By Arun Menon

This market review provides a comprehensive assessment of the global telecommunications industry based on financial results through March 2021 (1Q21). The report tracks revenue, capex and employee for 138 individual telecommunications network operators (TNOs). For a sub-group of 50 large TNOs, the report also assesses labor cost, opex and operating profit trends. The report also covers annual data for other financial metrics such as debt, cash & short term investments, M&A spend and cash flow from operations for the TNO-50. Our coverage timeframe spans 1Q11-1Q21 (41 quarters). The report’s format is Excel.

ABSTRACT

1Q21 RESULTS SUMMARY

Telco revenues grow at fastest rate in at least a decade

After staging a rebound in the final quarter of 2020, single quarter revenues for telecom network operators (telcos) continued an upward march in 1Q21 by growing at a solid rate of 7.3% YoY to post $473.2 billion. The robust YoY topline growth in the latest quarter also happens to be the highest in at least a decade. While a weak revenue base in 1Q20 coupled with a one-time growth in device/equipment sales due to 5G were key drivers, currency appreciation against the US dollar in several major markets also contributed. Annualized revenues also grew for the first time since 4Q18, posting $1.83 trillion with a YoY growth rate of 1.2% in 1Q21.

Exchange rates always play a role in growth as measured in USD, and that includes telco market revenues. In a fixed exchange rate scenario, where all currency exchange rates are held constant to the 1Q11 value, YoY revenue growth has been much more stable in the telecom sector than when using actual rates. Using this methodology, telco revenue growth would still have been an impressive 4.3% YoY in 1Q21, but significantly down by 3 percentage points when compared to actual exchange rate methodology.

On an annualized basis, only three out of the top 20 best performing telcos by topline in 1Q21 posted double-digit growth. These include Deutsche Telekom (39.3% YoY vs. annualized 1Q20), China Telecom (11.5%), and China Unicom (10.4%). China Mobile posted 8.7% revenue growth in 1Q21 on annualized basis. By the same criteria, the worst telco growth came from Softbank (-43.1%), America Movil (-10.9%), Telefonica (-7.9%), and Telecom Italia (-6.3%) during the same period. The big swings at Deutsche Telekom and Softbank are due to DT closing its acquisition of Sprint in April 2020.

Spending on capex was a mixed bag

In terms of capex spend, telcos spent more in 1Q21 with a YoY rise of 4.7% on a single quarter basis. This was the first instance of positive capex growth after steady falloffs throughout 2020. However, annualized capital intensity remained on a downhill slide for the seventh straight quarter, ending 1Q21 at 16.3% – an indication that telcos have not gone on a spending binge despite a revenue recovery. Telcos have avoided unnecessary spending during the crisis, postponed upgrades, faced delays in 5G auctions, leaned more on the webscale sector and carrier-neutral providers, and pushed suppliers hard. Annualized capex also declined by 1.5% YoY in the latest quarter.

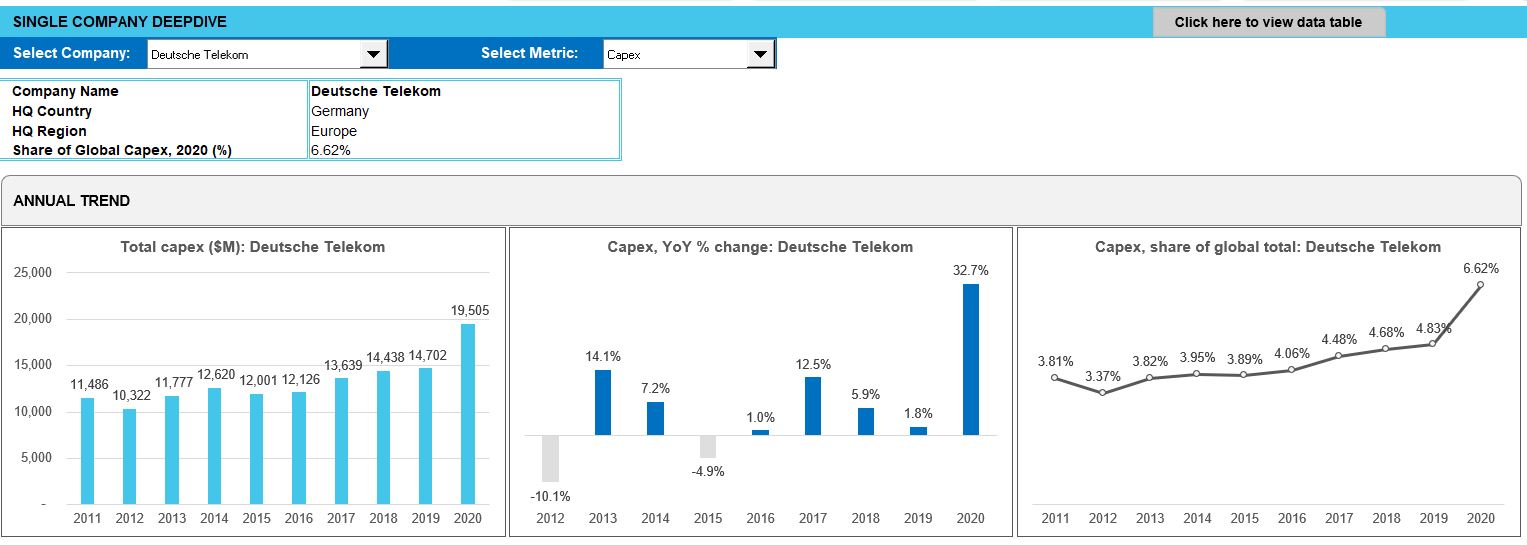

The biggest capex spender in 1Q21 on a single quarter and annualized basis was China Mobile. This was despite the company’s YoY drops of 14.2% and 12.9% in the single quarter and annualized 1Q21 periods, respectively, enabled by CM’s network partnership with CBN. Eight out of top 20 operators by annualized capex spend posted double-digit growth rates in the period ended 1Q21. Some of these include: Deutsche Telekom (+47.5% vs. annualized 1Q20), Airtel (+23.1%), Vodafone (+20.4%), CK Hutchison (+17.7%), and BT (+12.1%). On an annualized capital intensity basis, Rakuten beats all other telcos handily with a roughly 142% capex/revenue ratio for the quarter; its greenfield network rollout is reaching its peak. Most of the other capital intensity standouts are engaged in some level of 5G buildout, or related prep work: Globe Telecom (42.6%), Oi (39.9%), Telecom Egypt (35.3%), True Corp (31.3%), Digi Communications (30.1%), etc.

Profitability intact as telcos brace for digital transformation and automation

Telco profitability maintained a strong stance into 1Q21. Annualized operating margins ended 1Q21 at 14.8%, up from 13.9% in the same quarter of prior year. Annualized EBITDA margins improved marginally, up from 33.2% in 1Q20 to 33.9% in 1Q21. Reduced labor costs are not the direct cause of this margin growth. As noted, labor costs have been rising as a percentage of opex. Rather, telcos have been implementing a number of programs aimed at improved operational efficiency, especially in the sales & marketing area. These efforts accelerated in 2Q20 and 3Q20 as COVID-19 spread and telcos were forced to do business with minimal human intervention.

Industry headcount falling despite rise in labor costs

Industry headcount was 4.856 million in 1Q21, down from 4.961 million a year ago. Telco spending on digital transformation, software-defined networks (SDN) and AI tools have facilitated a smaller workforce. MTN Consulting expects headcount reductions to continue via attrition and voluntary retirement schemes, heading towards 4.5 million by 2025. However, we also expect telcos to invest heavily in their workforce: retraining existing employees on digital platforms, and hiring a new generation of software savvy employees. The average telco employee salary will rise as a result, an outlook consistent with 1Q21 results.

More important than headcount, though, is spending on employees. Telcos are in the midst of reshaping their workforce, hiring more costly software developers and others with IT/database and similar skillsets, which don’t come cheap. Telco labor costs as a percentage of opex (ex-D&A) has been rising gradually for several years, and that continued in 1Q21: from 23.9% in 1Q20, to 24.1% in 1Q21. On an absolute basis, labor costs represent $290.4 billion in annualized costs through 1Q21, just below the annualized capex figure of $297.9 billion.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Abstract

- Market snapshot

- Analysis

- Key stats through 1Q21

- Operator rankings

- Company Deepdive & Benchmarking

- Country breakouts

- Regional breakouts

- Raw Data

- Subs & traffic

- Exchange rates

- Methodology & Scope

- About

Figure & Charts

- TNO market size & growth by: Revenues, Capex, Employees – 1Q19-1Q21

- Regional trends by: Revenues, Capex – 1Q17-1Q21

- Opex & Cost trends

- Labor cost trends: 1Q19-1Q21

- Profitability margin trends: 1Q19-1Q21

- Spending (opex, labor costs, capex): annual and quarterly trend

- Key ratios: annual and quarterly trend

- Workforce & productivity trends: 1Q14-1Q21

- Operator rankings by revenue and capex: latest single-quarter and annualized periods

- Top 20 TNOs by capital intensity: latest single-quarter and annualized periods

- Top 20 TNOs by employee base: latest single-quarter

- TNOs: YoY growth in single quarter revenues

- TNOs: Annualized capital intensity, 2Q15-1Q21

- TNOs: Revenue and RPE, annualized 2Q15-1Q21

- TNOs: Capex and capital intensity (annualized), 2Q15-1Q21

- TNOs: Total headcount trends, 2Q15-1Q21

- TNOs: Revenue and RPE trends, 2011-20

- TNOs: Capex and capital intensity, 2011-20 ($ Mn)

- TNOs: Capex and capital intensity, 2Q15-1Q21 ($ Mn)

- TNOs: Revenue and RPE trends, 2Q15-1Q21

- Top 50 TNOs by total opex, 1Q21

- Top 50 TNOs by labor costs, 1Q21

- TNOs: Software as % of total capex

- TNOs: Software & spectrum spend

- TNOs: Total M&A, spectrum and capex (excl. spectrum)

- Top 50 TNOs by total debt: 2011-20

- Top 50 TNOs by total net debt: 2011-20

- Top 50 TNOs by long term debt: 2011-20

- Top 50 TNOs by short term debt: 2011-20

- Top 50 TNOs by total cash and short term investments ($M): 2011-20

Coverage

Operator coverage:

| A1 Telekom Austria | Advanced Info Service (AIS) | Airtel | Altice Europe | Altice USA | America Movil | AT&T | Axiata | Axtel | Batelco |

| BCE | Bezeq Israel | Bouygues Telecom | BSNL | BT | Cable ONE, Inc. | Cablevision | Cell C | Cellcom Israel | CenturyLink |

| Cequel Communications | Charter Communications | China Broadcasting Network | China Mobile | China Telecom | China Unicom | Chunghwa Telecom | Cincinatti Bell | CK Hutchison | Clearwire |

| Cogeco | Com Hem Holding AB | Comcast | Consolidated Communications | Cyfrowy Polsat | DEN Networks Limited | Deutsche Telekom | Digi Communications | DirecTV | Dish Network |

| Dish TV India Limited | DNA Ltd. | Du | EE | Elisa | Entel | Etisalat | Fairpoint Communications | Far EasTone Telecommunications Co., Ltd. | Frontier Communications |

| Globe Telecom | Grupo Clarin | Grupo Televisa | Hathway Cable & Datacom Limited | Idea Cellular Limited | Iliad SA | KDDI | KPN | KT | Leap Wireless |

| LG Uplus | Liberty Global | M1 | Manitoba Telecom Services | Maroc Telecom | Maxis Berhad | Megafon | MetroPCS Communications | Millicom | Mobile Telesystems |

| MTN Group | MTNL | NTT | Oi | Omantel | Ono | Ooredoo | Orange | PCCW | PLDT |

| Proximus | Quebecor Telecommunications | Rakuten | Reliance Communications Limited | Reliance Jio | Rogers | Rostelecom | Safaricom Limited | Sasktel | Shaw |

| Singtel | SITI Networks Limited | SK Telecom | Sky plc | SmarTone | SoftBank | Spark New Zealand Limited | Sprint | StarHub | STC (Saudi Telecom) |

| SureWest Communications | Swisscom | Taiwan Mobile | Tata Communications | Tata Teleservices | TDC | TDS | Tele2 AB | Telecom Argentina | Telecom Egypt |

| Telecom Italia | Telefonica | Telekom Malaysia Berhad | Telenor | Telia | Telkom Indonesia | Telkom SA | Telstra | Telus | Thaicom |

| Time Warner | Time Warner Cable | TPG Telecom Limited | True Corp | Turk Telekom | Turkcell | Veon | Verizon | Virgin Media | Vivendi |

| Vodafone | Vodafone Idea Limited | VodafoneZiggo | Wind Tre | Windstream | Zain | Zain KSA | Ziggo |

Regional coverage:

| Asia | Americas | Europe | MEA |

Visuals