By Matt Walker

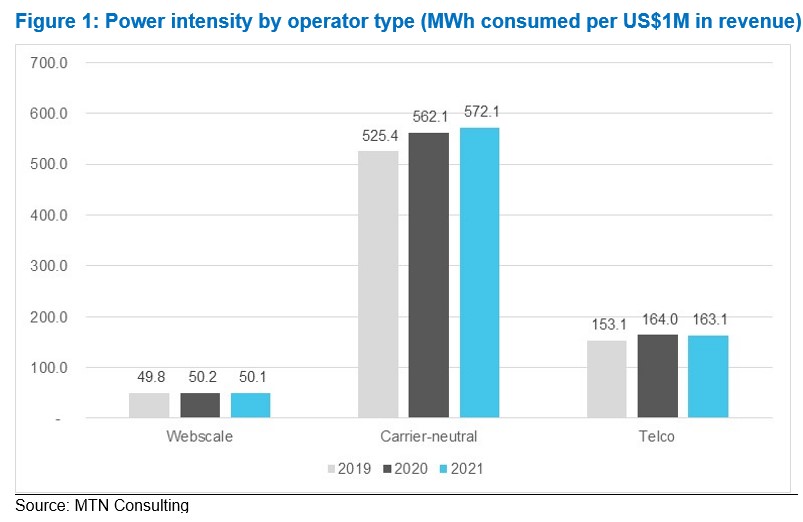

This brief presents data on energy spending by operators of cell towers, data centers, and fiber networks, and discusses the implications of the data and likely future directions. Utilities represent a large portion of operating expenses for these infrastructure-focused companies, which we track as “carrier-neutral network operators” (CNNOs). CNNOs also spend more than other types of operators. Webscale spending on power is miniscule relative to their size, less than 1% of opex (ex-D&A). Telcos spend a few % of opex (ex-D&A) on utilities. But CNNOs can spend more than 30% and up to 80% of opex (ex-D&A) on utilities.

- Table Of Contents

- Figures and Tables

- Coverage

- Visuals

Table Of Contents

- Summary – page 2

- CNNOs are more energy-intensive than other operator types – page 2

- Sustainability in networks needs to start with CNNOs – page 4

- Implications – page 5

- Appendix – page 6

Figures and Tables

Figure 1: Power intensity by operator type (MWh consumed per US$1M in revenue)

Figure 2: Utilities spend as a % of opex (excluding depreciation & amortization), 2020-22

Figure 3: Utilities vs. D&A costs as a percentage of total opex, 2022

Coverage

Companies mentioned:

America Movil

AT&T

Bharti Infratel (Indus)

Cellnex

China Tower

ChinData

Chorus Limited

Ciena

Crown Castle

CyrusOne

Digital Realty

GDS Data Centers

Helios Towers

IHS Towers

QTS Realty

Sarana Menara Nusantara

Switch

TDF Infrastructure/Arcus

Telefonica

Teraco

Verizon

Visuals