp in the face of the COVID-19 crisis, telcos will turn to vendors and webscale operators to fill the gaps. Potential beneficiaries of this change include webscale operators like Microsoft and a long list of vendors, including Accenture, Amdocs, Infosys, Oracle, TCS, Tech Mahindra, and Wipro.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Summary – page 3

- Software is central to telco efforts to compete

- About this report

- What’s the current situation? – page 4

- Software, already a major part of telco capex, is rising in importance

- Key findings

- How did we get here? – page 7

- The rise of software in telco networks

- Accounting for software

- What happens next? – page 10

- Layoffs will create opportunities for vendors

- Appendix – page 11

- About MTN Consulting

- Terms of Use

Figure & Charts

Figures & Charts

Figure 1: Telco Network Infrastructure vendor revenues by company type, 2013-19 (billion, USD)

Figure 2: Total telco capex (billion, USD) and software as a percentage of total, 2011-19

Figure 3: Ratio of software capex to software opex, select years

Figure 4: Purchased software as a percentage of total software capex

Figure 5: Labor costs as a percentage of telco opex (excluding depreciation & amortization)

Coverage

Organizations mentioned in this report include:

Accenture

Amdocs

Anritsu

AT&T

CenturyLink

Comcast

Corning

Dell Technologies

DT

Ericsson

Ernst & Young

Financial Accounting Standards Board

HPE

Huawei

IBM

IFRS Foundation

Infosys

KPMG

KPN

KT

NEC

Netcracker

Nokia

Oracle

Red Hat

SK Telecom

Spirent

Swisscom

TCS

Tech Mahindra

TeleManagement Forum

Telenor

TI

T-Mobile USA

VMWare

Vodafone

Wipro

Visuals

Source: MTN Consulting