By Matt Walker

Telco earnings reports from 2Q22 make clear that the spending climate remains strong. Capex climbed 3% YoY, pushing annualized capital intensity (capex/revenues) up further to 17.8% – the highest in at least a decade. The year-end 2022 capex figure may slightly exceed our latest forecast of $326B. This is benefiting lots of suppliers, but the benefits clearly are not distributed equally. With Europe’s big optical event coming next week (ECOC), now is a good time to check in on the top-line figures among the world’s optics-focused suppliers (fiber, access and transport). This is limited to a sample of vendors in this space, focusing on those which sell into telco markets, don’t rely primarily on one geographic market for sales, and report public financials with segment breakouts relevant to optical fiber, or access/transport systems.

- Table Of Contents

- Figures

- Coverage

- Visuals

Table Of Contents

Cover: page 1

Revenue trends for select vendors in optics space: pages 2-3

About: page 4

Figures

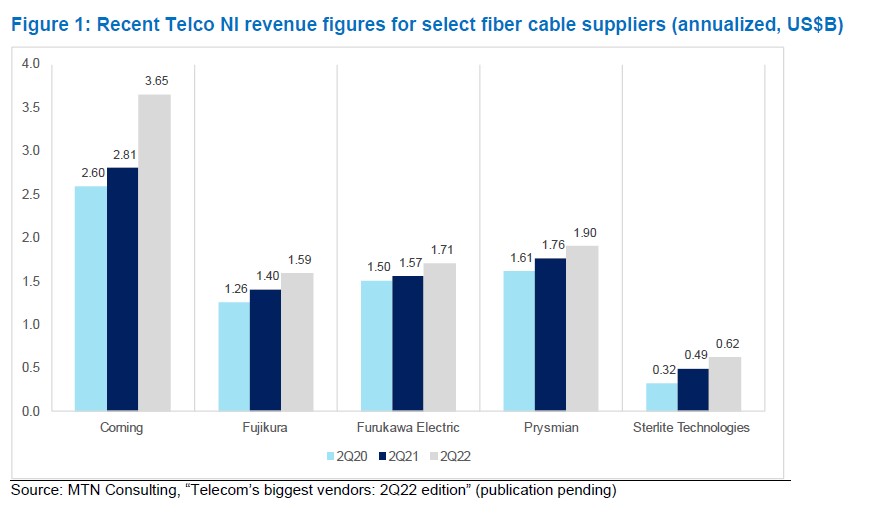

Figure 1: Recent Telco NI revenue figures for select fiber cable suppliers (annualized, US$B)

Figure 2: Recent Telco NI revenues for select optical access/transport vendors (2Q only, US$B)

Coverage

Companies and organizations mentioned in this report include:

Adtran

ADVA

Calix

Ciena

Corning

Fiberhome

Fujikura

Furukawa

Huawei

Infinera

Nokia

Prysmian

Sterlite Technologies

ZTE

Visuals