This report is the first in MTN Consulting’s “Telecommunications Labor Market Review” series. This series provides country-level analysis of labor markets in the telecommunications network operator (TNO) sector. Labor costs account for over 18-19% of TNO revenues, so this is a significant topic as telcos search for a sustainable growth model.

Each report in this series addresses the following topics: local economy; local telecom labor markets; telecom sector revenue & capex; telco labor costs, opex and profitability; macro trends; and, when relevant, implications of the growth of SDN/NFV and 5G mobile networks.

Canada

Operators in Canada are pursuing a wide range of business strategies as they look to reduce one of their largest overhead costs, i.e. the workforce. Apart from using automation and digitalisation to cut costs, telcos are also relying on voluntary separation programs (VSPs) to reduce these costs. A case in point is Shaw, which offered a VSP in early 2018, as part of its broader initiative to cut staff costs amid technological changes.

TNOs are also reshaping their workforces to prepare for new technologies like 5G. While 5G is at an early stage in Canada, lots of new 5G-related jobs are expected to appear, from deployment to testing and applications. However, total headcount for the telecom sector fell YoY by 1.3% to reach 163K in 3Q18. Canada’s telcos are slowly scaling down their network departments and pushing hard on unions for concessions. That is likely to lead to additional M&A.

Below are a few highlights from the report:

- Telco revenue was up by a 6.6% annualized rate in 3Q18, while capex grew 9%. Early 5G buildouts were a major reason for growth

- Labor costs for telcos in Canada are in the 23%-24% range of total opex, or around 30% of opex (excluding D&A).

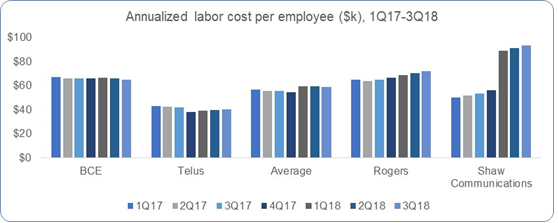

- The average labor cost per employees in Canada was $54.7K in 2017, marginally higher than the global average of $54.3K.

Report format: PDF (PPT available upon request).

- Table Of Contents

- Figure & Charts

- Visuals

Table Of Contents

- Key economic indicators – Canada

- Canada’s labor market – Communications industry

- Telecom revenue & capex analysis – Canada

- Telecom labor cost analysis – Canada

- Telecom opex and profitability analysis – Canada

- Recent labor trends in Canada

- 5G to spur employment across sectors in Canada

- APPENDIX 1

- APPENDIX 2

Figure & Charts

- Total # of employees and YoY growth rate (%), 1Q16-3Q18

- TNOs: Annualized revenue and YoY growth rate, 1Q17-3Q18

- Annualized capital intensity (%), 1Q17-3Q18

- Annualized labor costs and labor costs as % opex, 1Q17-3Q18

- Annualized labor costs per employee ($K), 1Q17-3Q18

- Annualized opex ($M) and YoY growth (%), 1Q17-3Q18

- Annualized operating margins, 1Q17-3Q18

Visuals