By Matt Walker

This brief examines the near-term outlook for telecom capital expenditures (capex) in India, based on the 1Q25 earnings of key operators: Airtel, BSNL, Jio Platforms, and Vodafone Idea (Vi). It analyzes how current spending patterns compare with previous forecasts, highlights the main forces shaping investment decisions, explores implications for vendors, and discusses trends in emerging areas such as AI, large language models (LLMs), and data centers.

India closed 2024 with $14.0 billion in telco capex and $41.0 billion in revenues, representing 4.7% and 2.3% of global industry totals, respectively. India’s capex to revenue ratio, or capital intensity, has remained above 30% for three straight years. Yet despite the sector’s scale and strategic importance, most Indian telcos are now guiding capex downward over the next few years. That trend is aligned with our forecasts, but at odds with the Indian government’s policy ambitions.

New policy initiatives aim to foster a vibrant domestic telecom tech ecosystem, better funded and more forward-looking than past efforts. But local startups developing next-gen telecom gear need real-world opportunities to test and refine their solutions. Those opportunities are set to shrink as telcos tighten their budgets to restore profitability.

Absent a shift in trajectory, India risks undercutting its own innovation goals. The most practical near-term solution? A government-led push for BSNL to deploy true 5G networks at scale, favorable treatment for Vi as it attempts to build out nationwide 5G, plus subsidies and other enticements aimed to make local Indian gear attractive to overseas buyers. That would help such Indian startups making waves like Astrome Tech, Coral Telecom, Frog Cellsat, Galore Networks, Niral Networks, Qbit Labs, Qnu Labs, Prenishq, Resonous Tech, Saankhya Labs, Scytale Alpha, Signaltron, Sooktha, VVDN, and WiSig.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 1

- Market background – India – page 1

- 1Q25 results – page 2

- BSNL – page 3

- Bharti Airtel – page 4

- Jio Platforms – page 5

- Vodafone Idea (Vi) – page 7

- Appendix – page 9

Figures and Tables

Figure 1: Capex forecast for India telco market and recent changes

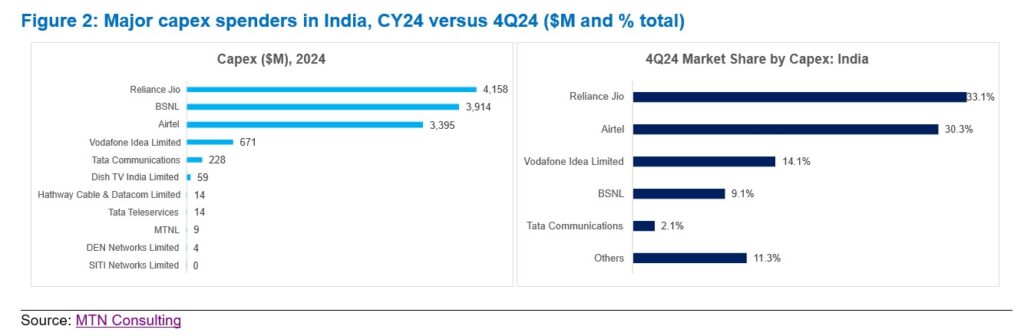

Figure 2: Major capex spenders in India, CY24 versus 4Q24 ($M and % total)

Figure 3: BSNL capex, capital intensity, and share of global capex

Figure 4: Airtel capex, capital intensity, and share of global capex

Figure 5: Jio Platforms capex, capital intensity, and share of global capex

Figure 6: Vodafone Idea (Vi) capex, capital intensity, and share of global capex

Coverage

Organizations mentioned:

AMD

Astrome Tech

Bharti Airtel

BSNL

Cisco

Coral Telecom

Ericsson

Frog Cellsat

Galore Networks

Jio Platforms

Niral Networks

Nokia

Prenishq

Qbit Labs

Qnu Labs

Reliance Industries

Resonous Tech

Saankhya Labs

Scytale Alpha

Signaltron

Sooktha

Vodafone Idea (Vi)

VVDN

WiSig

Visuals