By Arun Menon

The space communications industry is in the midst of a dramatic transformation, thanks to the advent of space technology companies such as SpaceX, and OneWeb. Both these new-age operators started the trend of manufacturing and deploying compact and less expensive satellites due to advances in design and production techniques. As satellites became smaller and cheaper to produce, mass production turned out to be feasible giving rise to the idea of deploying them in low Earth orbit (LEO) to save further on launch costs and even better, reduce latency. As a result, the concept of operating large LEO satellite constellations took off, transpiring into a mad rush for the satellite broadband market by both traditional players (Iridium, GlobalStar, Telesat) and non-traditional players (Amazon).

Below are key highlights from the report:

- LEO satellite networks are becoming ever more important due to their ability of providing global connectivity with reduced latency and costs. The unprecedented push for LEO constellations will see a growth explosion of 20x the current active satellites by the end of this decade – that’s more than 50,000 LEO satellites encircling the planet by 2030

- New-generation LEO satellite constellations are moving away from the traditional “bent pipe” network architecture to follow ‘Intersatellite Links’ (ISL), under which the system becomes a switching network, and data is transferred from satellite to satellite without having to come down to earth, as required under ‘bent pipe’

- The established frontrunners for LEO satellite broadband are Starlink (SpaceX) and OneWeb, but many others aim to make similar systems that include the likes of Kuiper (Amazon), IridiumNext, and Lightspeed (Telesat). China is the latest entrant to the space rush wherein many new space operators such as GW, Hongyan, Hongyun, and Galaxy Space are prepping to deploy more than 14,000 LEO satellites in total in the coming years

- Not all the satellite constellations will prosper. For a constellation to succeed, two major factors are crucial: constant capital flow, and building a services ecosystem through cross-selling. The fulfillment of these two aspects will decide the future leaders in the pack

- 5G and IoT markets are poised to transform further as LEO satellite constellations will likely broaden the reach of both the wireless network technologies. Specifically, LEO networks will provide backhaul support to terrestrial infrastructure operators in remote terrains

- LEO constellations also have their own share of hurdles as large number of small satellites orbiting Earth pose space junk and debris risks. In addition, pricing of broadband service offerings appears to be expensive for direct-to-consumer markets, as evidenced by Starlink’s beta offering. Regulatory ambiguity related to multi-country operations/coverage of LEO constellations also create a headache for satellite operators

Despite the recent surge in LEO satellite constellations, conventional telcos are unlikely to be disrupted as their core users would continue to prefer more affordable connectivity solutions. However, satellite operators will play an important complementary role by providing backhaul support to telecom and cloud providers. Telcos, webscalers, and the satellite players are likely to scale up their collaboration during the 2021-25 timeframe, as evidenced by the recent multi-year partnerships among these players to improve backhaul services for mobile and cloud connectivity.

About this report

This report from MTN Consulting delves into the drivers behind the sudden rush for LEO satellite constellations, network architecture trends, the LEO satellite broadband market landscape, the potential leaders and laggards, likely applications for LEO satellites, and challenges.

- Table Of Contents

- Figure & Charts

- Coverage

- Visuals

Table Of Contents

- Summary – 3

- What’s the current situation? – 4

- Space rush 2.0 – history repeating? – 4

- Large LEO satellite constellations poised for explosive growth – 4

- Elevation matters -6

- How did we get here? -7

- So why are LEO satellites game changers -7

- New network designs improve costs and performance of LEO satellite constellations – 8

- Satellite market landscape – 9

- What happens next? – 11

- Who will emerge as the leaders and laggards? – 11

- LEO satellite services will extend the reach of 5G and IoT – 12

- Key challenges – 13

- Conclusions? – 14

- Satellite connectivity will thrive, but terrestrial networks will continue to dominate – 14

- Appendix 1 – 15

- About MTN Consulting

- Terms of Use

Figure & Charts

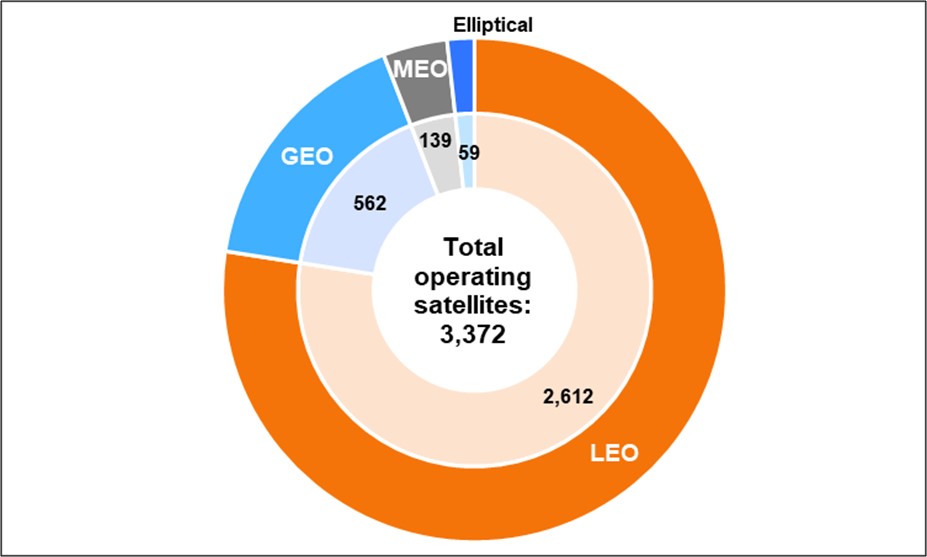

Figure 1: Total active satellites, by orbit type – 2020 – 5

Figure 2: LEO satellite deployment timeline – 2010-2030 – 6

Figure 3: Graphic representation of different satellite orbits – 6

Figure 4: Comparison of satellite networks vs. terrestrial networks – 7

Figure 5: List of key active and upcoming LEO satellite constellations – 9

Coverage

| Amazon |

| Bharti Global ($500M) |

| China Aerospace Science and Industry Corporation (CASIC) |

| China Aerospace Science and Technology Corporation (CASC) |

| Eutelsat |

| Fidelity |

| Galaxy Space |

| GlobalStar |

| GW (China) |

| Hughes |

| Iridium |

| SoftBank |

| SpaceX |

| Telesat |

Visuals