By Matt Walker

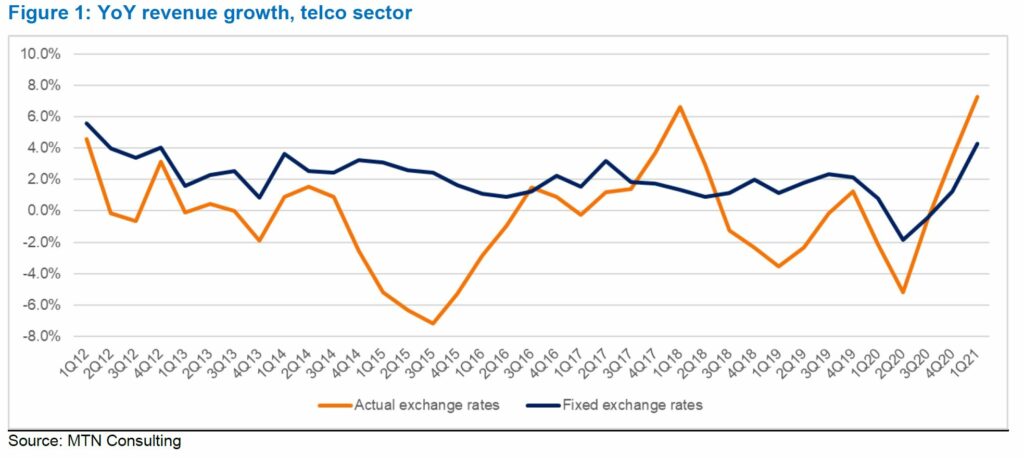

Revenues for the telecom sector saw a rebound in 1Q21, up 7.3% from 1Q20, to $473.2 billion. This is the fastest growth in at least a decade. Three factors are responsible. First, the base period of 1Q20 was weak due to the initial spread of COVID-19, when travel and regular work routines both came to a standstill. Second, as 5G network penetration has grown, telcos have recorded an impressive uptick in (one-time) device/equipment revenues. Finally, 1Q21 saw a sizable drop in the US dollar’s relative value in several key markets, including China, Europe, Japan, and Australia. Holding exchange rates fixed, the telco industry growth rate in 1Q21 would have been 4.3%.

The momentary revenue upswing in 1Q21 did not cause telcos to go on a sudden spending spree. They have been on the march towards cost reduction via digitation, virtualization, and automation for many years, and nothing has changed. That impacts capital expenditures: capital intensity in the telecom industry declined again in 1Q21. For the four quarters ended March 2021, annualized capex amounted to 16.33% of revenues, from 16.43% in 4Q20. This is the seventh straight sequential decline, and consistent with MTN Consulting’s expectation that capital intensity decline towards the 15.0% range by 2025.

Telcos are beginning to spend more on the cloud, with AWS, Azure and GCP recording well over $1B (combined) in sales to this vertical in 2020 (MTN Consulting estimate). Some portion of this flows into opex, not capex, but opex has also been held in check. Opex excluding depreciation & amortization amounted to 66.1% of revenues for the 1Q21 annualized period, unchanged from 4Q20 but down significantly from its recent peak of 69.7% in 4Q17. Telco profit margins improved throughout 2020, on an EBIT and EBITDA basis; in 1Q21, annualized EBITDA margin stayed flat at 33.9% but EBIT margin climbed to 14.8%, from 14.5% in 4Q20.

Industry headcount fell again in 1Q21, down another 27K to 4.856 million. Just as telcos are trimming capex in order to cut costs, they hope that fewer employees will lower opex, especially when combined with investments in automation and digitization across the business. Spending on employees (aka labor costs), however, are climbing on a per-head basis and as a percentage of opex. That is consistent with our forecast. The average telco employee is changing over time; unionization rates are falling but software development and IT skills are rising, and labor markets are competitive. Labor cost per employee was $59.8K per year in 1Q21, up from $58.1K in the 1Q20 period.

Note: this report is based upon preliminary numbers excerpted from a report to be published later in June (“Telecommunications Network Operators: 1Q21 Market Review”).

- Table Of Contents

- Figures

- Coverage

- Visuals

Table Of Contents

Summary – page 2

Revenue growth rate highest in at least a decade in 1Q21 – 2

Network spending a mixed bag – 5

Outlook for 2021 – 7

Appendix – page 9

Figures

Figure 1: YoY revenue growth, telco sector

Figure 2: Comparison of 5G and 4G subscription uptake in the first years of deployment (billion)

Figure 3: YoY telco revenue growth in 1Q21 – total versus equipment only

Figure 4: Annualized capex & capital intensity since 4Q11

Figure 5: Annualized EBIT and EBITDA margins since 2Q19, telco industry

Coverage

Companies and organizations mentioned in this report include:

Airtel

AIS

Amazon Web Services (AWS)

American Towers

Apple

AT&T

BCE

Cellnex

Charter Communications

China Unicom

Chunghwa

CK Hutch

Deutsche Telekom

Dish Network

Ericsson

Etisalat

Frontier Communications

Globe Telecom

Google Cloud Platform (GCP)

KPN

KT

Microsoft Azure

Millicom

MTS

Orange

PLDT

Proximus

Samsung

Shaw

SK Telecom

StarHub

Telecom Italia

Telefonica

Telenor

Telkom South Africa

True Corp

Turkcell

US FCC

Verizon

Vodafone

Zain

Visuals