By Matt Walker

Success of 5G relies heavily on affordable spectrum

Telecom operators are in the midst of an expensive network upgrade to support 5G mobile communications. Buying the spectrum — the radio frequencies reserved for use by the telecommunications industry — to support mobile service has proven costly over the last decade. With 5G’s arrival, spectrum costs threaten to overwhelm telcos already struggling with high core capital expenditures (capex) and a flat revenue outlook. Many spectrum auctions over the last year have delivered surprisingly high prices to telco buyers.

If telcos aspire to make money off 5G, now is the time to push for cheaper spectrum. Telcos need to lobby government bodies on auction terms; refarm, or repurpose older frequency bands so that they can be used for 5G; scour for available spectrum on the private market; and consider company acquisitions if the holdings are a match. The ongoing COVID-19 crisis will delay 5G deployments by at least three to six months, which creates some breathing room in which to address these issues.

Telcos also need to carefully study the technical means of delivering increased spectrum efficiency in the network. That includes, for instance, dynamic spectrum sharing, which Ericsson points to as a “key part of mobile service providers’ 5G strategy.” Relatedly, as MTN Consulting has argued elsewhere, telcos should consider ramping up their R&D budgets in order to independently assess the adoption of open radio access network/open networking solutions in the 5G network.

There are a number of common spectrum-related challenges facing operators across markets. That is verified by short case studies of 5G rollouts in the United Arab Emirates, Saudi Arabia, South Africa, Thailand, and Indonesia. For countries to see successful, affordable 5G deployments from multiple operators, policymakers need to do the following: shut down 2G and 3G networks to improve spectral efficiency; develop national spectrum roadmaps; facilitate low-cost device options; encourage development of new vertical markets in the Internet of Things; ensure operators can refarm unused spectrum; and address interference.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Summary – page 3

- Success of 5G relies heavily on affordable spectrum

- About this report

- What’s the current situation? – page 4

- Telcos need to build 5G on the cheap given macro and industry realities

- Key findings

- How did we get here? – page 9

- The role of spectrum in wireless networks

- The role of spectrum in 5G deployments

- What happens next? – page 17

- Predictions

- Appendix – page 18

- About MTN Consulting

- Terms of Use

Figure & Charts

Figures & Charts

Figure 1: Telco Capex plus Spectrum (U.S.$B)

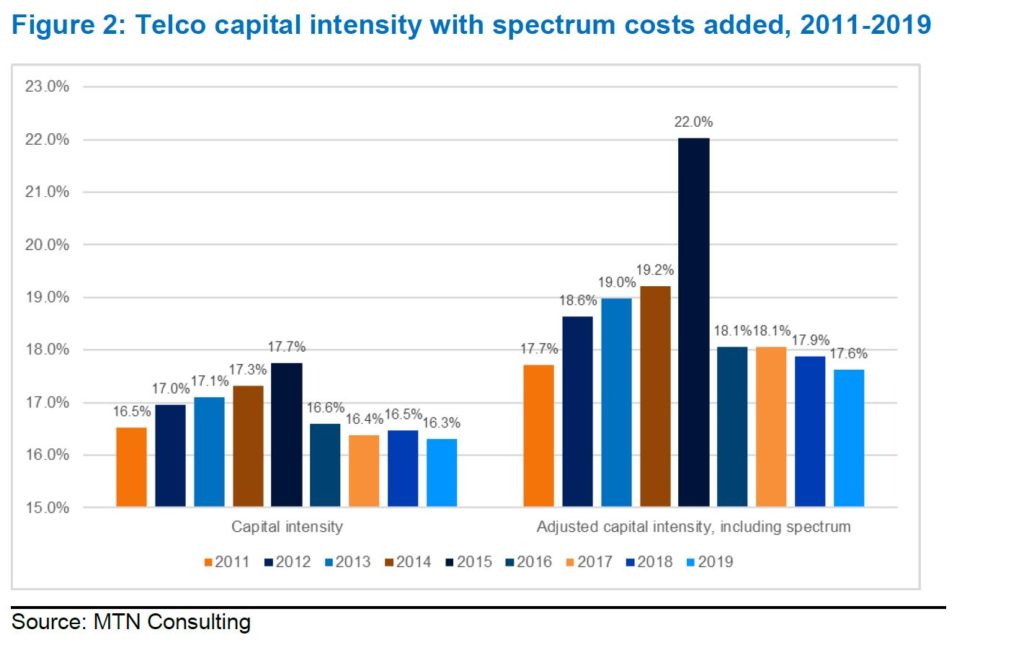

Figure 2: Telco capital intensity with spectrum costs added, 2011-2019

Figure 3: Spectrum cost added to core capex by company, 2011-2019 average

Figure 4: AT&T vs. Microsoft capital intensity

Figure 5: Select results of C-band auctions held in 2019-2020 (U.S.$M per MHz per person)

Figure 6: Supporting an end-to-end 5G experience

Figure 7: Range of frequencies in wireless communications

Figure 8: Use of radio waves in cellular networks

Figure 9: Telecom stats for case study examples

Coverage

Organizations mentioned in this report include:

AIS

Amazon Web Services

America Movil

AT&T

Axiata

BCE

Bharti Airtel

CAT

Cell C

China Mobile

China Telecom

China Unicom

Chunghwa Telecom

Cisco

CK Hutch

Dish Network Corporation

DT

DTAC

du

Ericsson

Etisalat

Frontier Communications

Huawei

Hutchison 3 Indonesia

IBM

Indosat Ooredoo

International Monetary Fund

International Telecommunication Union

Lebara

LG

Ligado Networks/Lightsquared

Megafon

Microsoft Azure

Mobily

MTN Group

Nokia

Ofcom

OneWeb

Orange SA

QCT

Rain

SAP

Singtel

SK Telecom

Smartfren

Softbank

STC

Telecom Italia

Telefonica

Telenor

Telkom Indonesia/Telkomsel

Telkom South Africa

Telus

TOT

TRAI

TrueMove H

TSMC

US Federal Communications Commission

Veon

Verizon

Virgin Mobile

VMWare

Vodacom

Vodafone

Wiwynn

XL Axiata

Zain Saudi Arabia

ZTE

Visuals