By Matt Walker

Summary

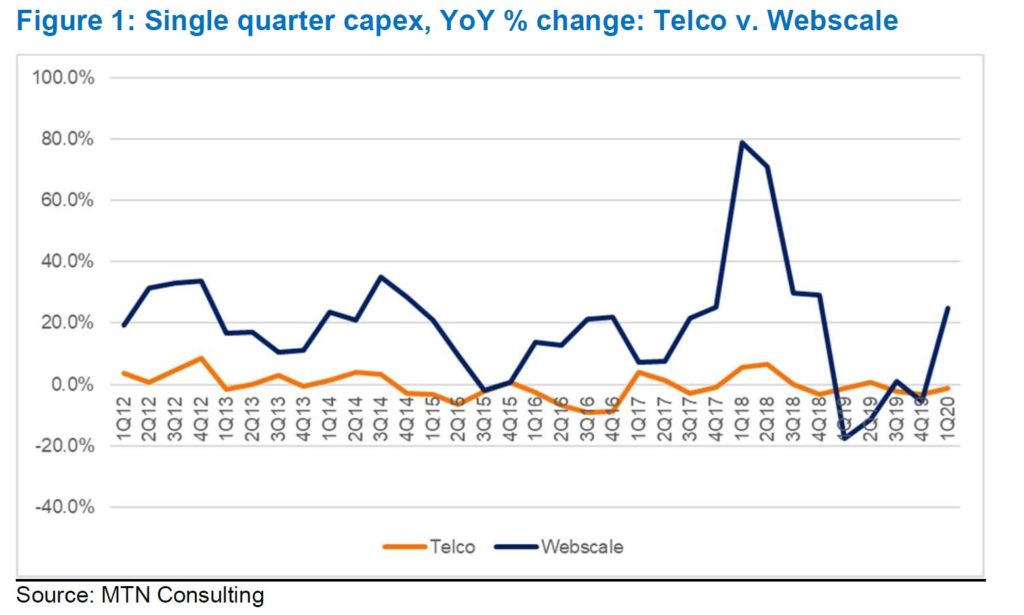

Telecom network operator (telco) capital expenditures (capex) declined by approximately 1.3% year-over-year (YoY) to $70.2 billion in the first quarter of 2020 (1Q20), not nearly as bad as many expected. Telco revenues in 1Q20 were $446.3 billion, dropping a bit faster than capex, down 2.2% from 1Q19. That disparity pushed the average 12-month capital intensity for the telco sector up slightly, to 16.35% from 16.31% in 4Q19. Amid the attempt to slow the spread of COVID-19, many telcos saw opportunities in the widespread lockdowns and rapid shift to working (and studying) from home, and embracing these opportunities required new network investment. Government classification of telecom construction as an “essential service” in many countries, plus the industry’s ongoing shift towards self-installation and automated customer care, helped to moderate some of the worst effects of the lockdowns. Supply chain constraints related to COVID-19’s spread appeared to be far more of a factor for vendors trying to assemble and ship gear than for telcos trying to install it; in the short run, a slowdown in government action on permitting and auctions has been a bigger concern. For network spending, the second quarter is likely to be significantly worse in a number of country markets, including the United States, and the overall network investment outlook for 2H20 is muddled. In earnings calls, many large telcos predicted that the worst of the crisis would be over with the closing of 2Q, but that they are retaining flexibility in their 2020 capex plans in order to deal with the uncertainty.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Summary (page 2)

- Supply side data suggests COVID-19 had minimal net effect on network investment in 1Q (page 2)

- Progression from 4G to 5G slowed by uncertainty around Huawei and business models (page 3)

- The economic effect of the “great lockdown” (page 3)

- Telcos are trying to be optimistic but 2H outlook is weak (page 4)

- What to expect (page 4)

- Appendix (page 5)

Figure & Charts

Figures

Figure 1: Single quarter capex, YoY % change: Telco v. Webscale

Coverage

Organizations mentioned in this report include:

| AT&T | BT | Charter Communications | Deutsche Telekom |

| Ericsson | Huawei | IMF | |

| KDDI | Netflix | Nokia | NTT |

| OECD | SMIC | TSMC | Verizon |

Visuals